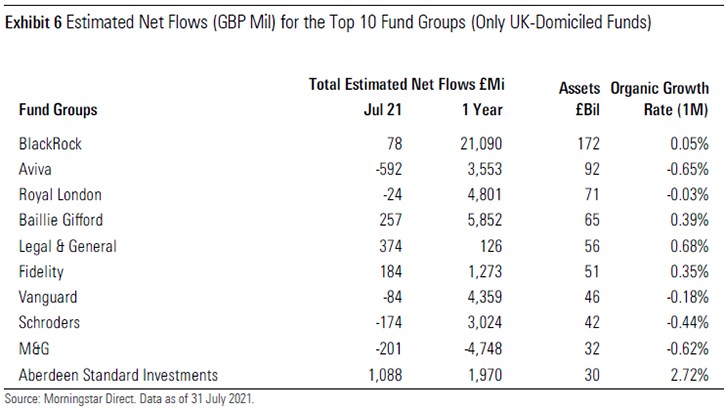

Fund flows have picked back up in July after a slow June, Morningstar data has revealed. In the past month, UK funds attracted £2.8 billion, significantly higher than the £167 million the month before.

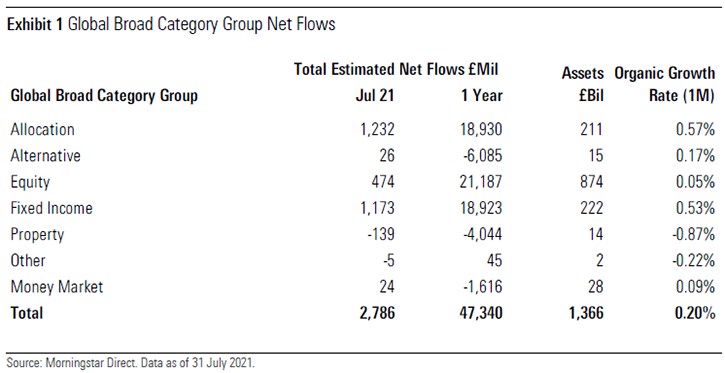

The July flows are the highest since April, which saw net inflows equalling £4 billion. However, the same trends we’ve seen throughout the year carry on; allocation and fixed income are enjoying continued popularity while equity funds struggle. Last month we noted that allocation funds have seen 12 consecutive months of inflows over £1 billion, and this continued in July with £1.2 billion added. In fact, the category has only seen net outflows five times in the past 10 years. GBP moderately adventurous allocation and GBP moderate allocation made up half of all allocation fund flows in July.

Fixed income has also seen similar flows, just under £1.2 billion. Funds with a sterling corporate bond and global bond focus proved popular. Equity funds continue their struggle with outflows and only managed to end July with net inflows of £474 million due to a one-off £1 billion investment into ASI Sustainable Index World Equity.

Elsewhere, only property and alternative categories saw net outflows, but they fared better than usual as both categories have been seeing continual outflows for almost three years.

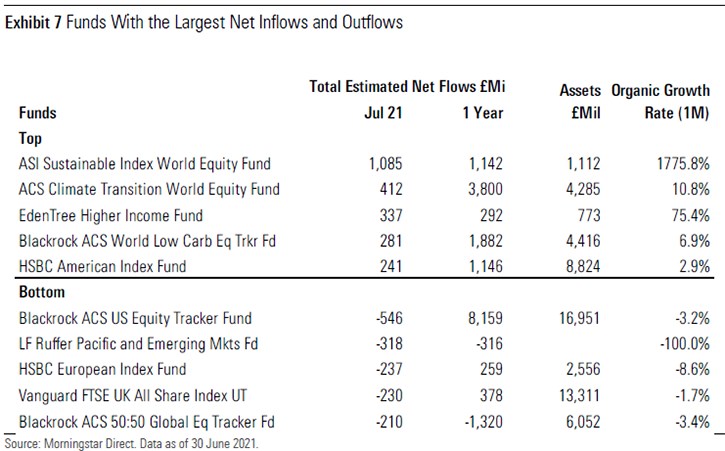

The previously mentioned subscription to the ASI index fund didn’t just help equities out – it was also a driver behind the sustainable fund and Morningstar Category global large-cap blend equity growth. These assets come from changes in the default pension fund for employees of Deloitte as it aims to make good on its climate change and sustainability commitments. Its peer BlackRock ACS World Low Carbon Equity Tracker also enjoyed strong inflows of £281 million.

Sustainable funds remained popular, with the sector equity ecology category bringing in £671 million in July, and £5.6 billion over the year, making it the third most popular category as measured by inflows.

The outflows seen in equities were driven by UK and US funds, consistent with trends seen in the past months. UK equity income remains out of favour despite the return to favour of value and recovery in dividends. Meanwhile, the US large-cap blend equity category has seen almost £10 billion in investments from August 2020 to the end of June 2021, but in July, £974 million was redeemed from these funds.

The popular category GBP moderately adventurous allocation includes funds that are enjoying ongoing popularity: Baillie Gifford Managed, Royal London Sustainable World, and Liontrust Sustainable Future Managed. But, it was EdenTree Higher Income that topped the table, doubling its fund size to £773 million due to net subscriptions of £337 million.

In more positive news, Invesco avoided net withdrawals in July, for the first time since December 2017. A virtually zero net flow for their main problem fund, Invesco Global Targeted Returns, meant that a very small net inflow was seen: £36 million. Invesco Income was also one of the few funds driving inflows in the unloved UK equity income category.

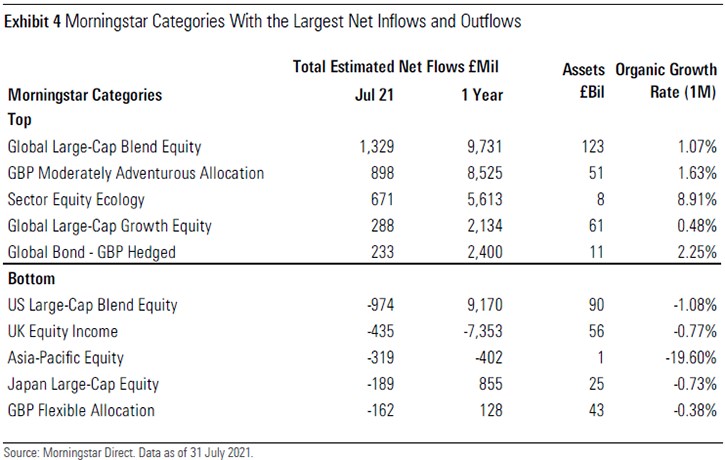

Overall, fund companies have seen varied performance. BlackRock, which has seen the highest net flows over the past year, had a muted July, while Aberdeen Standard Investments appears to have been the most popular. However, Bhavik Parekh, manager research analyst at Morningstar, explains that these assets were moved to the sustainable index fund from the SLI Master Trust, “meaning ASI as a business has not seen net new assets, only a change in their location. Aside from this one fund, there were no other funds that saw any significant change in assets.”