The scale of the Covid-19 pandemic has created unprecedented demand for vaccines. As governments across the globe now rolling out vaccination programmes, the market for coronavirus innoculations is expected to be worth $39 billion, with another $10 billion for other Covid-19 treatments.

The result of all available treatments, according to Morningstar's calculations, is that up to 3.3 billion people will receive a vaccine this year. That is far less than the 5 billion vaccines that the manufacturers themselves say they will deliver in 2021, but takes into account delays and delivery issues.

The shortfall is likely to come from problems in various areas, such as stock shortages (think of a lack of raw materials, machines and injection needles), transport (as many vaccines areunder strict temperature conditions) and governmental issues as the general public must be convinced of the need for vaccination.

It will come as no surprise that demand in the most developed economies, where the vaccines are primarily sold in the first instance, is so high. Last year, 1.8 million people worldwide died from Covid-19 and more than 83 million people became infected with the virus. And those are only the officially reported cases. In reality, the figures are likely much higher.

Pfizer and Moderna

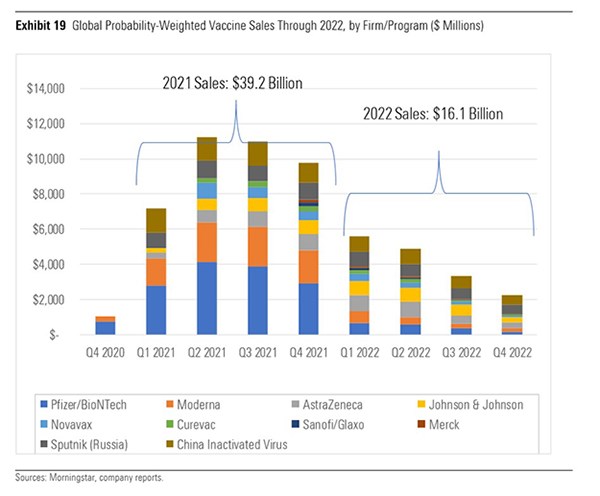

Morningstar expects revenues of $13.7 billion and $ 8billion this year for the first two vaccine makers whose treatments have been approved, by Pfizer/BioNTech's and Moderna.

And while those revenue figures may have boosted share prices, it is not the case that the enormous demand for vaccines and other treatments this year greatly increases the true value of these stocks. That is what Morningstar analyst Karen Anderson has concluded in her latest looked at the sector.

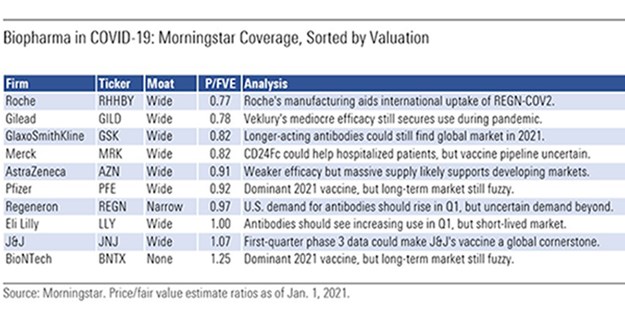

The so-called Fair Value of pharma companies - what a company is really worth in Morningstar's eyes and not its market value - is generally lower than their market value, or about the same for vaccine makers.

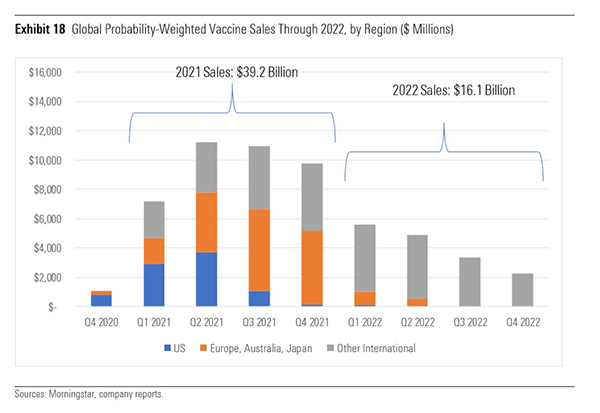

One of the main reasons for this view is that Morningstar analysts do not think peak vaccine sales, and the resulting higher revenues, will last. Global group immunity should be achieved by 2023, they say. Logically, the demand for vaccines will decrease in the run-up to this. The market of $39 billion this year will fall to $16 billion by 2022, according to their calculations.

A third factor depressing Fair Value Estimates is the fact that the price of coronary vaccines is below the usual level of new drugs. This is because the industry also realises the social importance of providing broad access to treatment, including for people (and governments) with a small budget.

Overvalued Stock Prices

However, different laws apply on the stock exchange, and optimism around the vaccine has understandably driven up prices. Those looking for undervalued picks in the sector should look to companies that market coronavirus treatments, such as Gilead, Roche, Glaxo and Merck. And AstraZeneca and Pfizer are also avoiding the trend of overvaluation, with a stock market value that is slightly below the Fair Value.

Incidentally, of the ten biopharma companies that are most valuable, eight already have a so-called Wide Moat status. This indicates that in Morningstar's eyes they have a great competitive advantage over their peers. They are Roche, Gilead, GSK, Merck, AstraZeneca, Pfizer, Eli Lilly and Johnson & Johnson. Of the top 10, only BioNTech has no Moat status, and Regeneron is assinged a Narrow Moat status.

Of course, market price is not the only thing in the spotlight when it comes to Covid-19. The global pandemic has thrust into the spotlight ESG matters and particularly the "S" or matters of social good. That's a good thing for companies working to find a cure. The lightning-fast development of effective vaccines has also brought the industry a lot of goodwill from governments. This will undoubtedly mean that in the near future they will take less time in price negotiations - because politicians and governments are now also more aware of the importance of a thriving pharmaceutical industry.

Sales by Region

According to calculations by Morningstar, the sales of vaccines will differ greatly per geographic region. Two speeds of vaccination become visible with developed economies leading the way, and emerging markets following to follow later. In the first two quarters of this year, the sales of vaccines in the US still dominate, with Europe, Australia and Japan close behind.

However, most of the world's population - some 6.5 billion of the 7.8 billion people on earth - does not live in one of these region. It is expected that vaccination in these regions will continue until 2023. There, Pfizer/BioNTech and Moderna will not dominate as vaccine sellers, but other parties are expected to take the lead.

Distribution Problems

Pfizer's vaccine is more difficult to distribute worldwide than Moderna's, primarily because it must be kept at a temperature of between -60 and -90 degrees Celsius. This means Pfizer's vaccine will be largely out of the reach of developing countries, at least until the pharmaceutical company manages to package it in the form of a freeze-dried formula, which is likely to be 2022 at the earliest.

And even if Pfizer manages to ship the vaccine across the world, governments must be able to ship it within their country. For transport to remote, rural areas, they will have to open and repackage Pfizer's vaccines in smaller shipments.

Compare that with the Moderna vaccine, which can be shipped "normally" at a standard deep-freeze temperature (-20 degrees Celsius). That does, of course, make logistics a lot easier. and it would make sense for governments to send the Moderna vaccine to remote, rural parts areas.

And then there is a second downside to Pfizer's vaccine: it has to be diluted before it can be administered. This is not necessary with Moderna's vaccine and that makes it a lot easier for pharmacists to use.