The Morningstar Developed Markets Europe Moat Focus Index tracks European companies that earn an Morningstar Economic Moat Rating of wide or narrow and are trading below their fair value estimate. These two characteristics make the index a fertile hunting ground for investors looking for high-quality stocks trading at reasonable prices.

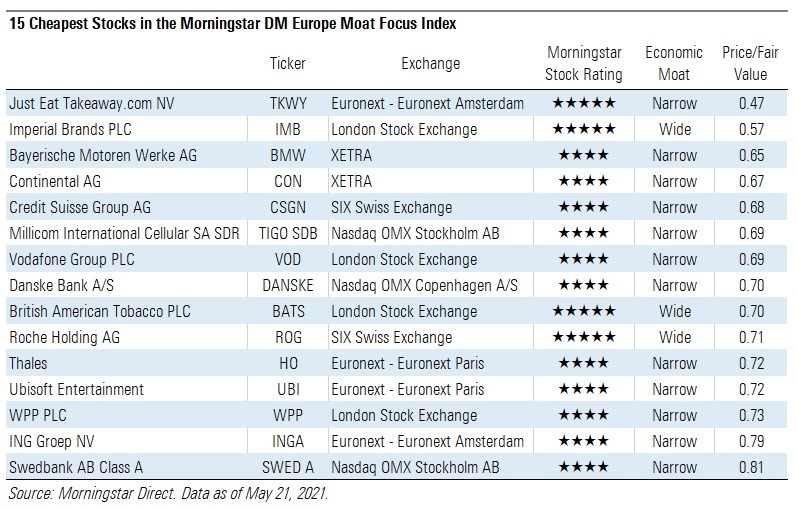

Here we take a look at the 15 cheapest stocks in the Morningstar DM Europe Moat Focus Index:

Particularly interesting is the presence of Just Eat (TKWY) and Imperial Brands (IMB), both names showing a 5-star stock rating and current valuation of approximately half of Morningstar's estimated fair value.

“Just Eat Takeaway is the market leader in more than 90% of the markets it operates in and is well positioned, in our opinion, to benefit from the structural trend of increasing digitisation of food delivery orders”, says Morningstar equity analyst Ioannis Pontikis. “Its business model is based on strong multisided platform network effects and exhibits moatworthy competitive advantages in most of the regions it operates in, a function of first-mover advantages it attained in key markets (UK, Netherlands) more than 15 years ago.”

Besides, the company is in good financial health. “Despite the group’s acquisitive nature, recent large transactions have been financed through a combination of equity and hybrid debt, leaving the balance sheet with an ample amount of cash. Even after the acquisition of Just Eat, the group is in good financial health, with an expected fiscal 2021 net debt/EBITDA of 0.7 times and about 500 million euros of cash on the balance sheet”, explains Pontikis.

“After four years of lousy underperformance, Imperial Brands finally delivered some validation for our investment thesis in the first half of fiscal 2021. We think Imperial's model is intact, but performance has suffered from misplaced organic investments for several years. First-half revenue grew by 3.5% year over year and on a constant currency basis, the best underlying performance by Imperial in recent memory”, says Philip Gorham, director of equity research at Morningstar.

“Stefan Bomhard has a new mantra for Imperial Brands: focus. The new CEO unveiled a five-year strategic plan that will concentrate investments both geographically and on emerging categories that are likely to become the largest profit pools in the future. We think the plan makes sense because it essentially recognizes Imperial's place in the marketplace”, explains Gorham.

How the Moat Focus Index is Built

In an effort to keep the index focused on the least-expensive high-quality stocks, Morningstar rebalances regularly, ejecting those stocks which no longer meet the criteria. Currently, the index consists of two sub-portfolios of 25 stocks each (many of which are overlap).

The sub-portfolios are reconstituted semiannually in alternating quarters, on a staggered schedule: one sub-portfolio reconstitutes in December and June; the other sub-portfolio reconstitutes in March and September.

We re-evaluate the index’s holdings and add and remove stocks based on a preset methodology. Because stocks are equally weighted within each subportfolio, the reconstitution process also involves rightsizing positions.

After the most recent reconstitution on March 19, 2021, half of the portfolio added 12 positions and eliminated the same number. Among the names added are AstraZeneca (AZN), Unilever (ULVR), Danone (BN), Publicis Group (PUB), and Just Eat (JET). Some of the removed names are Telecom Italia (TIT), Bayer AG (BAYN) and UBS Group (UBS).