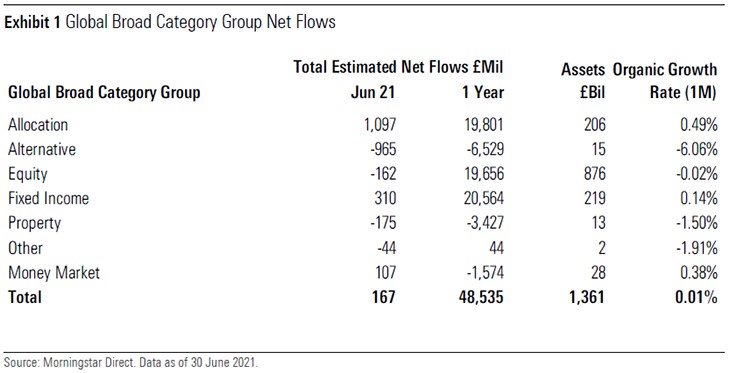

June has been a month of low flow activity for UK-domiciled funds, according to Morningstar data. After several months where billions have been flowing into the market, only a net £167 million was invested, compared with £2 billion in May and nearly £4 billion in April.

But despite the low activity, some trends from the past months have persisted. Allocation funds attracted £1.1 billion, the 12th consecutive month the category has brought in more than £1 billion. And fixed income funds have continued attracting investors but at a lower volume than previously, with £310 million in inflows. Still, the fixed income category remains the most popular category over the year, bringing in more than £20 billion - with allocation and equity funds attracting £19 billion of inflows over the year.

Equity funds saw negative flows of £162 million in June, but money market funds attracted £107 million in June, reversing the trend over the past year, when the category saw £1.6 billion in outflows.

Meanwhile, alternative and property funds have seen net redemptions for the past four to three years with little sign of change. The main driver has been the recent outflows from M&G Property Portfolio, which shed more than £800 million in a month when it reopened in May. The property fund category has seen more than £3 billion in outflows this year.

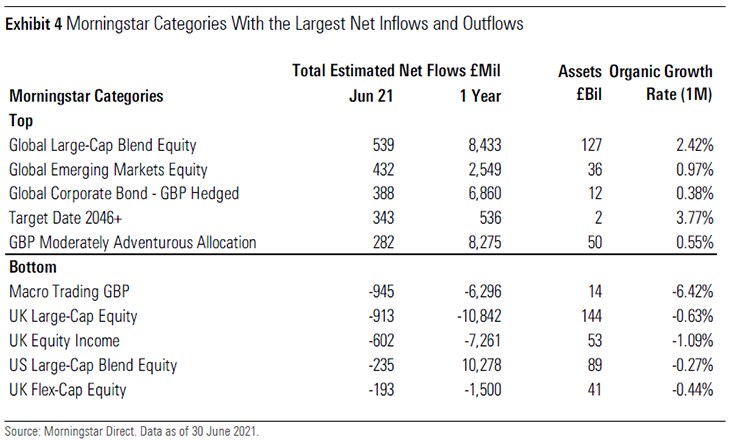

Consistent with the trends in the wider market, passive and sustainable equity vehicles saw net inflows, along with small- and mid-cap funds, but this was offset by their counterparts. UK Large-Cap Equity saw outflows of £913 million, making £1.1 billion of outflows so far this year, becoming the second-least popular Morningstar category behind Macro Trading GBP (which saw outflows of £945 million in June).

Macro Trading GBP includes many of the funds that used to be in the multistrategy-alternative category, such as Invesco Global Targeted Returns, which was the main cause behind the outflows. After its inception in 2013, the fund grew to almost £13 billion by 2018, but is now back to £2.5 billion, the size it first reached as a 21-month old fund in 2014.

Global Large-Cap Blend Equity was the most popular category, topping the charts thanks to a £438 million net inflow into BlackRock ACS World ESG Equity Tracker. According to Bhavik Parekh, manager research analyst at Morningstar, the fund is popular because investors, including local pooled pension groups, have found it an easy way to quickly improve their sustainable profile.

The second most popular category, Global Emerging Markets Equity, continues its run thanks to Royal London Emerging Markets ESG Leaders Equity Tracker, one of the most popular funds over the past year – but the majority of the money originated internally. Meanwhile, the popularity of the Global Corporate Bond – GBP Hedged category is due to only two funds: SPW Multi-Manager Global Investment Grade Bond and ASI Global Corporate Bond Tracker. They accounted for 98% of the category’s net inflows, but they also make up the majority of the category in terms of assets.

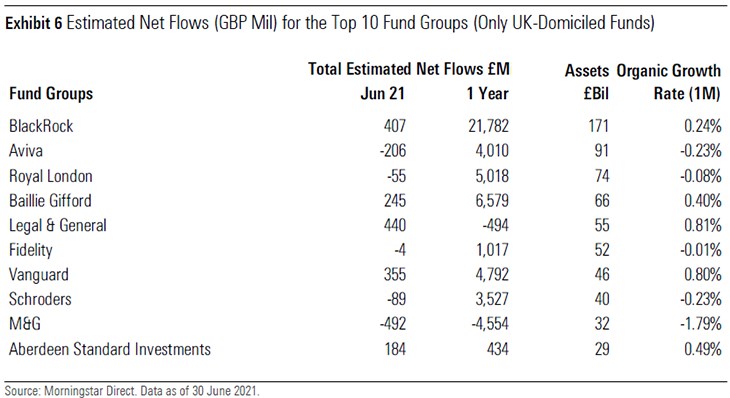

Of the top 10 fund groups, Legal & General, BlackRock and Vanguard appeared the most attractive to investors this month. BlackRock did have funds on both ends of the flows table, but thanks to the ESG tracker, it ended with inflows worth £407 million, passing the £21 billion mark for net inflows in the past year. But it was L&G which had the highest inflows among the top 10, as its Short Dated Sterling Corporate Bond Index and Japan Trust has helped bringing the fund closer to net zero flows after a disappointing year.

That said, the most popular fund group in June is neither one of these. Liontrust had £572 million in net subscriptions due to the popularity of its Global Dividend and European Growth funds. In fact, the entire Liontrust Sustainable Future range saw net inflows worth £360 million.

On the other end of the spectrum, M&G, second only to Invesco, had one of the highest net outflows in June. The property fund and M&G Global High Yield Bond were the main drivers but strategies that have seen many months of outflows, such as M&G Optimal Income, also contributed.