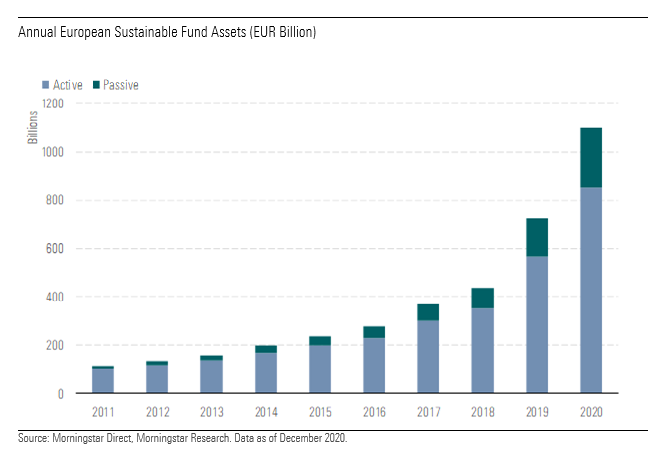

2020 was an exceptional year for ESG funds. Driven by increased interest in environmental, social, and governance issues, European sustainable funds broke new records in terms of inflows, assets and product development.

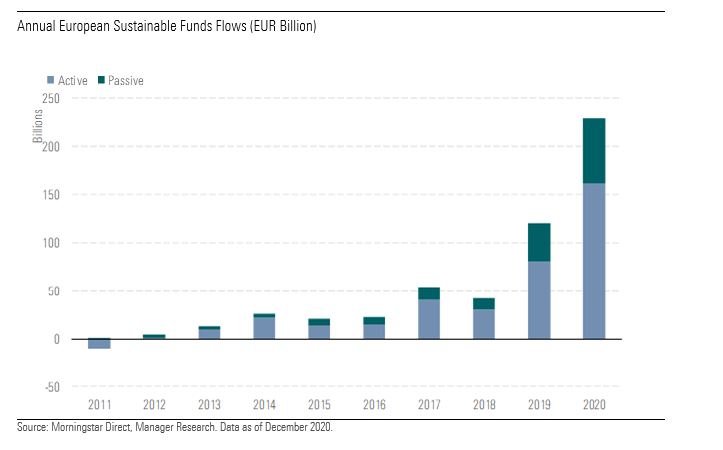

During 2020, sustainable open-end and ETFs available to European investors attracted net inflows of €233 billion. This was almost double the figure for 2019. In the fourth quarter alone, sustainable funds pulled close to €100 billion in net new money, taking 45% of overall European funds flows.

Our universe of sustainable funds includes equity, fixed income, allocation and alternatives funds that claim to have a primary sustainability objective and/or use binding ESG criteria for their investment selections. We do not include funds that employ only limited exclusionary screens such as controversial weapons, tobacco, and thermal coal, nor do we include the growing number of funds that integrate ESG considerations into their traditional investment process in a non-determinative way.

Why Are Investors Flocking to ESG Funds?

Several factors can explain last year’s high inflows. The prospect of more regulation in the space is one, but investors have also come to realise that ESG funds offer comparable, or even in some cases, better performance than conventional funds. The Covid-19 market sell-off in the first quarter was a good test in this respect. The pandemic has also accelerated investor’s interest in sustainability issues, and climate change in particular. It’s perhaps one of the few silver linings in the pandemic.

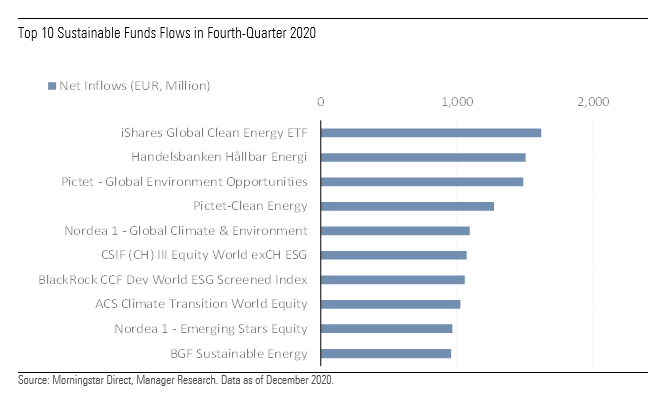

Increased awareness of the risks and opportunities created by the climate transition is evidenced by the fact that climate-related funds were among the best-sellers last year, while even more funds divested from the highest-carbon emitters. In the fourth quarter, seven funds with a climate-related flavour landed in the top 10 funds in terms of flows. Leading the charge were clean energy funds, which were also the big winners of 2020 in terms of performance. The top funds returned between 100% and 200%, driven by expectations of increased long-term demand for alternative energy equipment.

Record Year for Fund Launches

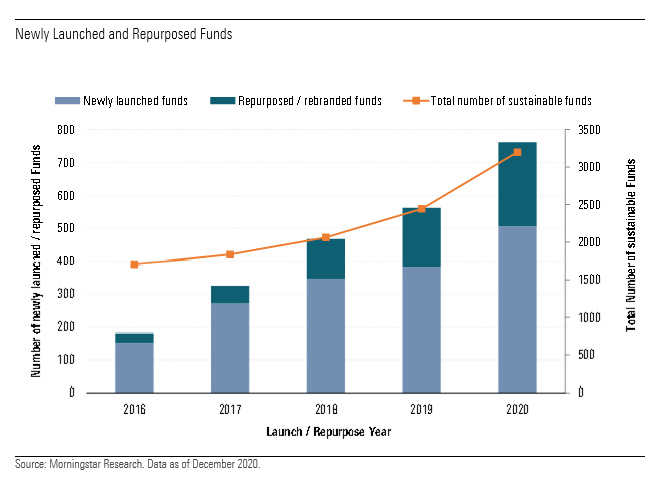

Meanwhile, the European sustainable funds space saw an unprecedented level of product development activity last year, with 505 new funds coming to market. Asset managers continued to expand the range of options available to investors in terms of asset class, market exposure, and theme.

While broad ESG funds continued to represent the bulk of new offerings, funds with an environmental flavour accounted for 13% of new launches. Two thirds of these target climate change. Funds such as UBS (CH) IF Equities Global Climate Aware Fund and RobecoSAM Smart Energy Equities fund allow investors to mitigate risk and/or gain exposure to companies that will benefit from, or contribute to, the transition to a low-carbon economy.

On the passive side, we saw the launch of nine funds that track Paris-aligned indices, including Lyxor S&P Global Developed Paris-Aligned Climate ETF and Franklin S&P 500 Paris Aligned Climate ETF. In order to achieve Paris-alignment classification, a fund must invest in companies that reduce their emissions by an average of 7% annually—the pace of phasing-out of fossil fuels set out in the Paris Agreement—and the fund overall must have a carbon-emissions footprint 50% below that of the broader market.

Other sustainability-related themes addressed last year included gender, smart cities, the ocean, and the UN's SDGs. Examples include RobecoSAM Global Gender Equality Impact Fund, Lyxor MSCI Smart Cities ESG Filtered (DR) ETF, BNP Paribas Easy - ECPI Global ESG Blue Economy and NT Europe Sustainable Select SDG Index Fund.

Launching new funds is not the only way asset managers have responded to increased investor demand for sustainable investment options. They also repurpose existing conventional funds. They do so by changing the investment objective and/or investment policy of their funds. And many reflect the new mandates by rebranding the funds. Repurposed funds hit new highs last year. We identified 253 such funds, 87% of which reflected the change by rebranding.

The record number of fund launches and repurposed funds in 2020 brought the total number of European sustainable funds to 3,196 funds.

Growing interest in ESG issues, accelerated by the pandemic, and regulation will likely continue to drive demand for sustainable funds in Europe. We expect 2021 to be the year when ESG truly enters the mainstream. It is likely that changes to MIFID II will encourage more retail flows into sustainable funds as financial advisors are now legally bound to ask a client about their sustainability preferences.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)