Women are dramatically outnumbered in all areas of finance, but especially in the field of investment management. According to Morningstar data, when it comes to gender diversity, the global fund industry looks much like it did 20 years ago.

At the end of 2000, 14% of fund managers were women. And at the end of 2019, 14% of fund managers were women. In 2016, CFA Institute, a global association of investment professionals, conducted a survey that showed that men dominate the investment management industry worldwide. Across the Americas, Europe, Middle East, Africa and the Asia-Pacific geographic areas, women in each country represent less than 50% of all CFA members. Asia has the highest percentage, while Latin America has the lowest. In the US, the percentage is slightly above 18%.

The gender gap is a chasm in the fund industry. The cause is likely a complicated combination of structural barriers and implicit biases. But it has nothing to do with ability, as demonstrated in a Morningstar study in 2018 showing that the gender of fund managers doesn’t affect investment performance.

The Case for Increasing Disclosure

New laws and institutional investors put pressure on companies to improve the board diversity and disclosure on gender diversity and pay gap. The Harvard Law School Forum on Corporate Governance says Norway was the first country to pass a law that required publicly listed companies to have at least 40% of board seats to be held by women in 2003. Other European countries—France, Spain and Italy - enacted similar diversity laws.

Almost 15 years later, in 2018, California became the first US state to pass a board diversity law, though it is currently facing court challenges. California was followed by Illinois, which passed a law in August 2019 requiring companies to make additional disclosure on board diversity. Washington is the latest addition to the list with its new board diversity legislation and other states including Hawaii, Massachusetts, Michigan, New Jersey are in the process of drafting similar laws to be effective in coming years.

The Survey

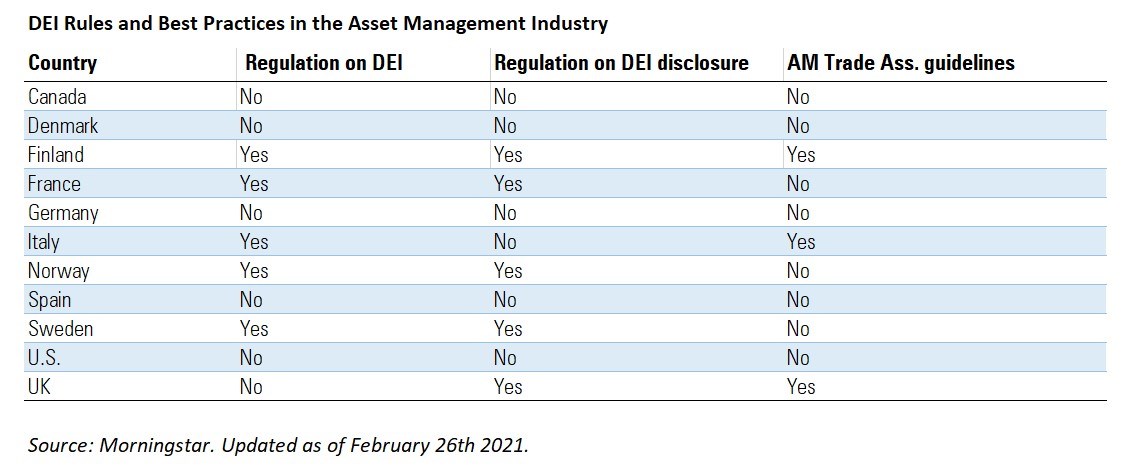

In February 2021, we conducted a global survey to review the DEI (Diversity Equity and Inclusion) best practices in asset management industry. We covered 11 markets: Canada, Denmark, Finland, France, Germany, Italy, Norway, Spain, Sweden, the US and UK. We asked three key questions:

1) Are there any laws/regulation in your country about board diversity, pay equity, diversity policy that apply to investment firms?

2) Are there any laws/regulation regarding the disclosure about diversity policy that apply to investment firms?

3) Has the local AM trade association set some guidelines on diversity, equity and inclusion? If yes, are they on a voluntary basis?

Let’s take a look at the key findings:

Regulation on Diversity and Pay Gap

According to our survey five out of 11 markets have regulations on diversity and pay gap that apply to investment firms and six do not.

Most countries that answered yes to the first question did the same for the second. Canada, Denmark, Germany, Italy, Spain and US don’t have laws regarding the disclosure on diversity policy that apply to investment firms. The UK implemented these disclosures, but doesn’t have a specific law about board diversity that applies to investments firms.

Trade Association Guidelines

Few asset management trade associations set up guidelines on diversity, equity and inclusion. According to our survey, only three associations out of 11 have such guidelines. In the UK, the Investment Association supports D&I through a range of internal and external initiatives, including helping firms attract, recruit, retain and promote from a diverse and inclusive perspective; an industry talent service, the Women in Finance Charter (which commits firms to helping women into senior roles by setting targets and reporting progress) and the Diversity Project (aims to achieve equality of opportunity).

An Overview by Country

Gender diversity has become an increasingly important issue in many countries, but the regulations and best practices for the asset management industry differ from one another. Below, you can find the local editors and analysts’ short report.

Finland

Asset managers and, more broadly, financial companies typically have set up an equality plan. It is required for all employers with at least 30 workers. Board must have more than 30% women. Companies do make references to the way they are working to become more diverse but usually not with hard promises.

France

French trade body is currently working on DEI, but no clear guide has been published yet. A number of polls have been conducted in the industry. They essentially focus on gender inequalities. Key-findings include that women represent 42% of workforce but only 8% of senior management in the French asset management industry.

Germany

In Germany a law regarding DEI is currently being discussed. If implemented, it would require the management boards of listed companies with more than three members to include at least one woman. However, only a limited number of local asset managers is listed (with DWS being the largest), so the impact may be quite limited in practice.

Italy

In Italy, the most recent survey was conducted by Assogestioni’s among 14 asset managers representing 85% of Italian total asset under management (April, 2019). Key-findings are that women make up only 18% of corporate bodies, but 13 out of 14 firms have at least one woman on the board.

Norway

In Norway, there are regulations for both diversity policy and related disclosure. According to Morningstar data, the number of women in leadership roles is quite high in top asset management companies: 50% at DNB 50%, 30% at Storebrand, and 30% at KLP.

Spain

As of November 2018, there is a Spanish law on non-financial information and diversity. This law obliges companies of a certain size to publish information on social and personnel issues, with an emphasis on the information being published by gender, age and professional qualifications. It also stresses the need for a balanced presence of men and women on boards of directors and in management positions.

Sweden

Due to Swedish legislation, all companies have to provide numbers on female/male employees. AMs follow these regulations as well as general anti-discrimination regulations.

US

In the US, there aren’t laws on diversity that apply specifically to asset management companies. There are pay gap rules that apply generally, however, and around diversity disclosure.

UK

The Government adopted a voluntary, business-led approach to increase women’s boardroom representation in listed companies. According to the Hampton-Alexander Review report 2021, the number of women on FTSE 350 boards has risen from 682 to 1026 in five years. FTSE 100, 250 and 350 all reached target of women making up 33% of boards by the end of 2020.

Thanks to Morningstar colleagues Christopher Greiner, Emma Berglow, Fernando Luque, Holly Black, Jackie Cook, Jocelyn Jovene, Matias Möttölä, Natalia Wolfstetter, Per Mattsson, Ruth Saldanha, and for contributing to the survey.