ESG risks have been at the forefront of investors’ minds this year. Companies as diverse as miner Rio Tinto (RIO) and fashion retailer Boohoo (BOO) have incurred the wrath of shareholders for not meeting environmental, social and governance standards. The coronavirus pandemic has also increased the pressure on companies to show they are doing the right thing by customers and the wider environment they operate in; those that fall short are punished in share price terms and placed under pressure to change by large investors.

In our ESG week we are looking at the companies with the lowest ESG risk as measured by ratings agency Sustainalytics, part of the Morningstar group.

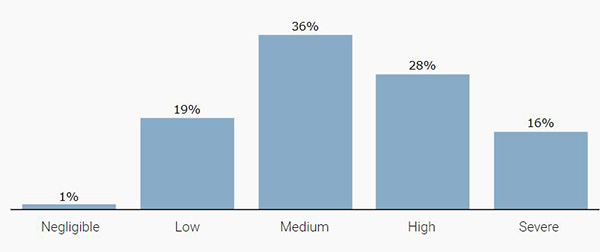

According to Sustainalytics, just 1% of the 12,643 companies it covers has a “Negligible” risk rating, the lowest category, while 19% are rated low, 36% medium, 28% high and 16% are in the highest category of severe. That leaves 65 listed companies on the elite list and we've picked five companies from the UK, Europe, North America and Asia.

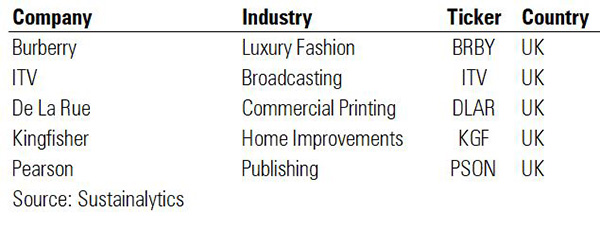

The UK is not usually thought of as being in vanguard of ESG, so it may be surprising to learn that nine of the 65 companies are London listed, and among them are household names like ITV (ITV), Burberry (BRBY) and B&Q owner Kingfisher (KGF).

A recent stock of the week, Burberry operates in a high-risk industry where working conditions are under increasing scrutiny. “With many of its suppliers based in Asia, the company is present in labour markets associated with poor working conditions,” say Sustainalytics analyts. But it manages that risk well, they say, ranking above peers like Pandora and Prada, which have a “low” ESG risk rating.

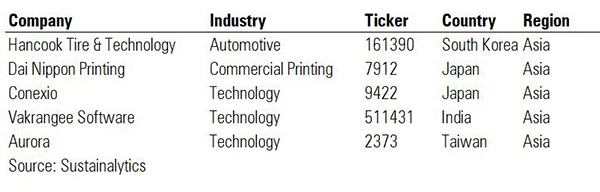

South Korea’s Hankook Tire also makes it into the negligible ESG risk category, despite operating in the carbon-intensive automotive industry – Japan’s Toyo Tire Corp has a high ESG risk rating, for example. Sustainalytics analysts say that Hankook’s handling of ESG issues in general is strong. For example, the company incorporates environmentally friendly design into its products and looks to recycle by-products from the tyre-making process.

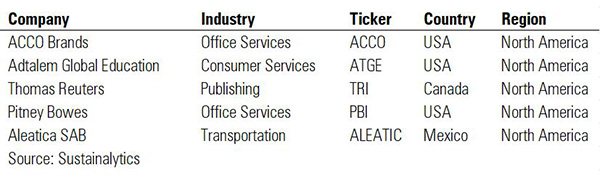

North American companies rank highly in the lowest category of ESG risk and we have handpicked five from a range of industries, including Mexican transport firm Aleatica and US mailing equipment firm Pitney Bowes. New York-listed stationery firm Acco also makes it on the list. Office products aren’t necessarily the most ESG friendly – how many pens have you thrown away in your lifetime? – but it has the lowest ESG risk among peers and ranks 82nd among 12,692 rated by Sustainalytics. Still, its analysts say Acco can still improve ESG disclosure to investors and the public.

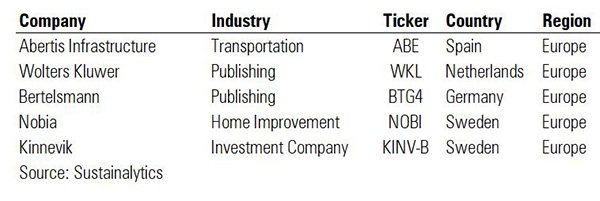

Publishing companies are well represented in the global list of best-ranking ESG firms. Two of Europe’s biggest names, Wolters Kluwer of the Netherlands and German media giant Bertelsmann, make the grade. “Through its stakes in some of the largest television, radio and publishing companies in the world, Bertelsmann is exposed to a host of ethical risks,” Sustainalytics says, but management is strong and ESG disclosure follows best practice. Bertelsmann ranks 27th out of all companies rated by Sustainalytics and is in second position among all media companies and second in publishing companies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)