A year ago this March, the Bank of England cut interest rates to 0.1%, and there has been little sign since of any move upwards. While that's good news for homeowners, more than a decade of ultra-low interest rates has been dire for savers.

The prospect of negative rates appears to have been taken off the table, but there is little hope for savers of a reprieve from rock-bottom interest rates. Many standard savings accounts these days even pay below the base rate, with 0.01% now a common interest rate. And with inflation expected to rise in the coming months, that means your cash is very unlikely to be able to keep up with any rise in living costs.

Myron Jobson, personal finance campaigner at Interactive Investor says the pandemic has come as a painful reminder to many people to keep a rainy day fund: “While there is little carrot offered to squirrel cash into a savings account amid the low interest rate environment, we all need cash savings.”

We’re assuming you’re reading this because you’ve already made up your mind to put some of this year’s (and maybe next year’s) Isa allowance into cash and are looking for the best rates. We’ve already run through the pros and cons of Cash Isas in a separate article.

Some things to remember before opening that account:

- You can have a Cash Isa and a Stocks & Shares Isa in the same year, so how your split your £20,000 between those is up to you

- You can only open one Cash Isa with one provider each tax year - although transfers from previous tax years are allowed

- Check if it’s flexible, allowing you to replace money you’ve dipped into

- Check the terms – is the account easy access (which usually have lower rates) or fixed for a set period?

- You may get paid interest monthly or annually (often you can choose)

- Don’t forget your additional £1,000 savings allowance too

- Most providers are signed up to the Financial Services Compensation Scheme, which protects up to £85,000 of your savings (in total, per individual not per household)

- You have to be 16 to open a Cash Isa

- Sometimes bigger deposits attract better interest

What Are the Best Cash Isa Rates?

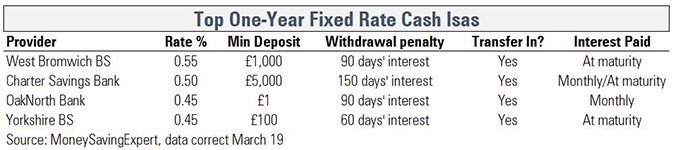

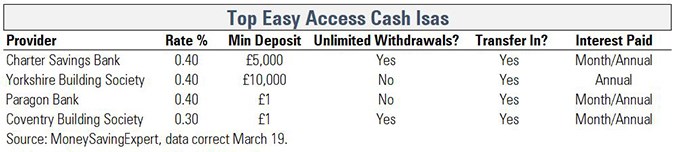

Using data from MoneySavingExpert, we reveal the best easy access and one-year fixed rate Isas:

If you opt for a fixed rate you can expect higher interest rates, and the longer you do this for, the better the rate. At the moment, to get over 1% - beating inflation - you need to lock your money away for five years. Bear in mind with fixed-rate Isas you can always access your money if necessary but the penalties can be painful for doing so, usually involving forfeited interest. A five-year fixed rate carries a penalty of 365 days' lost interest, for example.