In a hostile environment for UK dividend investors, some companies have managed to maintain or grow their payouts over the past 10 years. Some, like drinks maker Diageo (DGE) have an admirable unbroken run of 20 years of rising dividends. But many firms have struggled to keep up payments to investors amid the economic storm, and 2020 is not the first year that their dividends have been cut. We’ve crunched the numbers to unveil some of the most frequent dividend cutters on the UK stock market in the last 10 years.

The Serial Dividend Cutters

Over 20 years there have been two major stock market crises: the Great Financial Crisis and the Covid-19 crisis (2020 onwards). Dividend cuts in these times of severe market stress are inevitable and often prudent.

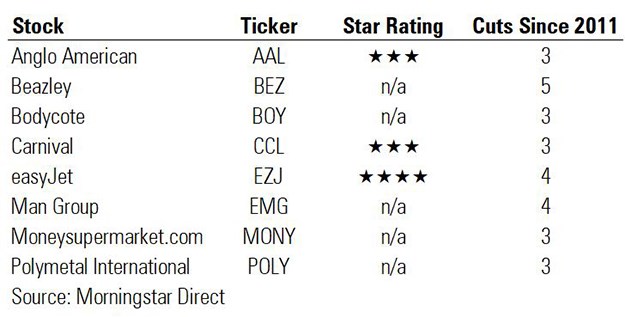

We’ve looked at Morningstar Direct data going back 10 years and found that a number of companies have cut their payouts in the past decade - even in the good times. To make it on to our list of serial dividend cutters, a stock has to have reduced its share payout three times (including special dividends).

Among the large-cap companies on our list is Beazley (BEZ), which manages insurance syndicates for Lloyd’s of London and has cut its dividend five times in the past 10 years, in 2012, 2015, 2017, 2018 and 2020.

Airline easyJet (EZJ), a recent stock of the week, makes it into the four-cut club, with reductions in 2013, 2015 and 2018 and inevitably, in 2020 as travel restrictions grounded the industry. Morningstar analysts rate the budget airline as four stars, meaning its shares are currently undervalued. The firm's dividend was suspended last year to shore up cash, and analyst Joachim Kotze doesn’t expect it to be reinstated any time soon.

International cruise company Carnival (CCL) is another stock to have been impacted heavily by the pandemic; 2020 actually brought an end to a reasonable streak of dividend increases that it had maintained from 2014 onwards, but it has still cut three times in the past decade. Like easyJet, Carnival suspended its payout in the height of the crisis last March, although it had just paid out a dividend two weeks before. Its shares fell off a cliff at the start of last year, from £35.87 at the start of 2020 to £6.20 in mid-March, a fall of 82%; at around £13 now, the shares are a touch below their fair value of £14.70, according to Morningstar analysts.

Scrapping the dividend is one way the company can shore up its finances until cruise passengers get back on board. In her latest update on the company at the end of January, analyst Jaime Katz says the company has enough liquidity to stay afloat – 15 months’ worth, assuming no revenue is earned in that period. “We don't anticipate an imminent credit crunch in the near term,” she says.

Anglo American (AAL) is the only large-cap miner to make it on to our list, as it cut its dividend in 2020 as well as in 2014. In 2016, it didn’t make any payout at all as miners reeled from a crash in commodity prices, which was triggered by an economic slowdown in China. Commodities firms were some of the best dividend payers on the FTSE going into 2020, but again have wielded the axe, this time in the shape of cut special dividends. According to Link, mining firms’ 2020 payouts were nearly 50% below those of 2019, but just 26% down when special dividends are stripped out.

Dividends paid by financial group Man (EMG) in 2020 were roughly the same as in 2019 (7.8p versus 7.93p per share) - a decent achievement given the environment. But its dividends fell in three consecutive years in 2012, 2013 and 2014, and from 2018 to 2019. And if you take in 2020, Man joins Beazley on five cuts.

Moving down the list, FTSE 250 hot metal specialist Bodycote (BOY), comparison site Moneysupermarket (MONY) and precious metals company Polymetal (POLY) each made three cuts in the past decade.

Do Dividend Cuts Matter?

Do cuts matter? While a dividend cut can be interpreted as a red flag, it's not unusual for firms to cut payouts one year and restore them the next. Unilever (ULVR), for example, cut its payout in the wake of the 2008 financial crisis and again in 2015, but its 20-year trend has generally been on an upward slope. A dividend cut is not necessarily a sell signal - the important thing is to look at the reasons behind the cut; is it because profits have slumped or is it a sensible reaction to a wider market issue?

Some growth companies make no dividend commitments, so fluctuations matter less to long-term shareholders. But to some investors, income matters a great deal and any changes can wreak havoc on their financial plans. This is one reason to ensure your portfolio is well diversified, so you are not overly reliant on one or two stocks for vital income payments.