Growing environmental, social and economic issues are challenging us to reduce waste and pollution, avoid plastic items and be eco-friendly. Research refers to it as “sustainable lifestyle”, or “living well within the earth’s limit”. How you put that into practice can vary, from Practices encompass a wide range of activities, including energy and water conservation, waste recycling, “green” consumption, travel and tourism behaviours. We struggle to be sustainable consumers, so how can we be sustainable investors?

Sustainable funds have been attracting more and more flows. Assets in sustainable funds hit a record high of $1,258 billion as of the end of September 2020. Europe surpassed the $1 trillion mark. Hortense Bioy, Morningstar Director of Sustainability Research, says: “The strong inflows speak of the growing investor interest in ESG issues, especially in the wake of the Covid-19 crisis. The disruption caused by the pandemic has highlighted the importance of building sustainable and resilient business models based on multi-stakeholder considerations. The average outperformance of sustainable funds in the first quarter globally has also helped alleviate some investors' concerns about a potential return trade-off in sustainable strategies”.

Fund companies have raced to respond to this interest, both by launching new ESG offerings and repurposing existing one with a sustainable gloss. But many investors may be confused by the wider (and ever-growing) range of products. How we can distinguish between what is ESG and what it isn’t?

What Sustainable Investment Means

Sustainable investment can be defined as a long-term oriented investment approach, which integrates environmental, social and governance (ESG) factors into the research, analysis and selection process of securities within an investment portfolio.

The acronym ESG therefore encompasses three areas The first is the environment, which includes climate change and carbon emissions, air and water pollution, biodiversity, energy efficiency, waste management. The second one includes data protection and privacy, gender and diversity, human rights, labor standards and community relations. The third one covers issues such as board composition, bribery and corruption, executive compensation, lobbying and political contributions.

How to Identify Sustainable Funds

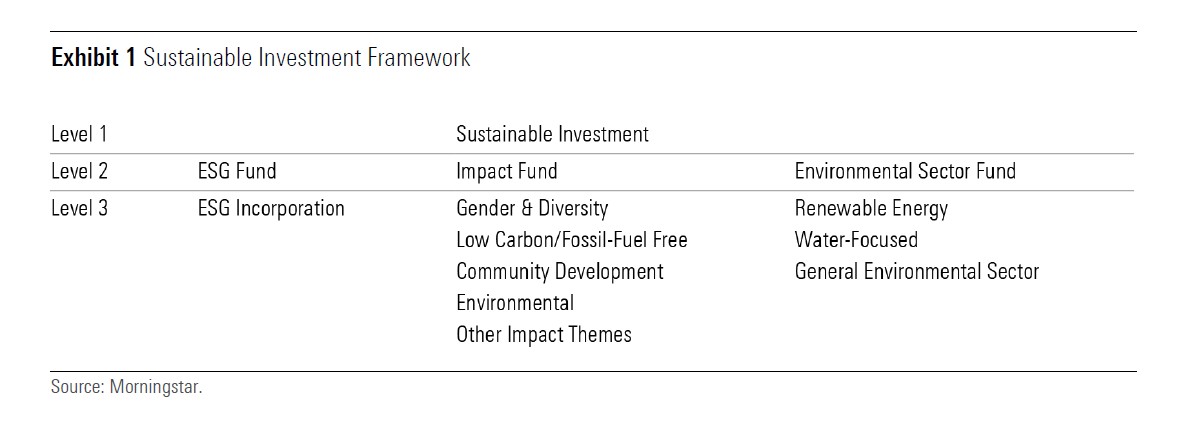

Many asset managers offer intentional sustainable funds: they are described as focusing on sustainability, impact, or environmental, social, and governance factors in its prospectus or other regulatory filings. There are different approaches: some funds incorporate ESG factors into the investment process, while others (impact funds) in addition to financial return, seek to deliver a measurable impact on specific issues or themes like gender diversity, low carbon, or community development. Finally, "Environmental Sector Funds" are strategies that invest in environmentally oriented industries like renewable energy or water.

Employs-Exclusion Funds

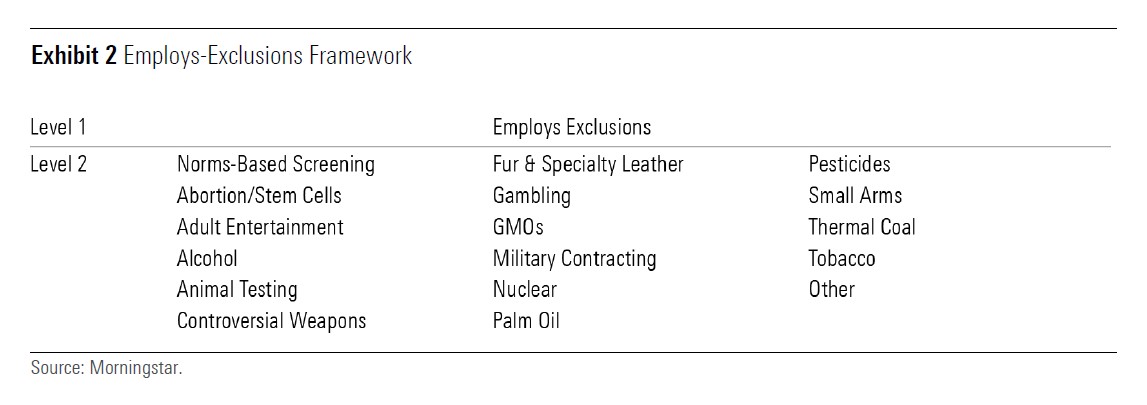

"Employs Exclusions" strategies exclude certain sectors (controversial weapon, thermal coal, tobacco, etc.) companies, or practices (human rights violations, child labor issues, etc.).

Active Ownership

Asset managers occupy an important role in the “stewardship ecosystem.” They collectively represent a large pool of capital which affords them a powerful role as financial stakeholders. They have the right to cast votes on directors, on pay practices, and on other issues including environmental and social ones. They can also engage in a dialogue with corporate management and board members over corporate governance and other concerns.

How to Do an ESG Risk Check-up

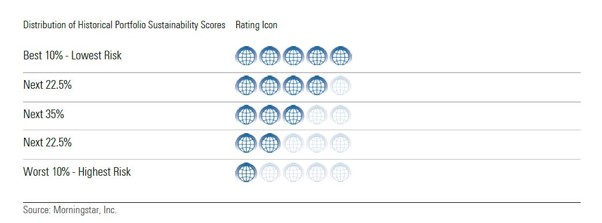

ESG issue can have a material financial impact on the portfolio. The Morningstar Sustainability Rating (the “Globe" ratnig) provides insight into how well companies in a portfolio are managing the material ESG issues they face both relative to their industries and across industries. It is based on the ESG Risk Rating, provided by Sustainalytics (a Morningstar group company), that is the amount of ESG risk that remains after taking into account companies’ ESG management activities.

The rating provides investors with a way to evaluate any portfolio on ESG risk. Investors can use it to evaluate how much ESG risk is in the funds they own and to identify funds with lower levels of ESG risk (5 or 4 Globes). Those wanting to invest in intentional sustainable funds should expect those funds to have relatively low ESG risk.

The Morningstar Sustainability Rating

Does My Fund Manager Take ESG to Heart?

If we want to understand how and the extent to which ESG factors are incorporated into the strategies we own, we should consider what the asset management firm brings to bear. We should ask ourselves: how important ESG is to the character of the firm? What are ESG resources (specialised team, ESG data, etc) in the firm? Are there clear environmental and social proxy-voting guidelines?

Morningstar analysts evaluate firm ESG commitment digging into these topics and they place asset managers into one of four tiers: Leader, Advanced, Basic, and Low. For example, for Leader firms, ESG is often core to the company’s identity, meanwhile Advanced ones are among the industry’s better ESG proponents, but they usually have a more limited application than Leaders.

Morningstar also assigns ESG Commitment Level for individual funds, using analysts’ qualitative appraisal of the extent to which strategies incorporate ESG factors. For example, Leader strategies are truly and fully committed to ESG investing, meanwhile Low level ones are either doing nothing or little on the sustainability front.

In the past, data and information about how sustainable funds, equities and asset management groups was available only for professional investors. Today, it is much easier to access that information and therefore find investments which align with your own world view. The sustainable investing world is still in its infancy, but already it has come on leaps and bounds, and its army of fans is growing alongside assets under management.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)