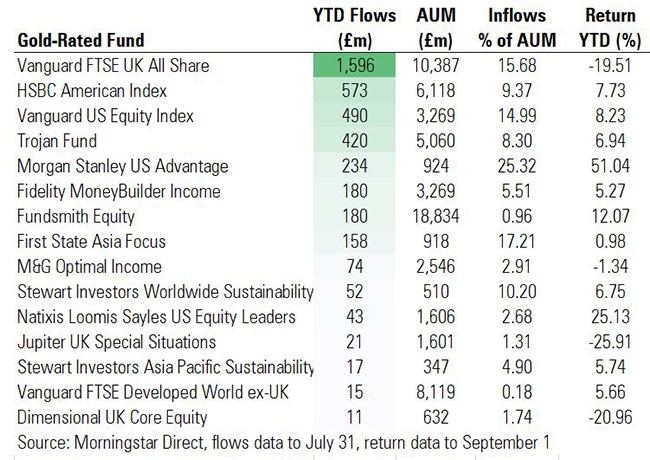

We have just looked at the highest rated Morningstar funds that have seen net outflows this year, so now we turn our attention to those Gold-rated funds that have attracted the most investor cash so far.

2020 has been a turbulent year for major asset classes, but investors quickly got back on their feet after a savage but shortlived bear market, and started buying funds again, with flows returning to passive funds in particular. Some 15 of the 24 funds rated Gold by Morningstar analysts have seen positive inflows the year, with trackers seeing the lion’s share of net new money.

Inflows for the Vanguard FTSE UK All Share Index in particular overshadow all the others on this list: the fund brought in £1.59 billion of new money in the year to date and the next biggest is HSBC American Index, with £573 million of net inflows. There are four index funds on the list of 15, but they account for 66% of net inflows between them.

Interestingly, the three Gold-rated UK equity funds that saw positive inflows this year were among the worst performing in the year to September 1, according to Morningstar Direct data: the Vanguard FTSE All Share fund is down nearly 20%, Jupiter UK Special Situations is nursing losses of almost 26%, while Dimensional UK Core Equity is around 21%.

Because of the strong recovery seen by US equity markets since the March crash, American equity funds are among the best performers of this cohort, with Morgan Stanley US Advantage posting outsized gains of over 50% (the S&P 500 is up 10% this year).

Of course, inflow numbers alone don’t tell the full story. We've looked at each fund's total assets under management across all share classes to see what percentage of assets each has brought in this year – the Vanguard FTSE UK All Share’s £1.5 billion of inflows, for example, are in proportion for a fund that has broken through the £10 billion in assets this year.

Here we look in detail at three of these funds, what they own and what Morningstar analysts think of them.

Morgan Stanley US Advantage

This fund’s 50% gain in tough market conditions has caught the eye of investors, who have added the equivalent of 25% of AUM this year. What lies behind the fund’s stellar performance? Its biggest holding is Canadian firm Shopify (SHOP), (which we featured earlier in the year as an e-commerce disruptor) whose shares are up 176% so far this year, although Morningstar analysts think the company is now nearly 60% overvalued after such a strong run. The fund’s second biggest holding is retail juggernaut Amazon (AMZN), whose shares have nearly doubled so far this year.

Morningstar fund analyst Jeffrey Schumacher praises the team’s “unique and thoughtful investment culture”. “[Manager] Dennis Lynch and team look for companies with defensible business models that dominate their markets or benefit from a strong network effect,” Schumacher says.

Fidelity Moneybuilder Income

One of two Gold-rated bond funds to have achieved positive inflows this year, Fidelity Moneybuilder Income has over £3 billion in assets and has attracted £180 million in assets this year as investors back fixed income in an uncertain market environment. UK Gilts are among the fund’s top 10 bond holdings, while utilities also feature heavily in the portfolio, with bonds from the likes of Thames Water and Electricite de France. This year the fund has posted returns of 3.12% and that rises to nearly 5% annualised over a 10 year period.

Under Morningstar’s enhanced focus on fees, the fund’s cheapest share class was assigned a Gold Rating earlier this year. Analyst Louise Babin says the fund is a steady performer in the fixed income space: “The performance of the strategy has been consistently solid over the long term. Whilst other options may deliver higher long-term returns, this strategy offers a good trade-off between active risk and excess returns.”

Stewart Investors Worldwide Sustainability

One of two funds with an ESG focus in this group, Stewart Investors Worldwide Sustainability has brought in £52 million of new money this year and posted gains of 6.75%. “Stewart Investors Worldwide Sustainability boasts an impressive investment team and top-notch research approach, landing it among our top global equity ideas,” says Morningstar analyst Ronald van Genderen. Like Fidelity Moneybuilder Income, this fund was upgraded to Gold as part of Morningstar’s rating changes in March.

Van Genderen says the 50-stock portfolio is different from both its peers and benchmark, with a bias towards defensive, consumer stocks. Its biggest holding is Italian medical diagnostics company Diasorin (DIA), whose shares have risen sharply this year as demand for Covid-19 testing has soared during the pandemic. The company is awarded a narrow moat by Morningstar analysts and has an 18% market share in the expanding immunodiagnostics sector, providing testing for diseases such as tuberculosis, measles and hepatitis. Other holdings include wide-moat consumer goods giant Unilever (ULVR), which also makes it on to our list of top 20 FTSE dividend payers.