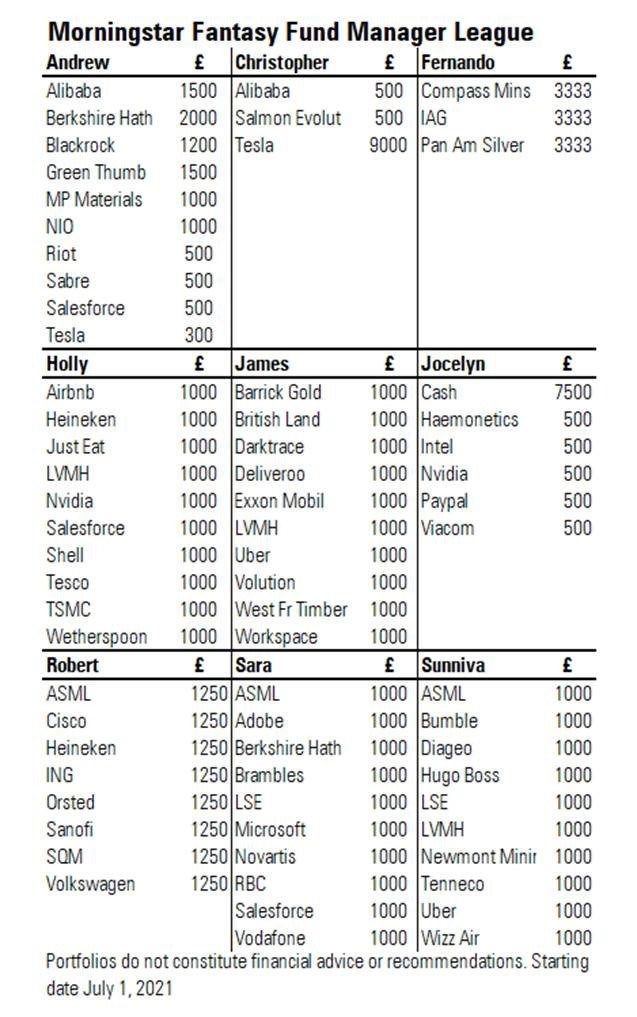

Morningstar’s editors are a competitive bunch, so we’ve decided to pit our share-picking prowess against each other to see who can build a winning stock portfolio.

We’ve given each editor an imaginary £10,000 to invest across up to 10 shares, to see who can grow their money the most.

In the spirit of avoiding short-term trading, editors will be given the opportunity to buy or sell shares or rebalance their portfolio once per quarter, with the first opportunity being October 1. (It's worth pointing out that at Morningstar we favour long-term buy-and-hold investing as a rule). But we’ll provide monthly performance updates in the meantime, using our portfolio monitoring tools in Morningstar Direct, to keep an eye on how we’re doing.

It’s crucial to point out at this stage that these share portfolios are absolutely not recommendations. The 10 stock limit means they are not well-diversified and nor do they represent what editors would do with their own money. In fact, many of the editors have chosen to ramp up the risk far more than they usually would with their own money.

With that said, let’s take a look at the initial portfolios:

It’s a varied mix. Jocelyn Jovene, editor of Morningstar France, has gone for a cautious approach, keeping 75% of his money in cash for the time being as he believes the market is looking expensive and there may be buying opportunities down the line.

Meanwhile, data journalist Christopher Greiner has put 90% of his money in Tesla (TSLA). “Tesla’s mission is to accelerate the world’s transition to sustainable energy – what’s not to like? The mother of all the catalysts that I believe will send Tesla to the moon is when it solves full self-driving,” he says. He has also selected Salmon Evolution (60E), a Norwegian land-based salmon farmer, which recently South Korea’s Dongwon Industries, one of the world’s leading seafood companies. He says: “South Koreans love salmon and are already importing huge amounts of Norwegian salmon, so I see great long-term potential."

Fernando Luque, editor at Morningstar Spain, has taken a similarly concentrated approach, and also has just three stocks in his portfolio. He has picked British-airways owner IAG (IAG) as a recovery play. “It is one of the few airlines with a 4 star Morningstar rating and I’m surprised it is lagging the sector,” he says. Meanwhile, with inflation picking up across the globe, some would argue that now is a great time to have exposure to gold and silver, such as metals miner Pan American Silver (PAAS).

Andrew Willis, content editor for Morningstar Canada, is “going global and fringe for high growth”. He’s got a decent chunk of his portfolio in Warren Buffett’s Berkshire Hathaway (BERK.A), hoping that the Oracle of Omaha “still has some aces up his sleeve”.

Research editor Robert Van Den Oever has chosen some home-grown companies from his native Netherlands. Among his portfolio is semiconductor producer ASML (ASML), which he likes for its continuous innovation and investment in new technology, investment bank ING (ING), and brewing company Heineken (HEIA). The portfolio also featured names set to benefit from the global move to electrification including offshore wind farm operator Orsted (ORSTED) and Volkswagen (VOW3), which is ramping up its electric vehicle production.

Sustainable Stocks

Meanwhile, there’s a sustainable theme across the portfolio of Sara Silano, editorial manager for Morningstar Italy. She screened for stocks that have at least a 4 Globe Rating from Morningstar, indicating above average ESG credentials, as well as those which have a coveted Economic Moat. The 10 stocks in her portfolio also all come from a Morningstar Sustainability, Low Carbon or Diversity index. Holdings include Vodafone (VOD), Microsoft (MSFT) and healthcare giant Novartis (NOVN).

Data journalist Sunniva Kolostyak has also used an ESG screen to pick her portfolio, selecting top performing stocks in the year to date which also have a low ESG risk rating and a Morningstar rating of 3 stars are more, indicating that they are trading at or below their fair value estimate. “Some of the stocks I chose because I know them well through our coverage, and others I believe will benefit as economies continue to open post-lockdown.” Her portfolio includes dating app Bumble (BMBL) and London Stock Exchange group (LSEG).

James Gard, senior editor at Morningstar UK, has combined a mix of old and new economy stocks in his portfolio, choosing ride-sharing app Uber (UBER) and food delivery app Deliveroo (ROO) as well as gold miner Barrick Gold (ABX) and real estate company British Land (BLND). Another interesting addition is Cambridge-based artificial intelligence firm Darktrace (DARK), whose shares leapt 32% when it floated in April.

In my own imaginary portfolio, I’ve taken an “invest in what you know” approach, choosing the stocks of companies I use and believe will thrive post-lockdown including beer giant Heineken, travel app Airbnb (ABNB), and food delivery app Just Eat (JET). I’ve also added chip-makers Nvidia (NVDA) and TSMC (2330), as I believe the supply issues in this sector aren’t about to be solved any time soon.