While the UK and much of Europe has re-entered lockdown, the prospect of a coronavirus vaccine and a new President in the White House have boosted investor confidence as well as the value of pension pots linked to the stock market.

This year’s events have had a deep impact on household finances in the UK, but have they made permanent changes to retirement plans? The official data paints a mixed picture, and advisers say that while there has been little evidence of panic among potential retirees, there has been a big shift in attitudes.

In April, in the aftermath of the sell-off in global stock markets, we asked whether you should take a pension holiday to shore up your finances. Those who kept investing in equities via their pensions will have been rewarded as stock markets have recovered strongly since then. So someone looking at their pension statement in November may be feeling more optimistic about their retirement prospects than they did in March and April. But we are still a long way from normality. Here, we look below at how coronavirus has shifted the dynamics of retirement.

Changed Spending Patterns

In July, we tackled the difficult question of how much money you need to retire. This year’s events have forced people to reassess what their spending priorities are – if you can’t take three holidays a year and don’t need really that second car, perhaps you may need less in retirement than you think.

Further reductions in spending come from having no commuting costs to pay and not having to pay National Insurance on your income. Whether a vaccine will trigger a holiday and eating out boom remains to be seen but for some, this year has proved they can live comfortably without this discretionary spending.

Unemployment Risk

Job insecurity is likely to be a long-lasting legacy of coronavirus. Unemployment is rising fast and the likely length of an economic downturn is hard to predict. Many employed people in their 50s and 60s will have planned for a much longer working life (with longer to contribute to a pension), but may now have been put on furlough or lost their jobs. That increases the temptation to dip into the pension pot (for those on defined contribution schemes) and rebuild it in better times. From 2016, those aged 55 and over have been able to access this money.

Kay Ingram, director of policy at LEBC financial planners, says that all other measures should be looked at before dipping into your pension: applying for Universal Credit, using your cash or stock market Isas or even selling assets. Dipping into the pension pot is a trap that many middle-aged people fall into when faced with a short-term cash flow problem, she says, and rebuilding your pot back up is hard. “The sooner you start taking money out, the less likely it is to last your whole lifetime,” she says. Morningstar’s head of retirement research, David Blanchett, adds that one thing people consistently get wrong when planning for later years is when they will stop working – often this is earlier than people think.

What Does the Data Tell Us?

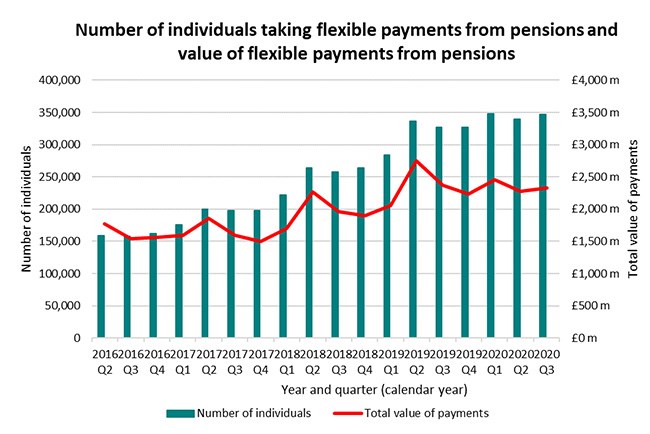

The latest HMRC data doesn’t suggest that the crisis has led to a big surge in people panicking and taking money from their pensions - yet. Some £2.3 billion was withdrawn from pension pots between July and September, down 2% on the same period in 2019, ie. before coronavirus. In the second quarter, in the teeth of the crisis, that figure was down 17% year on year.

However, there was a 6% rise in the number of people taking payments from their pensions in this period: 347,000, up from 327,000 the year before. HMRC says that usually the third quarter sees a tailing off in the number of people taking payments, so this year is unusual. “This change in behaviour may be attributable to the impact of the Covid-19 pandemic,” it says.

Tom Selby, senior analyst at AJ Bell, says the fall in overall value of withdrawals shows the over-55s are taking a cautious approach after the stock market sell-off, suggesting people didn’t panic even during the height of the market crisis. The pandemic was the first difficult test faced by pension freedoms and Ed Monk, associate director of personal investing at Fidelity, thinks they’ve passed: “The risk of making unsustainable withdrawals rises when fund values fall, so it is welcome to see many taking a considered approach.”

Tax and Spend

Regardless of coronavirus, the reality is that people are living longer and need to fund a bigger part of their life in retirement than previous generations. How they do this in a world of low returns from assets is the subject of this article on retirees investing in the stock market by Morningstar editor Fernando Luque.

Long after a vaccine has been found, the UK Government will still be paying off the costs of bailing out UK plc in 2020. How it plugs this gap is a matter of conjecture but last week we received some indication that a doubling of capital gains tax could be on the cards. AJ Bell’s Selby says this possible tax raid strengthens the case for tax-efficient investing in pensions and Isas. You can take 25% of your pension as tax-free sum, for example, and pensions are usually free of inheritance tax too. They also attract tax relief up to 45%, a break that has been in the Chancellor’s sights for a while now – and could be scrapped in favour of a flat rate as early as next year.