Exchange traded commodities (ETCs) are a popular and low-cost way of gaining exposure to the movements of oil, gold and other precious metals without the hassle and expense owning the product itself. The appeal of such funds was apparent in 2020, a volatile year which saw oil plunge and gold soar.

What Happened to Oil in 2020?

The collapse in oil prices in April 2020 saw the commodity's price move into negative territory for the first time. It was largely sparked by a drop-off in car and air travel as a result of the Covid-19 crisis. At the time, Morningstar analyst Kenneth Lamont looked at the phenomenon of negative oil prices, cautioning that investors keen to leap in to buy “cheap” oil via ETCs could come a cropper because of technical reasons (for more on “rolling costs” and “contango”, the article is here).

Oil prices rely on supply and demand. They reflect expectations about the strength or weakness of the global economy, as well as output from oil producing countries like Saudi Arabia and Russia.

While air and car travel are yet to recover, the price of oil has rallied. This sea change has been led by the approval of Covid-19 vaccines, the US Election result and China’s swift recovery. It has been further fuelled by hopes that the world can get back on to a more “normal” footing at some point this year.

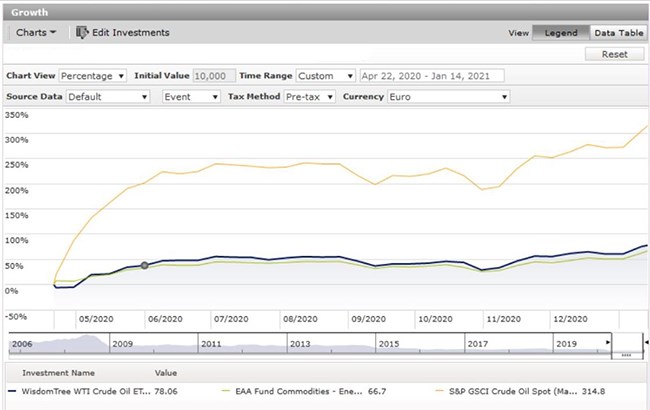

So, did investors who bought in at oil’s low point reap the rewards? Using Morningstar Direct data, we analysed the performance of one popular ETF, Wisdom Tree WTI Crude Oil (CRUD) versus the Morningstar Commodities – Energy category. The category wsa up 66% in the year while the price of crude oil soared 314% from its low point. The ETF, meanwhile, was up 80% from the low.

Why the disparity? Oil ETCs don’t track the spot price of oil neatly because they don’t buy and sell the physical barrels themselves. Instead, they invest in futures contracts (a type of derivative) which have their own pricing dynamic. Often with investment, timing is everything and performance can look completely different if you move the time periods around – the bounce from the bottom for the ETF was impressive, but performance fo 2020 as a whole less so: it was down 53.9%. For comparison, the Morningstar WTI Crude Commodity index, lost 40% last year.

What Happened to Gold in 2020?

While physical gold itself returned 20% for 2020 as a whole, it lagged during the end-of-year equity rally, after the US Election results and news of a Covid-19 vaccine.

With gold, we see a much closer correlation between the ETF performance and the price gain of the commodity itself: the iShares Physical Gold ETC (IGLN) and WisdomTree Physical Gold (PHAU) both gained 20% last year.

This is because gold ETFs can get exposure to the gold price having to take physical delivery of gold bars or trade commodity futures contracts. Investors also have a choice of open-ended funds, gold mining shares and investment trusts, all of which have different characteristics.

Gold’s performance is driven by sentiment, how cautious or bullish investors are feeling, and that makes it difficult to predict. Some experts think risky assets such as equities will be back in favour as the world moves towards Covid-19 immunity, which would depress gold prices. Others think the prospect of inflation and a weaker dollar, means gold has a chance to shine again this year. BMO Asset Management’s chief economist Steven Bell says that even if inflation doesn’t materialise this year, the fact that the markets are worried about it means that traditional inflation-protection assets like gold should do well.

Timing and Trends

As long-term investors, Morningstar believes that timing the market is best left to professionals, who have the resources to back big bets like the turn in oil prices.

Even if you’d bought an oil ETC at the right moment, the near 80% gain would only be on a par with the best-performing equity funds of 2020 - and you’d still be behind the gains in oil market itself and missed out on a rebound of 300%+. Morningstar’s Lamont says a successful investment in oil at the right time would have come in the context of a year of extreme performance (a 700% gain for Tesla, for example). “There have been a lot of big payoffs if you happened to time them and guess them right,” he says.