Sustainable investing is on the rise, and hundreds of funds with an ESG flavour have been launched in recent years to meet investor demand. An increasing number of asset managers are now claiming to incorporate environmental, social, and governance factors into their investment decisions.

This leaves investors with a lot of work to do to differentiate between funds that truly focus on ESG and those using ESG considerations in a limited way. Morningstar has developed a wide array of ratings, data, and analytics to help sustainability-aware investors make better investment decisions.

The first and most recognisable measure is the Morningstar Sustainability Rating—the "globe ratings" as they are widely known—a measure of how well a fund’s holdings are managing their ESG Risks relative to the fund’s peer group.

Such quantitative measures are very useful, but to provide investors with even more analysis and context, we’ve just launched a qualitative ESG measure: the Morningstar ESG Commitment Level for funds and asset managers.

What’s different about these two ratings (and what’s similar)? Here we compare the two measures and how they can be used to assess the sustainability profile of funds.

The Morningstar ESG Commitment Level

The ESG Commitment Level expresses our analysts’ assessment of the extent to which funds and asset managers incorporate ESG into their investment processes. It helps investors understand which funds and asset managers have a greater commitment to ESG and what the best practices of such funds and asset managers are.

The scale runs from best to worst as follows: Leader, Advanced, Basic, and Low.

For our first round of evaluations, we selected 107 strategies covered by our analysts globally. These included 77 ESG-focused funds and 30 conventional funds, selected in order to showcase a diverse range of strategies with exposure to a variety of asset classes. Going forward, we will produce the Morningstar ESG Commitment Level for all strategies that have a Morningstar Analyst Rating.

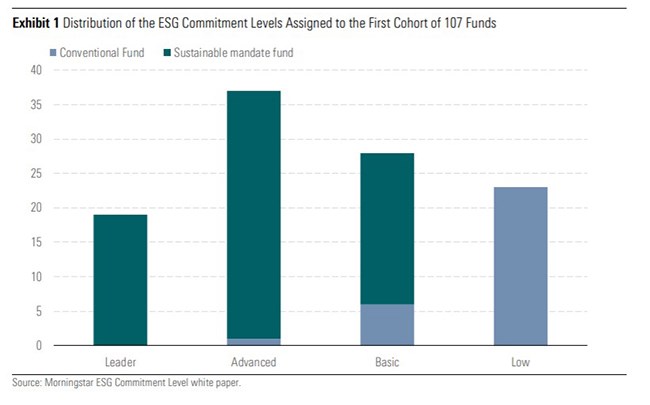

The below chart shows the distribution of ESG Commitment Levels assigned to this first cohort of funds. As one would expect given our sample’s bias to ESG-focused strategies, the distribution skews slightly towards the higher levels, with 19 Leaders and 37 Advanced, while 28 received a Basic rating and 23 Low. No conventional funds received an ESG Commitment level of Leader, but one was rated Advanced. No ESG-focused funds earned an ESG Commitment level of Low, but 21 received a Basic designation. Of course, subsequent assessments will include larger proportions of conventional funds and therefore will likely result in many more Low and Basic assessments.

How Do the ESG Commitment Level and Sustainability Rating Compare?

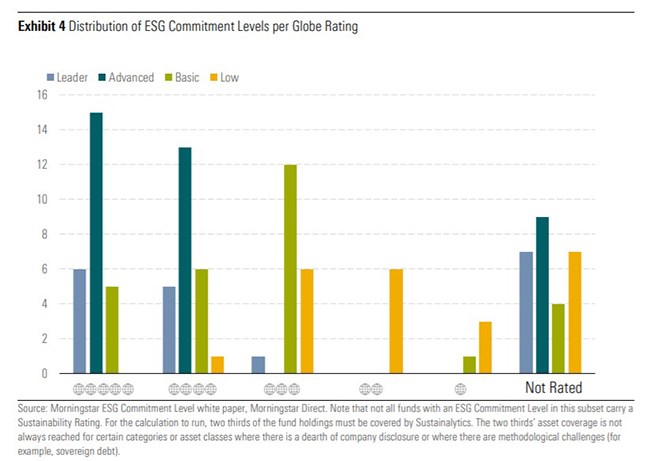

From the below chart we can see that all but one of the Advanced and Leader funds carry a Sustainability Rating of 4- or 5-globes. This means that, in this subset of funds, those most committed to ESG are among those that invest in companies that best manage their ESG risks. Those carrying a Low or Basic rating, meanwhile, are more likely to have a rating of one, two, or three globes. We can therefore conclude that the ESG Commitment Level for the first cohort of funds broadly aligns with the Sustainability Rating.

How do the ESG Commitment Level and the Sustainability Rating Align?

It is not always the case that the ESG Commitment Level and the Sustainability Rating align though. And investors shouldn’t necessarily expect the two metrics to line up for several reasons:

As the Sustainability Rating is a measure of a fund’s ESG risk, it reflects a risk outcome only rather than a manager’s intention to incorporate ESG factors into its investment process and stewardship efforts. It is equally important to understand that the Sustainability Rating is based on Sustainalytics’ view of the ESG risks that are most material to a fund’s holdings, and this view may differ from that of the manager running a particular strategy.

The Sustainability Rating is also a relative measure; it is a snapshot in time of the ESG risk profile of a fund relative to its Morningstar Global Category peers. While a fund’s ESG risk profile can change following a change in portfolio holdings, its Sustainability Rating may equally change following changes in the peer group.

Finally, ESG considerations can involve more than just an assessment of ESG risks. They can involve an analysis of the impact of companies’ products and services on society. Some funds aim to invest only in companies whose core business model contributes to society. But these may come with higher ESG risks.

When assessing a fund's commitment to ESG, our analysts take a holistic approach. They go beyond an assessment of ESG risks. They assess the degree of ESG incorporation, the ESG resources allocated to the strategy, the ESG expertise of the portfolio management team, and the extent of its engagement activities.

What Should Investors Make of Misalignment?

Investors should thus consider the ESG Commitment Level and the Sustainability Rating in tandem. A fund may score well on the Sustainability Rating now, but this outcome could be more by design than by intention. This is the case for UBS MSCI EMU ETF, which until a couple of months ago earned a Sustainability Rating of 4-globes. Following the September rebalancing of its portfolio, the fund now carries 3-globes. But regardless of the Sustainability Rating, we assigned this fund a Low ESG Commitment Level because it tracks an index that doesn’t take any ESG considerations into account.

Meanwhile, there are funds such as Natixis Sustainable Future 2015-2060 and Perpetual Wholesale Ethical SRI that currently carry 5-globes but have been awarded a Basic ESG Commitment Level because we don't believe they incorporate ESG factors to a great extent or in a committed way.

Other funds, including Fidelity US Sustainability Index, American Century Sustainable Equity, and BetaShares Global Sustainability Leaders ETF, also score highly on our globe metrics but are brought low by their asset manager score. According to the methodology for the ESG Commitment Level, for a fund to achieve Leader status, the backing asset management firm must achieve status of Advanced or higher; to achieve Advanced status, the backing asset manager must have a level of Basic or higher. Fidelity Investments, American Century, and BetaShares all received an ESG Commitment Level of Low.

Conversely, Stewart Investors Wholesale Worldwide Sustainability earned a Leader ESG Commitment Level, but the fund currently carries only a 3-globe rating. The fund holds several companies that Sustainalytics considers high or medium risk. Despite the overall Average Sustainability Rating, we think the strategy incorporates ESG factors into its investment process in a comprehensive way.

How to Use ESG Ratings

The Morningstar ESG Commitment Level provides a powerful addition to the toolkit of a sustainability-aware investor, even more so when used in concert with quantitative ratings such as the Morningstar Sustainability Rating. In addition to knowing what’s under the bonnet of a fund from an ESG risk perspective, investors can now get a better understanding of how ESG factors inform a strategy.

It is too early to extrapolate the results of the first cohort to the wider universe of funds under coverage, however, and although the two metrics complement one another, they are distinct tools ideal for answering distinct questions.