Climate change poses a significant business risk to many companies, so it's no wonder that greener technologies and renewable energy are developing at a steady pace. Worldwide, consumers, policymakers, and investors alike are pressuring companies to reduce their carbon footprints.

The societal shift away from carbon will affect companies financially so how effectively firms can adjust their operations and products to the economy of tomorrow will determine which are able to survive and thrive.

To find companies that can successfully compete in the transition to a low-carbon economy, we’re turning to Sustainalytics’ carbon risk assessment, the same measure behind our Morningstar Portfolio Carbon Metrics for funds. The assessment captures how vulnerable a company is in the transition away from a fossil-fuel-heavy economy.

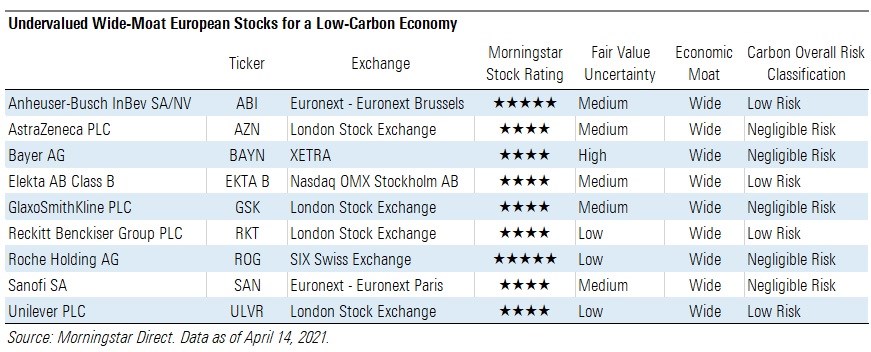

Specifically, we screened European stocks which have a wide economic moat, a stable or positive moat trend, a 4 or 5-star Morningstar Rating, and a carbon overall risk classification of Negligible or Low.

In other words, we searched for European companies with a solid competitive edge, very well-positioned for a low-carbon economy and currently trading in a buying range. We found nine of them.

A closer look at the two names on the list holding a 5-star Rating.

Anheuser-Busch InBev

In our opinion, beer giant AB InBev (ABI) has one of the strongest cost advantages in our consumer defensive coverage and is among the most efficient operators. Vast global scale, along with its monopoly like positions in Latin America and Africa give AB InBev significant fixed cost leverage and procurement pricing power.

Morningstar director of equity research Philip Gorham says that AB InBev is well-positioned to exploit secular growth in several of its markets. In Latin America and in Asia, which combined make up almost two thirds of earnings, the consumer is trading up into premium global brands, and ABI holds a strong portfolio with Budweiser, Corona and Stella Artois. Developed markets, on the other hand are likely to remain fragmented and competitive.

After a sharp 10% decline in sales and 25% decline in adjusted profits last year, Morningstar analysts assume a rebound in sales growth of 8.3% in 2021, primarily due to a recovery in the on-trade. Beyond that, they assume the secular industry growth rate returns, with an estimate of medium-term revenue growth of 4%.

Roche

“We think Roche's (RO) drug portfolio and industry-leading diagnostics conspire to create sustainable competitive advantages”, says Karen Andersen, healthcare strategist for Morningstar. “Roche's wide moat arises from its status as the leader in oncology therapeutics and in vitro diagnostics, and the firm has a promising strategy of combining its expertise in both areas to generate a growing personalised medicine pipeline, making use of companion diagnostics. Much of Roche’s moat in pharmaceuticals is derived from its long relationship with Genentech. Roche first acquired a controlling interest in Genentech in 1990 and owned almost 56% of the firm before Genentech's board accepted its $95 per share offer to acquire a full interest in 2009.”

Roche’s biologics focus and innovative pipeline are key to the firm's ability to maintain its wide moat and continue to achieve growth as current blockbusters face competition. Roche's diagnostics business is also strong. With a 20% share of the global in vitro diagnostics market, Roche holds the number-one rank in this industry over competitors Siemens, Abbott, and Ortho.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)