From choosing the right mortgage to dealing with the conveyancing process, buying a property is a complicated business. And when it’s your first time, there are some important additional factors to get to grips with.

So if you’re planning to get a first toe on the property ladder, what do you need to consider?

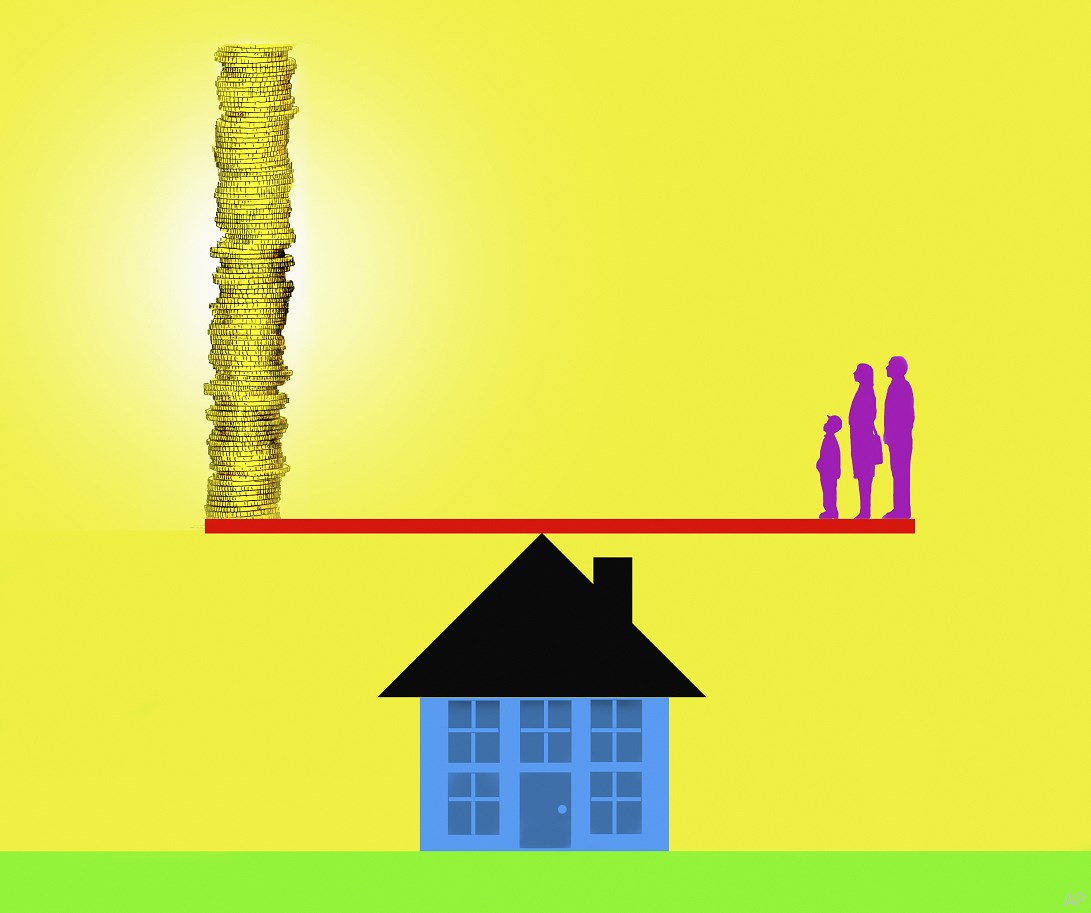

Assess Affordability

Before you can even think about home-hunting, you need to know how much you could borrow.

In years gone by, lenders would work on the basis of multiples of your income, but these days they look at total "affordability". This takes into account regular outgoings such as commuter costs, childcare and other loans, as well as your lifestyle, to make sure you won’t be too stretched if interest rates change.

A good place to start is with an online mortgage affordability calculator such as that on the Money Advice Service website. Typically, a lender will offer 4 or 4.5 times your income, whether you’re buying alone or jointly.

Look at Loan to Value

To get any kind of fixed-rate mortgage, you currently need a deposit of at least 10% of the property value, says David Hollingworth, director of communications at L&C Mortgages.

With a 10% deposit you’ll be looking at 90% loan to value (LTV) deals - meaning the lender puts up 90% of the property value. Such a deal leaves the lender shouldering a lot of risk and therefore comes at higher interest rates than lower LTV alternatives available to those with larger deposits.

According to Moneyfacts, there are more than 200 90% LTV fixed-rate mortgages for first-time buyers (FTBs) available, and as at mid-February 2021 the best rate is 3.29%.

However, Hollingworth points out: “If you can scrape together more - say 15% – you could access a wider range of options, which could make a big difference to your finances.” For instance the best fixed-rate deal for an 85% LTV mortgage for FTBs on Moneyfacts is 2.69%.

If you don’t earn much, the value of loan you’ll be able to get will be lower. Again, a larger deposit can help as it will widen your choice of properties.

Build a Deposit

With property prices soaring, perhaps the biggest challenge is to raise a deposit of at least 10%. Many FTBs rely on the bank of mum and dad to help, and we’ll look at other ways that parents can help their children get onto the housing ladder in a separate article.

Otherwise, the bottom line in most cases is that you’ll need to save hard, whether by trimming your bills (switching utility provider, for instance), cutting back on treats and non-essentials, getting extra work, finding a lodger if you rent alone, or maybe even moving to cheaper accommodation or back to your parents’ house for a while (if you can face it!) to save on rental costs.

One obvious step if you’re under 40 is to set up a tax-free Lifetime Isa in which to put your deposit money. You can save up to £4,000 a year into either a cash or a stocks and shares Lifetime Isa and the government will top it up by 25% when you buy your first home. But you must hold it for a year and you need to be sure you’ll be using the money for a property – if you don’t, you’ll have to pay a penalty to access it before retirement age (unless you’re terminally ill).

Check your Credit Score

When you get to the stage of finding a home and applying for a mortgage, be warned: lenders will look carefully at your credit history. Each lender has its own scoring model, but they will also conduct an external credit check.

You can check your credit score for free at credit reference agencies such as Experian or Equifax. If the number is high, it indicates you’ve managed credit well in the past, and lenders should therefore be more positive about lending to you in future.

There are various things you can do to get your credit score into good shape. First, make sure you have registered to vote. If you haven’t, you can do so here and you find more information about what a credit score is here, as well as tips on how to improve your score here.

Perhaps surprisingly, not having a credit card may work against you, because there’s no evidence to show how you’ve managed your debts. So make sure you have one and use it from time to time – but ideally clear the debt each month, or at least pay off more than the minimum amount. That shows you take your financial obligations seriously, and can make a big difference to your credit score.

Many people who are renting move home quite frequently, so do make sure also that all your credit cards, bank accounts and other contracts such as mobile phone documentation are registered to your current address.

Finally, keep an eye on your credit history to make sure you’ve not been scammed and there are no fraudulent accounts running in your name. Head to the Action Fraud website for more help.

Take a Longer Mortgage Term

If you’re worried that you’ll struggle to meet your monthly mortgage repayments on a mainstream mortgage with a 25-year term, one option becoming more commonly used is to opt for one that runs for 30, 35 or even 40 years. Because the debt is spread over a longer period, monthly repayments are smaller, easing the pain when you start out.

However, Hollingworth warns, the downside of a longer term is that it will cost considerably more in total if you stick with it indefinitely. “It’s a good way to give yourself some breathing space at the outset,” he says. “But over time, your earnings are likely to rise, so once you can afford to, it makes sense to reduce your mortgage term when your deal ends, or else make a point of making overpayments - most lenders will allow you to overpay by up to 10% a year without penalty.”