The coronavirus pandemic will reverse globalisation.

For some people it’s a prediction, for others an aspiration. The virus’s rapid spread across the globe highlighted the fragilities of an interconnected world. Turning inward, increasing self-sufficiency, and decreasing dependence on global linkages are plausible responses.

But while global travel certainly ground to a halt in 2020, business does not appear to have become less global. That’s the conclusion reached when examining the revenue mix of publicly traded companies, aggregated to the index level.

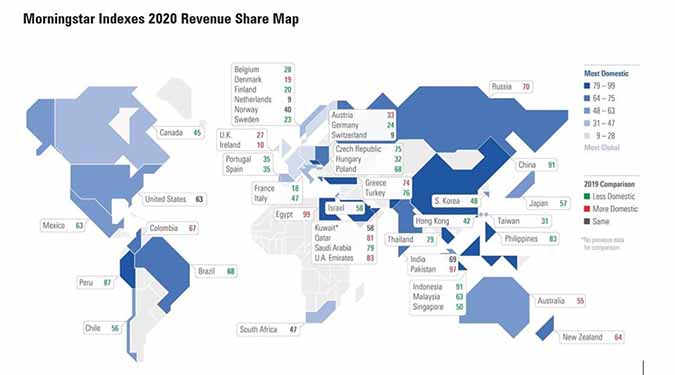

The world map above shows the share of revenue earned domestically for 49 markets across the globe, represented by Morningstar country indices. Estimates based on annual report data from 2020 shows only 13 countries becoming more domestically focused in 2020. The UK was among the markets turning inward, but the change was small, and the UK remains a highly global equity market in absolute terms.

Meanwhile, 29 markets became more globalised, with the share of revenues sourced outside the country increasing between 2019 and 2020. Nearly all Asian markets turned outward in 2020, despite their pandemic lockdowns. The Morningstar US Market Index earned 63% of its revenue domestically in both 2019 and 2020, making it one of several countries whose mix did not change during the pandemic year.

How Global is the UK Market?

The UK equity market already reflects the “Global Britain” envisioned post-Brexit. Just 27% of revenues are sourced domestically. The UK became slightly more domestic in 2020, though the margin was small and corporate reporting conventions make precision impossible. Many companies do not break out the UK in their revenue reporting. Morningstar estimates that roughly 23% of the UK market’s revenue came from the US in 2020, 17% from emerging Asia, and 12% from the eurozone.

The three largest constituents of the Morningstar UK Index – Unilever (ULVR), AstraZeneca (AZN), and HSBC (HSBA) – are massive global players. Unilever reports its largest geographic source of revenue as “Asia/Africa, Middle East, Russia, Turkey.” The UK is included in Europe.

Source: PitchBook Platform. Morningstar Data.

Markets’ skew to certain sectors can affect their revenue exposure. Healthcare, for example, tends to be global, contributing to the outward focus for markets like Denmark and Switzerland. Technology is another global sector that has contributed to global revenues for the US market. Indeed, companies like Apple (AAPL), Facebook (FB) and Google-parent Alphabet (GOOGL) all earn the majority of their revenues from outside their home markets. Conversely, financial services, utilities, and telecom tend to be far more domestic.

How Global are Global Markets?

Brazil’s market became significantly more global in 2020, falling from 77% domestic revenue in 2019 to 68%. What’s going on? Commodity giants Vale (VALE) and Petrobras (PBR), which together represent roughly 20% of the Morningstar Brazil Index, each saw a decline in their share of revenue sourced domestically.

This is undoubtedly due to Brazil’s struggles with Covid-19. As the pandemic has ravaged the country, causing the economy to contract by more than 4% in 2020 and unemployment to climb above 14%, Vale reported its share of revenue sourced from China increasing to 57.82% in 2020 from 48.55% in 2019. Robust economic activity in Chinese led to higher demand for the raw material to make steel.

The Difference Between Economies and Equity Markets

Globalised revenue streams provide yet another reason that investors should distinguish between a country’s economy and its equity market. One of the great investment lessons of 2020 is that the two can move in opposite directions. Although national equity markets are often cited as barometers of their countries’ economic health, markets are a collection of very specific companies influenced by a variety of forces, macro and micro, domestic and global.

This is especially true of European equity markets. The Netherlands, Switzerland, Ireland, Denmark, France, Finland, Sweden, Germany, the UK, and Belgium all earn 70% or more of their revenues abroad. The Morningstar France Index, for example, is hardly a proxy for the French economy. Luxury-goods maker LVMH Moet Hennessy Louis Vuitton (MC) is the largest public company in France and derives more than a third of its revenues from Asia and roughly a quarter from the US.

The world’s most domestically oriented equity markets belong to emerging economies with large populations: Egypt, Pakistan, Indonesia, and China. India is an exception to this rule, being far more global than China and others, owing to IT service providers like Infosys and Tata Consultancy Services, which earn much of their revenue in the US and Europe.

Globalised revenue streams have been cited by some as reason to avoid investing internationally. If domestic companies are doing business around the globe, doesn’t that count as geographic diversification? Global interconnectedness has surely contributed to higher correlations between stock markets around the world.

But investors with significant home-country bias are narrowing their opportunity sets and potentially eschewing great investment opportunities. For example, a US-based investor who doesn’t own Novo Nordisk (NOVO) of Denmark is missing one of the leaders in diabetes therapies serving the US equity market, while Taiwan Semiconductor (2330) is a leading chip-supplier to the US.

Corporate data from 2020 does not support the view that globalisation is in decline. For investors, thinking globally remains critical.

Index-level data is as of 30 April 2021, based on the most recent corporate filings, typically 2020 annual reports. Company-level revenue data represents 99.4% of global market capitalization across developed and emerging markets. Data has been collected for 7,311 of the 7,391 constituents of the Morningstar Global Markets Index, of which the individual country indexes are carve-outs.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.