This year’s stock market turmoil has led to a sharp rise in the number of underperforming funds, according to Tilney BestInvest’s twice-yearly Spot the Dog report.

The report reveals that 150 funds have consistently underperformed over the past three years, holding nearly £55 billion of investors' cash between them. The amount of money languishing in underperforming funds has soared more than 60% since the last report in February when 91 funds made the list.

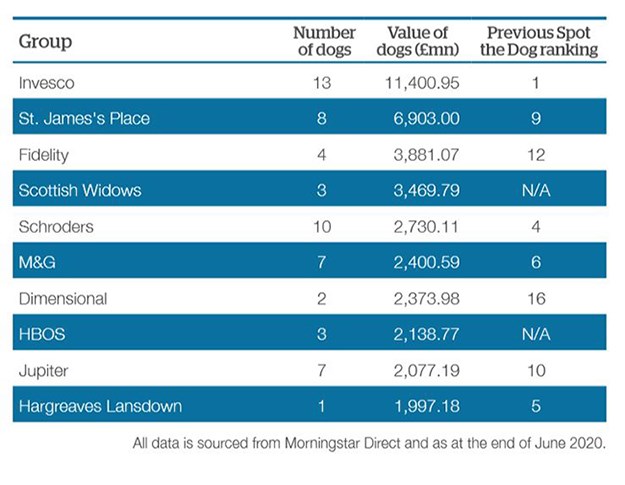

Fund house Invesco is once again top of the table with 13 so-called “dog” funds, with a total of £11.4 billion in assets under management. Wealth manager St. James’s Place has moved up to second spot with eight dog funds worth £6.9 billion, and Fidelity has also entered the top three with four underperforming funds worth £3.8 billion.

The £3 billion Invesco High Income heads the list as the largest underperforming fund – £100 invested in it three years ago would be worth £67 now. Among the other biggest underperformers on the list are the £1.5 billion Invesco UK Equity Income fund and £1.3 billion St James’s Place UK High Income - £100 invested in either of these three years ago would now be worth £68. The worst performer overall, however, is ASI Income Focus, which would have left you with £55 if you’d invested £100 three years ago.

To make it on to the list, a fund must have delivered a worse return than the market it invests in for three consecutive 12-month periods, and it must have underperformed that market by more than 5% after fees over the three-year period.

Jason Hollands, managing director at BestInvest, says this year’s market crash and recovery has created a stark divide between fund winners and losers, particularly in terms of sectors and styles. He says: “The relative winners have been areas like technology, online stocks and consumer staples companies, but at the other end of the spectrum major sectors like energy and financials have been hit really hard.”

He also notes that the gap in fortunes between growth and value-focused funds has become extreme this year. One value-focused fund in the top five large underperforming funds is Fidelity Special Situations, which has a Morningstar Analyst Rating of Silver. Analyst Fatima Khizou praises the fund’s experienced manager Alex Wright, its rigorous approach to stock selection and long-term performance record. “Wright is a thoughtful investor whose knowledge of the portfolio, and insights at company and industry levels, continue to impress,” she says.

A Fidelity spokesperson says of the fund’s inclusion in the list: “After a disappointing first quarter 2020, the fund has recovered some of its underperformance as fundamentals have started to come back to the fore and some of our holdings heavily sold off by the market in the spring have demonstrated their resilience through significantly better than expected results.”

Under New Management

If you own one of the funds on the list, should you sell? Not necessarily, says Hollands, as there may be multiple reasons why the funds have underperformed. “In some cases, repeatedly poor decision-making or unjustifiably high fees may be to blame. In others, it can be down to a particular approach that has worked well in the past being out of favour with current market trends.”

In the case of Invesco, the High Income and Income funds are under new management after Mark Barnett’s departure this year. An Invesco spokesman says: “Invesco has over the course of the year made several changes and improvements across the teams that manage these portfolios to strengthen and develop our investment proposition. This report is only a snapshot over a specific time period, during which much change was taking place." Both funds have a Negative Rating from Morningstar analysts and are rated one star. ASI Income Focus also has new managers, Charles Luke and Thomas Moore, who took over earlier this year.

A spokesperson for St James’s Place says: “When assessing performance, it’s important to do so on a like-for-like basis. St. James’s Place fund performance is shown net of all charges, including ongoing advice and administration, and therefore these analyses do not make accurate like-for-like comparisons.”