With Earth Day in mind, we asked our Twitter followers to pick a European company heavily involved in renewable energy for Stock of the Week. You plumped for dominant Italian utility Enel (ENEL), which owns and manages a range of sustainable energy assets across the world including wind farms, hydro-electric dams and geothermal power plants.

Renewable sources of energy make up more than half of its output, accounting for 49GW out of a total of more than 86GW – and around 30% of group profits. By revenue, it was the biggest energy company in the world, just ahead of France’s nuclear generator EDF (EDF). Enel floated in 1999 but the Italian state still owns around 20% of the shares.

The Case for Investing in Utilities

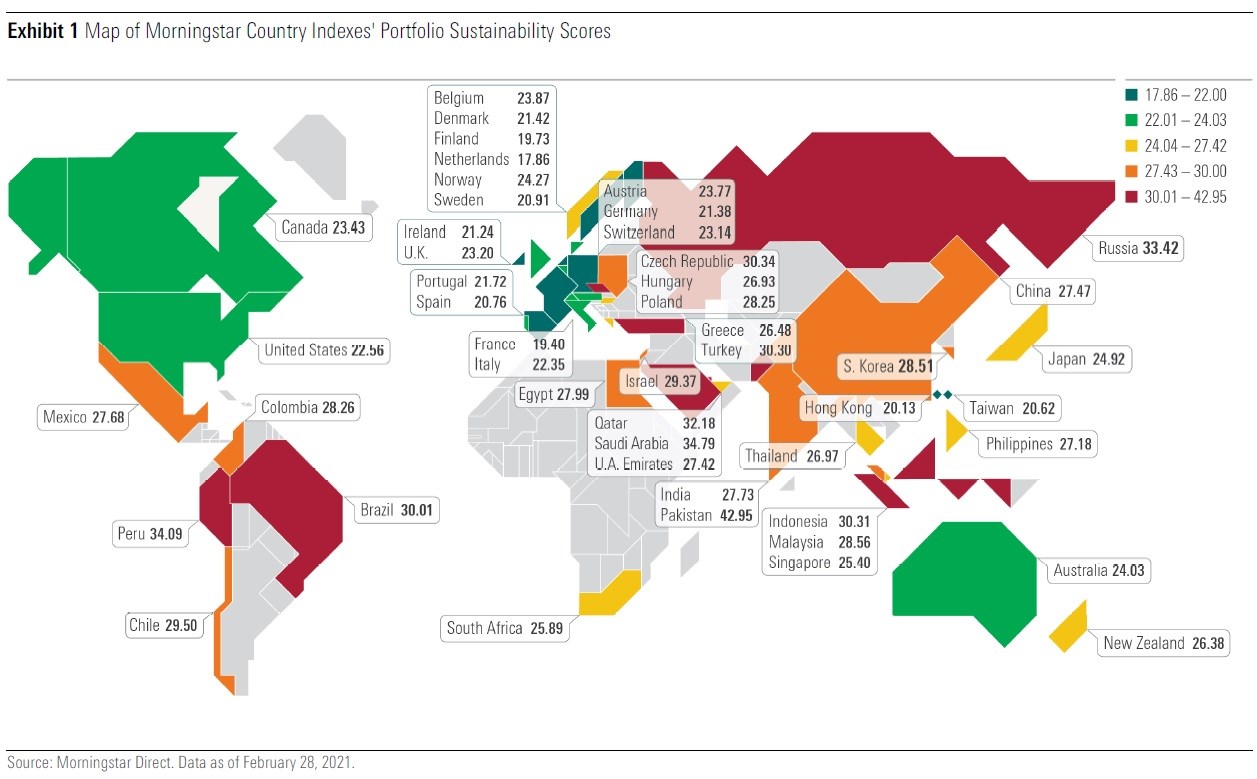

European utilities were once seen as dull investments, good at generating dividends for shareholders but essentially a defensive stock with limited growth prospects. The boom in renewable investing has turned this perception on its head, and European energy companies, especially those quick off the mark in embracing renewables, are highly prized. Indeed, as Morningstar’s Sustainability Atlas shows, Europe leads the way in ESG, with low carbon footprints and companies actively pursuing sustainale objectives. Over the last 10 years this has led to a revaluation of shares in energy companies like Enel.

In July 2012, Enel shares were changing hands around €2 and are now nearly €9, a rise of around 300%. Morningstar’s utilities analyst Tancrede Fulop rates the company’s shares as fairly valued at €8.70, placing them in 3-star territory, and suggests investors wait for a drop in the shares “to get an entry point into this quality name”.

Despite the share price growth, Enel is still prized as a dividend stock though, with a yield around 4.4%. In its latest results, the company declared a dividend of €0.358 per share – meaning the dividend has been increased by 16.5% a year since 2014.

Enel and the Shift to Low Carbon

Two years ago, Enel launched a low-carbon plan for 2020-2022 to increase renewable capacity – but last year’s pandemic had some notable impacts, especially in Latin America. Some 0.8GW of new renewable capacity has been pushed back from 2020 to 2021, Enel says, but it still plans to add 5GW of renewable energy assets in 2022, the equivalent to over 2,000 wind turbines.

One factor that could help renewables-focused companies like Enel is the European Union’s post-Covid recovery plan, which involve subsidies and investment in green energy. Morningstar’s Fulop argues that Enel is one of the best positiioned companies to benefit from the €750 billion EU recovery plan known as “Next Generation EU” – because Spain and Italy, two of Enel’s largest markets and some of the hardest hit by the pandemic, are expected to receive the most subsidies.

Green bonds are an increasingly popular way for investors to back projects and receive an income in return. In 2019, Enel issued the first bond linked to the United Nations’ Sustainable Development Goals (SDGs). As Hermes Investment Management’s Mitch Reznick and Aaron Hay point out, these bonds are not linked to specific projects, and if the company doesn’t meet these targets, it faces a big jump in its interest costs. The bonds were linked to SDG number 7 on affordable and clean energy and number 13 on climate action. These bonds “form a milestone in evolution of sustainable fixed-income investment”, Hay and Reznick say. “Enel has attached the heart of its business to environmental progress and backed the promise with its own cost of capital”.