2020 is was, if nothing else, a year to remember - and it was a record year too for exchange-traded funds (ETFs). Despite the sharp stock market sell-off of March 2020, investors continued to put their money to work, and the amount held in ETFs swelled to a record high.

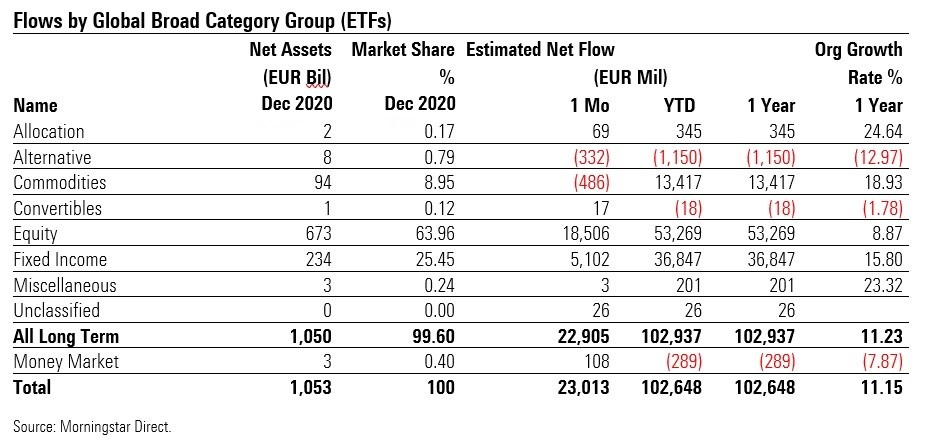

European-domiciled ETFs saw assets under management climb 14% in the year, bringing them to the second best calendar year of their (short) history. As of December 31, 2020, Morningstar estimates that assets under management had reached €1.05 trillion, up from €923 billion at the end of 2019.

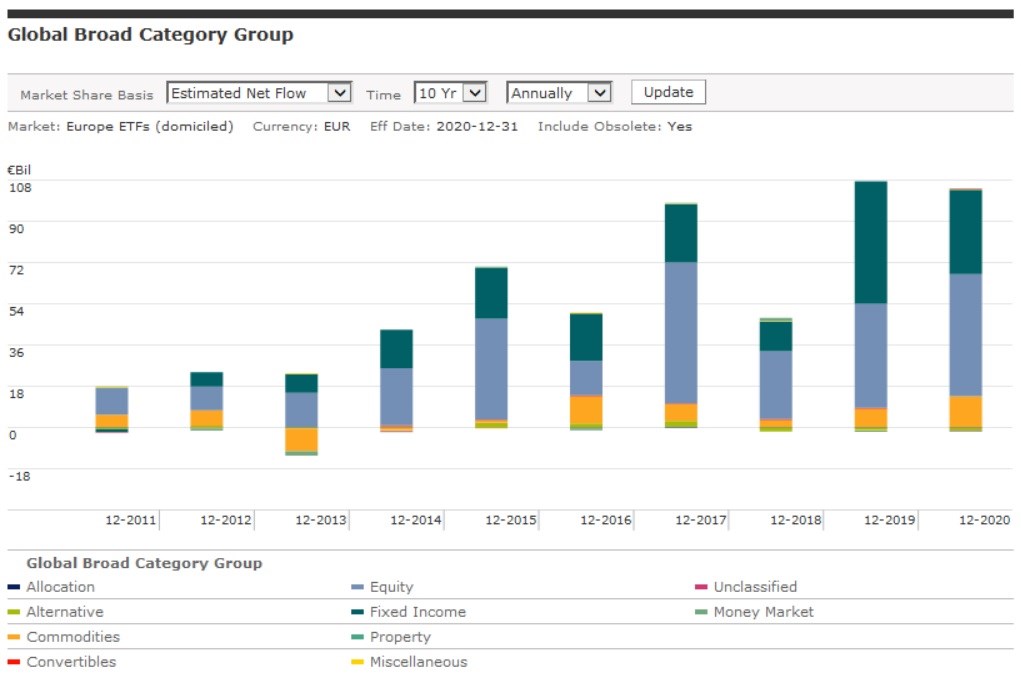

While much of that is due to the market rally which rounded off the year, some €103 billion of that growth came from new money invested. That was just €4 billion less than the record inflows reached in the previous year. Indeed, ETFs (excluding those focused on money markets) recorded organic growth of 11.2% in 2019. For comparison, active funds recorded organic growth of 2.7% between November 2019 and November 2020 (December data is not yet available for active funds).

Raccolta netta annuale degli ETF europei a dieci anni

Source: Morningstar Direct.

Fixed Income Gains Traction

A more detailed look at where those inflows were directed reveals that equity-focused ETFs products were widely in favour, with net inflows of €53.3 billion in the year, up from €45.9 billion in 2019. Bonds, meanwhile, attracted €36.8 billion of new money in 2020, down from €54 billion the previous year.

But fixed income comes from a lower base and as a percentage it actually saw a much greater organic growth rate than equity products, at 15.8% growth for the year compared with 8.9%. While investors have long used ETFs to track equity markets, fixed income products have taken longer to gain traction. But in the current environment of record low interest rates, it seems investors are now turning away from actively managed bond funds to low-cost trackers.

Gold Shines in a Difficult Year

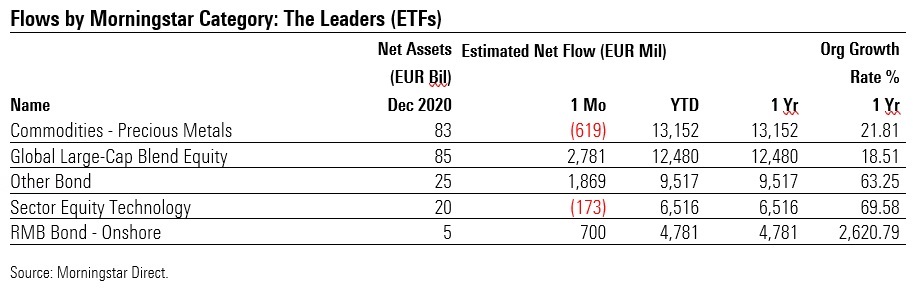

When we look at Morningstar categories, it is interesting to note it is passive funds investing in precious metals which attracted the greatest flows during the year. This was sparked by a rally in the gold price, with the price of the yellow metal soaring at the height of the Covid-19 induced volatility as investors looked for protection.

But the rally was not sustained through the year and gold ETCs even recorded net outflows during the final quarter of the year. With € 4.5 billion grossed, the iShares Physical Gold ETC was the best-selling fund in its category during 2020.

Also noteworthy is the entry into the top flight of Chinese government bond ETFs, which were snapped up like never before. The purchases have been driven on the one hand by the strength of the Chinese currency and on the other by extremely attractive yields. Indeed, at a time when there is more than $16 trillion in bonds paying negative rates in the world, the 10-year bond issued by the People's Republic of China offers a yield of 3.19%. iShares China CNY Bond UCITS ETF has dominated this group, attracting almost €4.6 billion, making it the single best-selling ETF in 2020.

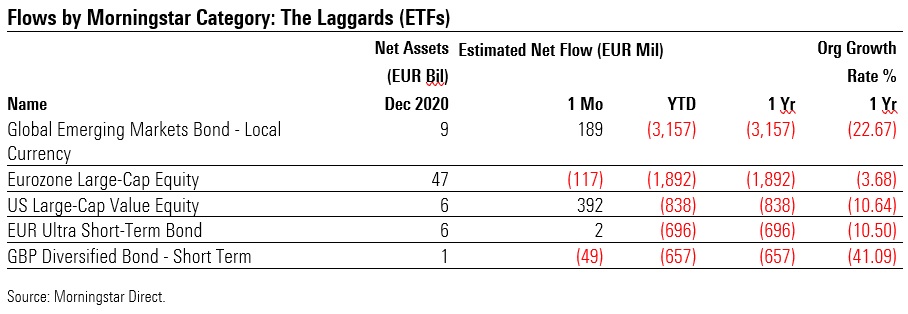

On the outflow side, however, ETFs exposed to emerging bonds in local currency were the most affected, followed by those exposed to large-cap Eurozone shares

iShares Remains Top Dog

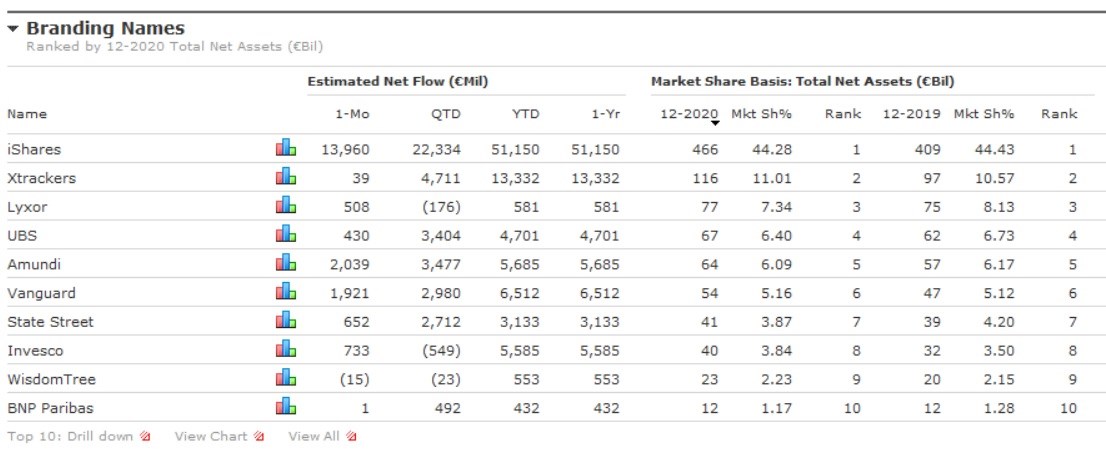

Market leader iShares retained its position as top dog in the year, attracting net inflows of more than €51 billion in 2020. Some €28 billion of that went into equity options.

In second place is Xtrackers, with €13.3 billion collected. The Xtrackers S&P 500 Equal Weight UCITS ETF 1C was the best-selling fund among those offered by the German provider (€1.4 billion). Vanguard then follows, with €6.5 billion in net inflows. The Vanguard FTSE All-World UCITS ETF fund was the best-selling fund, with €2.3 billion attracted in 2020.

The market share of iShares has dropped slightly in the last year, from 44.43% to 44.28% and Xtrackers also lost ground. Meanwhile, Vanguard, Invesco and WisdomTree have flexed their muscles to grow their share.

Fonte: Morningstar Direct.