The Covid-19 crisis has driven some fundamental changes in consumption patterns. Initially people panic-bought toilet papers and eggs, leaving supermarkets shelves empty, then there was a huge demand for bicycles and office equipment, as people tried to adapt themselves to the new “normal”.

“I grew up in communist Poland, so I remember empty shelves from my childhood, but I never thought I would have seen that in London,” says Aneta Wynimko, manager of the Fidelity Global Consumer Industries fund.

But with lockdown ending and a degree of normality starting to return globally, are these changes here to stay or will it soon be business as usual?

One trend that's here to stay, according to Wynimko, is online shopping. The shift away from the high street to online stores was already underway, but has accelerated in recent months. Previous sceptics of online shopping have been won over by its safety, speed and convenience in recent months and are unlikely to revert.

And Wynimko says this is true of other sectors, too: “There are some powerful trends investors should consider, such as self-care, hygiene and exercising. In the UK 49% of people are exercising more since Covid-19, and many started focusing on healthy eating and making their home a nicer environment.”

Caroline Reyl, co-manager of the Pictet Premium Brands fund, agrees: “It's the fact that people were confined within their home for such a long time; it has a long-term impact on the way consumers look at things.”

Investing in Cosmetics and Sports

While the lockdown has created issues for those companies which hadn't invested in their e-commerce strategy, it's undoubtedly been a boon for the online leaders. Lockdown has hugely benefitted e-commerce giants such as Amazon (AMZN) and Alibaba (BABA) as well as smaller players such as Ocado (OCDO) and Zalando (ZAL).

But Reyl thinks sports and cosmetics are the winning sectors from the pandemic, and points to L’Oreal (OR) as one example of a brand leading the charge with a strong social media presence, something which is particularly important for businesses trying to reach young shoppers.

“The company has changed itself from a cosmetic staple to a beauty tech company,” adds Wynimko. “It has invested in e-commerce and on communicating with its customers.” Morningstar analysts, however, have a one-star rating on the stock, indicating it is trading above its fair value.

Nike (NKE), which had already been enjoying the athleisure boom of recent years, is another favourite. It's another company that interacts with its customers through social media, offering them tips on how to exercises, as well as showing off its latest product lines. Such companies stand in stark contrast to more traditional luxury retailers, many of which are struggling to reach the next generation of consumers.

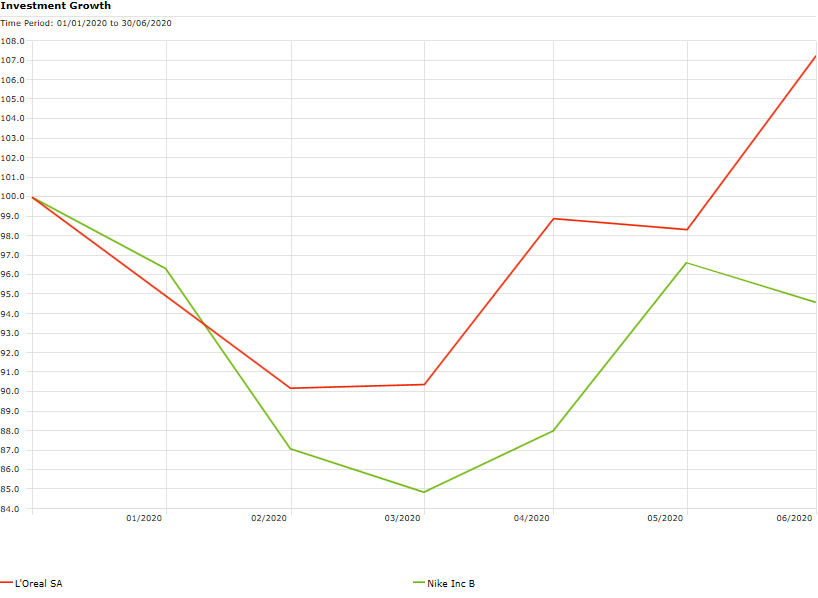

How L'Oreal and Nike Have Recovered Since the March Sell-Off

Elsewhere in the sector, Reyl rates Lululemon Athletica (LULU), a Canadian brand known for its high-end yoga leggings. “It’s a great investment,” she says. “People are exercising more and it's a trend that will last as people increasingly focus on their wellbeing.”

Are Consumers More Conscious?

Of course, it's not all just about social media and getting likes on Instagram. Young consumers in particular are increasingly conscious about the carbon footprint of their products.

The Covid-19 crisis has highlighted hundreds of corporate controversies, as some companies prioritise profits over the safety of their staff and customers. At the other end of the spectrum, some businesses have given their staff bonuses for working during the worst of the pandemic or switched their manufacturing processes from producing clothes to making PPE, or putting their alcohol distilleries to work making hand santisers.

Reyl says these days consumers expect their favourite brands to give back to society. Wynimko adds: "As the pandemic moved through the world, some big companies knew exactly what to do. Some chief executives have taken a salary cut to save the jobs of their employees; these things don't go unnoticed and these will be the brands that consumers trust."

Of course, it's impossible to say how long the effects of Covid-19 will remain or whether consumers with short-term memories will revert to their old habits. For investors, Reyl says, it's important to be selective because not all brands will make it through the pandemic.

While those firms with the best stores, the strongest brands and the greatest customer service should thrive, others will struggle to survive. "We are about to see a divergence between those brands with heritage and expertise that can hold up through this crisis - and those that just don't have those qualities."