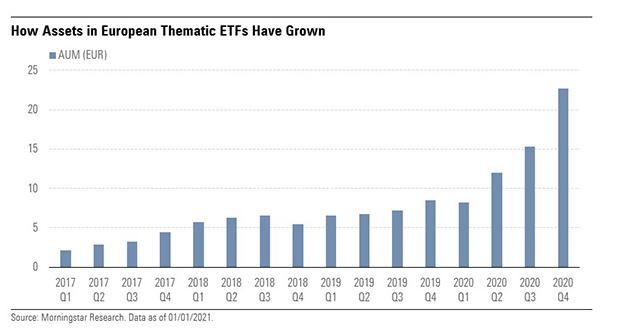

Thematic ETFs in Europe emerged as one of the big winners in 2020 as eye-catching returns helped attract a record €9.5bn in net new assets across the year. These strong flows helped assets under management more than double from €8.2bn to an all-time high of €22.7bn.

So, what is a thematic ETF? Simply, it is a tracker fund which is designed to tap into a specific theme. This might be robotics or artificial intelligence, clean energy or even logistics. These passive funds are different to traditional ETFs because they don't simply mirror a stock market, but aim to capture the perform of a chosen trend or industry.

Energy and Connectivity Themes Attract Attention

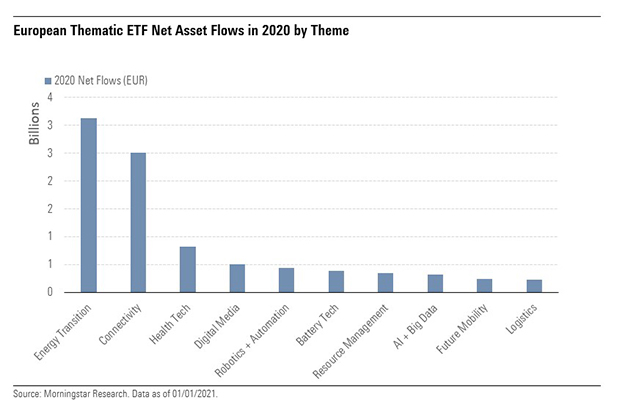

One third (€3.1billion) of thematic ETF net inflows went into Energy Transition themed funds over the course of 2020. The disruptive volatility experienced in the oil markets led many investors to seek alternatives and to revaluate the risks of alternative energy sources – not to mention their potential rewards. The US election result and other pro-environmental political developments globally were also supportive to this theme.

Elsewhere, connectivity funds also proved popular. The group, which includes Cyber Security and Cloud Computing themes, collected € 2.5bn over the year.

Stellar Returns in 2020

In a turbulent year for markets, thematic ETFs were some of the stand-out performers. Some 33 of the 36 European-listed thematic ETFs outperformed the MSCI World Index, and most by a handsome margin.

The iShares Global Clean Energy ETF (INRG) returned an attention grabbing 120% over the course of the year. And clean energy wasn't the only theme to win big; many funds with a technology theme benefited from changes in consumer and company behaviour sparked by the lockdown as the Covid-19 pandemic spread around the world. For example, the WisdomTree Cloud Computing ETF (WCLD) returned 92% and the VanEck Vectors Video Gaming and eSports ETF (ESPO) returned 68%, boosted by the surge in remote working and demand for online entertainment respectively.

Even the worst thematic performers managed positive returns. These include the iShares Ageing Population ETF (AGED), which was hit hard during initial stages of the pandemic but rebounded to return 3% for the year as a whole, thanks largely to its outsized exposure to healthcare stocks.

But while you can clearly win big if you pick the right thematic ETF at the right time, if you pick wrongly the losses can be large – and the journey can sometimes be volatile. For example, the L&G ROBO Global Robotic and Automation ETF (ROBO) lost 16% in 2018 before gaining 32% the following year. It is important to understand the risk and return characteristics of an ETF (or any fund, for that matter) before including it in your portfolio.

Investors should be wary and look beyond dazzling short-term returns when selecting thematic ETFs. Morningstar research has shown that thematic funds globally have struggled to survive and outperform global equity benchmarks over longer periods of time.

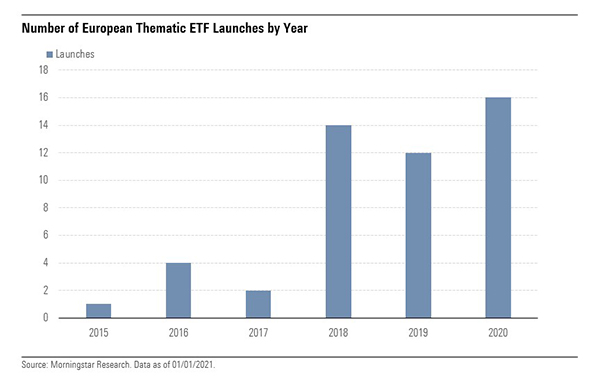

New Launches

But investors are clearly interested in this part of the market, and fund providers are responding to that demand. Indeed, 2020 saw a record 17 new thematic ETFs come to market, including the first medical cannabis ETFs from UK-based thematic specialists HanETF and new entrant Rize ETF. The latter also launched sustainable future of food and education tech and digital learning offerings.

Two new energy transition funds also caught the eye: JPMorgan Carbon Transition Global Equity UCITS ETF (JPCT) selects those stocks deemed to benefit most from the shift to a low carbon economy, while iClima Global Decarbonisation Enablers ETF takes a different tack, targeting companies offering products and services that enable CO2 avoidance.

Growth in the market has also attracted new entrants. The most notable of these is US-based thematic ETF specialist Global X, who currently manage more than €17 billion in assets in the US. Initial European launches cover the video games and eSports and telemedicine and digital health, with more expected to follow.