Not all junk bond investing is created equal. BB-rated debt sits at the top of the below-investment-grade credit-quality rating spectrum and carries the lowest relative credit risk among its fixed income peers.

With each step down the credit-rating ladder, from AAA through A and BB, the likelihood of the bond issuer defaulting increases exponentially. Indeed, according to data from the S&P Global Ratings 2020 Annual Global Corporate Default And Rating Transition Study, the global corporate annual default rate for issuers rated BB was roughly 1% last year, compared with roughly 4% for issuers rated B and almost 50% for issuers rated CCC, CC, and C.

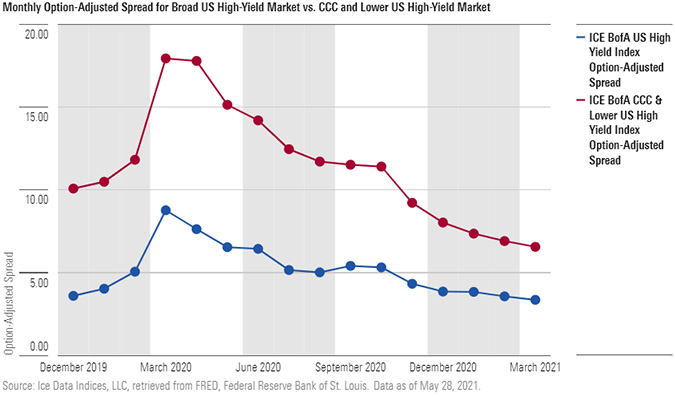

That higher risk does, of course, come with a higher risk premium – that is to say a higher risk bond pays a higher yield compared to low-risk bonds like US Treasuries. However, these relative risk premia are not always constant. During the Covid-19 crisis in March 2020, for example, US corporate bonds rated CCC or lower yielded roughly nine percentage points more than the average for the broader US high yield market, as measured by the ICE BofA US High Yield Index. By March of this year, that difference had shrunk to just three percentage points as yields fell across the market.

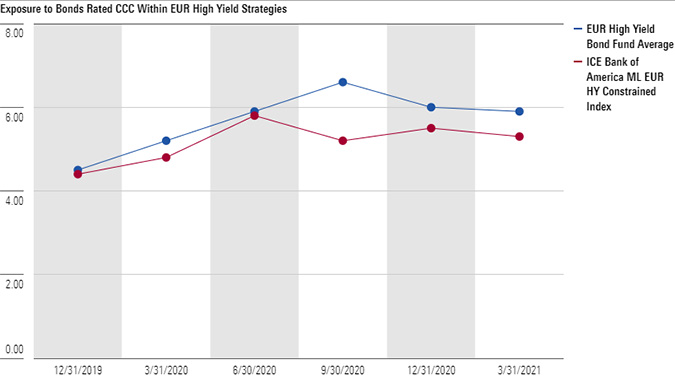

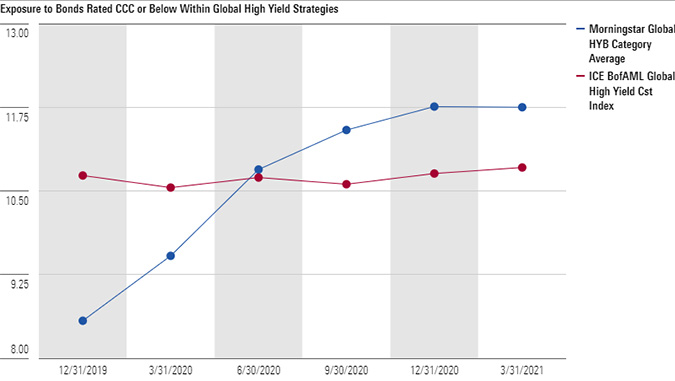

Despite the additional credit risk in lower-tier debt and tighter credit spreads compared with a year ago, high yield bond managers have warmed to the riskier segments of the market. While the share of bonds rated CCC or lower within the ICE BofAML Global High Yield Constrained benchmark has stayed fairly stable at close to 11% since the end of 2019, the typical fund in Morningstar’s Global High Yield Bond category has increased its exposure to such credits from roughly 8.5% at the start of 2020 to almost 12% by March 2021. The trend is also visible, but less striking, within Morningstar’s EUR High Yield Bond category. Typical CCC exposure for funds in that category rose from roughly 4.5% in December 2019, in line with the ICE BofAML EUR High Yield Constrained index, to roughly 6% in March 2021, a moderate overweight.

Fund managers cite a number of reasons in explaining why they feel comfortable dipping into the most highly-levered segment of their market despite shrinking yields. The US Federal Reserve’s ongoing high yield debt purchases, a response to the Covid-19 crisis, helped calm fears of another panic-driven market sell-off. A burgeoning economic recovery, particularly in the US, should boost company balance sheets. And after the high yield market saw a spike in defaults in 2020, many argue that the wobbliest companies have been shaken out of the market, leaving behind a stronger cohort of borrowers less likely to renege on their obligations.

Within the Global High Yield Bond category, Silver rated T. Rowe Price Global High Yield Bond fund stands out for its strong embrace of CCC debt, having tripled its stake from 4% in December 2019 to 12% in May 2021. Following the March 2020 selloff, managers Mike Della Vedova and Rodney Rayburn scooped up the debt of highly-levered companies they think are poised to benefit as the world’s economies reopen, like casino giant Caesar’s Entertainment or gaming supplier Scientific Games. Other managers in the category were more incremental in their approach. Bronze-rated BGF Global High Yield Bond and Silver-rated PIMCO GIS High Yield Bond increased their CCC stakes over the same period, though only by one to two percentage points.

Among strategies that specialize in euro-denominated high yield debt, Gold-rated HSBC GIF Euro High Yield Bond is known for its cautious and contrarian style. Although manager Philippe Igigabel’s initiation of a 6% position in CCC-rated bonds this year echoes moves by competitors, he has stuck to subordinated issues from otherwise more highly-rated issuers. The fund’s CCC stake features names like shoemaker Birkenstock and frozen food company Picard, which the manager argues have sturdy business models less vulnerable to global economic swings.

Volatile performance is to be expected in high yield bond investing, but it's still worth examining an individual fund's credit risk before diving in. Managers with more moderate approach, such as Blackrock and PIMCO, have offered smoother returns than peers. For a more aggressive approach, like that of T. Rowe Price Global High Yield, understanding the roots of that volatility is key to getting comfortable owning it.