It’s little surprise that gold is attracting a lot of investor attention. The price of the lustrous yellow metal recently hit a record high and it's never been cheaper to invest in the asset.

Indeed, fund house Invesco this week revealed it has reduced the fee on its physical gold ETC from an already low 0.19% to a market-leading 0.15%. It now effectively costs investors just £1.50 for every £1,000 they invest in the fund.

This isn’t the first time that investors have found themselves drawn to something shiny, however. With a reputation as a safe haven at times of uncertainty, gold tends to rise at times when other assets are falling.

While the FTSE has fallen and many businesses have been pushed to the brink, the price of the precious metal climbed 34% in the year to August 5. As a result, investors have poured more than $10 billion of new money into gold ETFs year to date, according to Invesco. Assets in its own ETC have swelled to $14 billion.

Mike Coop, portfolio specialist at Morningstar Investment Management, says: “People have a deep rooted, emotional response to gold. You can see that in how we refer to it in everyday language: good as gold, gold-plated, gold-class. We think of gold as safe, secure and as being the best and that impacts how people view it in investment terms too.”

Yet despite its allure and popularity, many experts say that holding gold is not a sensible investment move - particularly after its recent climb. Here are just some of the reasons not to invest in gold.

Gold is Not a Safe Haven

A safe haven is an asset which holds its value – or increases in value – even in times of uncertainty. Does gold meet that definition? Probably not. Because, while gold sometimes (but not always) rallies during downturns, it tends to lose those gains during better times.

Brian Dennehy, managing director of FundExpert, points out: “Between 1980 and 1982, the price of gold fell 52%. Between 2011 and 2015, it fell 42%. This is not how a safe haven behaves.”

Some might say, instead, that a safe haven protects your money from the erosive effects of inflation. But Dennehy says this has also not played out with gold; he calculates that taking inflation into account the gold price tumbled 83% between 1980 and 2001. And if protection from inflation is a main reason to choose gold, then now is clearly not the time to invest – currently, deflation is a bigger risk than rampant inflation.

Gold is Driven by Speculation

The stock market is, the old saying goes, in the short-term a voting machine and over the long-term, a weighing machine. So, although share prices may fluctuate for various reasons – panic, euphoria, fashion – for a short period, in the end it is fundamentals that win out.

Over the long-term, the success of a business will be determined by fundamental factors such as profits, return on invested capital, and how it treats shareholders. The same cannot be said of gold.

Because gold doesn’t pay dividends or make a profit or loss, its price is only determined by investor sentiment. If it is in demand, the price goes up, if it is out of favour, the price falls. Coop says: “That means you’re simply relying on other people to be prepared to pay a higher price for an asset than you did.”

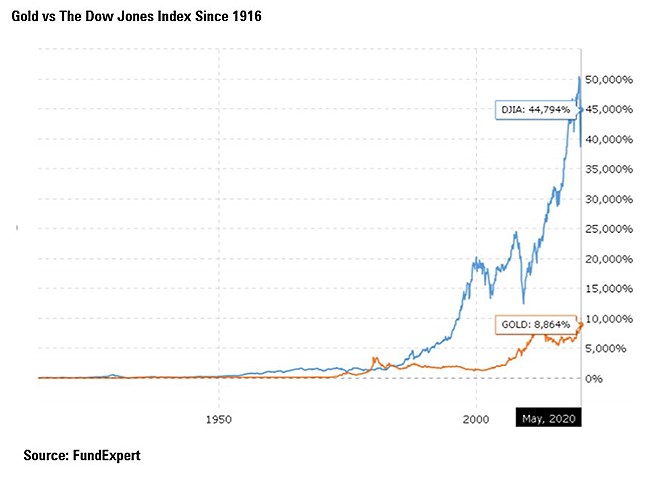

While it may be possible to guess which way that trend will go in the short-term, this is speculating not investing. A glance at the performance of the US stock market against gold since 1916 suggests that investing based on fundamentals tends to reap greater rewards.

Gold is Not a Currency

The main reason many people invest is to get an income. Dividend-paying equities and reliable bond yields produce pay outs that can be rolled back up into your investments, or drawn down to pay the bills. Whether it’s an ETF that tracks the gold price or bullion kept in a vault, gold patently does not pay an income.

Some would argue, instead, that the precious metal is a safe, physical store of value to be used when the going gets really rough. But there are problems with this argument, too. The idea of gold being traded and used in place of traditional currencies hinges on an almost apocalyptic scenario.

Coop says: “You can’t buy your fish and chips with a lump of gold, and a lot of pretty extreme things would need to play out for people to abandon their own currency and use gold instead. It’s a low probability game, and you’re a bit late if you decide to play it after the price has climbed so high.”

Dennehy adds: “If you really believe an apocalypse is likely, you should grow you own food, invest in two goats and live near a reliable and remote water source.”

What are the Alternatives to Gold?

So, if gold isn’t an insurance policy for your portfolio, what is? “It’s a good question and one that is vexing a lot of people right now,” says Coop. Arguably the best insurance policy is not any single asset but rather to hold a well-diversified mix of investments.

He says high-quality government bonds have done a great job in protecting investors from falling stock markets. Currencies such as the yen and US dollar are often touted as safe havens, but FX trading requires specialist knowledge and can be incredibly risky, he adds.

Dennehy says would-be gold investors might do better to consider stocks in gold mining companies instead of the metal itself, and Coop points to cyclical sectors that tend to do well when inflation rises such as banking and energy.

“Infrastructure is another asset class worth looking at. It’s linked to inflation and demand for this type of service is not very cyclical – the water and electricity is the last thing you switch off,” Coop adds.

View the latest pricing and investment return data on gold stocks available in the market.