As the spread of the coronavirus is contained in some places, we remain vulnerable in others. A new report from Sustainalytics sheds some light on trouble spots and highlights evolving risks for investors looking to avoid controversy with the pandemic. A bulk of the environmental, social and governance (ESG) risks stem from workplace safety, product safety, labour relations and business ethics issues, the study finds.

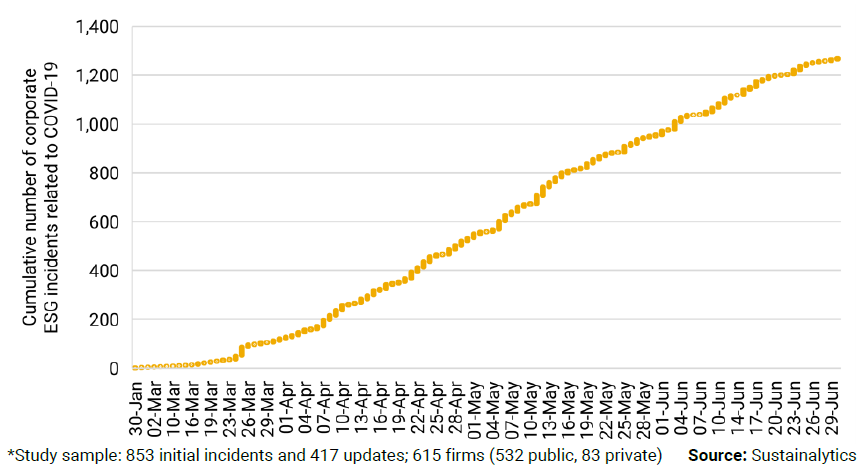

Martin Vezér, of the Sustainalytics thematic research team, led an investigation of more than 1,200 Covid-related ESG incidents in the first half of 2020. “While the Covid-19 infection curve has been flattening in key regions, we find that globally the number of corporate Covid-19 incidents continues to climb,” the report notes.

Corporate Covid-19 incidents occurred in 68 countries, but the US alone accounted for more than half of the cases. “We attribute the prevalence of corporate Covid-19 incidents in the US to a combination of factors, including its large market economy, the pervasiveness of news media coverage in the country and the extensiveness of Sustainalytics’ tracking of firms with US operations,” the report notes. “Moreover, Covid-19 has had a disproportionate impact on the US population, with more than 3.5 million confirmed human cases to date – more than any other country in the world.”

Far from a Bell Curve: Corporate Covid-19 Incidents Time Distribution, First Half of 2020

Sustainalytics says that when the ESG controversies began pouring in, it scrambled to adapt its tracking system to account for the toll the outbreak was taking. The first company picked up was Carrefour China. “In January, the Shanghai Administration for Market Regulation opened an investigation into a Carrefour store in Xuhui, China and issued a CNY 2 million (US$ 290,000) fine for increasing food prices during the outbreak in defiance of a government order.”

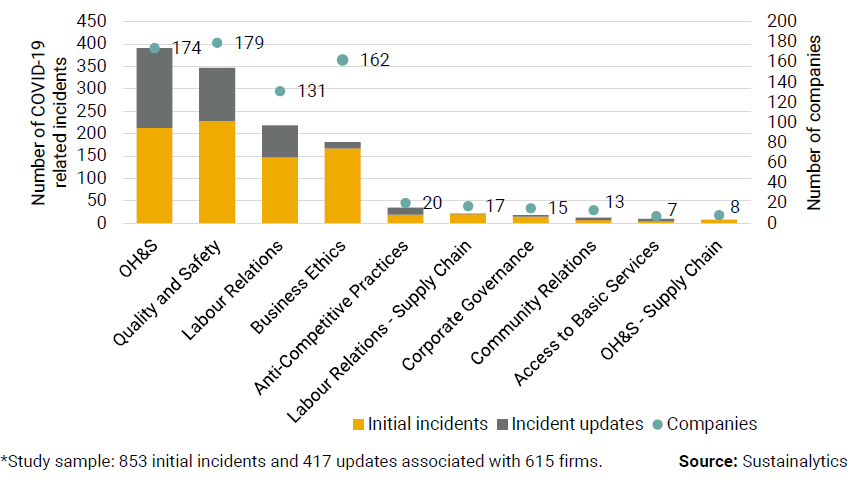

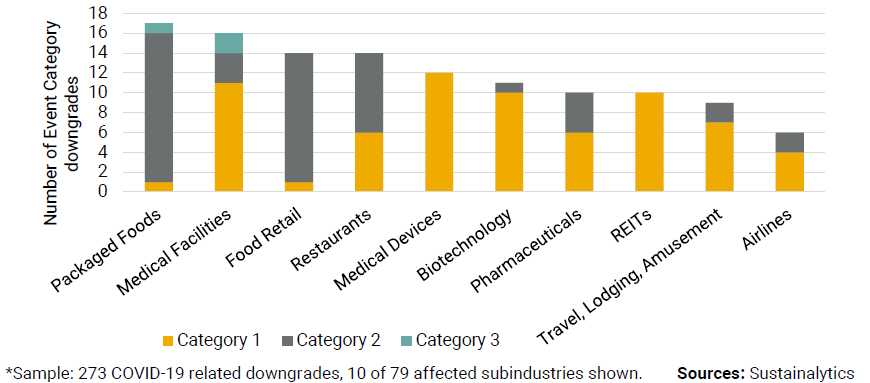

But this type of business ethics risk wasn’t the top controversy. Employee and product safety were the main concerns and contributed to 273 downgrades for companies at risk of Covid-19 related events.

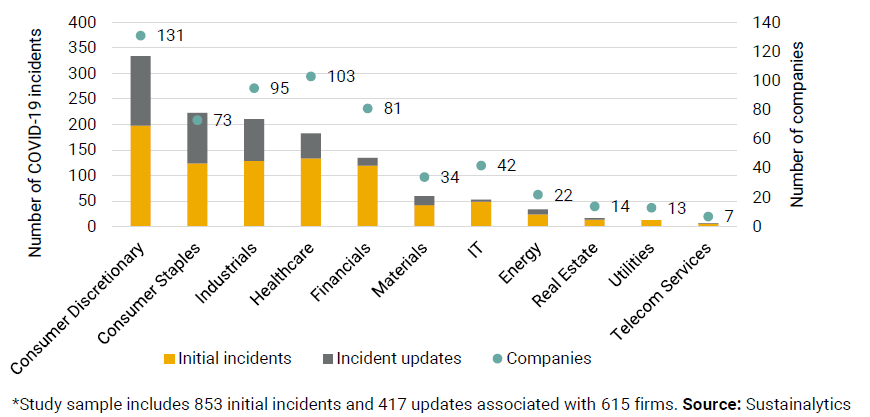

Top 10 Event Indicators By Number of Incidents and Involved Firms

“OH&S [Occupational Health and Safety] accounts for 31% of our sample – more than any other Event Indicator,” the report remarks. “Around 34% of OH&S incidents (133 of 391) stem from the Consumer Discretionary sector, which has faced criticism for failing to provide adequate protective gear to workers and for breaching social distancing rules. Related cases include lawsuits filed by families of employees who died after contracting Covid-19, regulator involvement and safety probes.”

Issues around employee health and safety lingered, while also negatively affecting labour relations. Views on a company’s overall business ethics also suffered, to round off the key Covid-19 related incidents.

Accident-Prone Amazon

After bottoming out in March, Amazon (AMZN)’s share price soared on strong sales, especially in the grocery segment, but it’s come at a cost. Of the 391 occupational health and safety incidents recorded by Sustainalytics, Amazon accounted for 51.

“The firm has faced accusations of imposing high production targets that have prevented workers from adhering to safety procedures, failing to offer adequate protective equipment and retaliating against workers who have raised related concerns,” the report notes. “As a result, Amazon has been a target for protests, strikes, lawsuits and pointed letters from US senators and attorneys general. Although Amazon has announced new investments for Covid-19 safety measures, our outlook for its Category 3 OH&S event rating changed from neutral to negative.”

Sector Exposure to Covid-19 Incidents

The report attributes the outsized incident exposure to two main factors: first, while many companies in other sectors have slowed operations during lockdowns, many consumer discretionary firms have continued to operate and provide essential services, with some players increasing production. Second, this sector contains a host of big brands, such as Amazon, Carnival Corp. (CCL) and McDonald's (MCD), which have large operational footprints, supply chains and controversies that attract sustained media coverage.

Lose-Lose Situation for Service Providers

While Amazon was still able to benefit as a service in high demand through the pandemic, other big brands that stuck their necks out to provide in-person customer service encountered both reputational risk and immediate losses to the bottom line. “The global restaurant sector has come under pressure as several markets have restricted dine-in service in an effort to curb the spread of Covid-19,” says Morningstar Sector Strategist RJ Hottovy in an analyst note on McDonald's, “Restrictions vary by geography, but we expect uneven guest traffic to persist into the back half of 2020.”

Cruise lines have further to recover and greater risks related to health and safety to overcome – and Carnival’s got the biggest brand. “Carnival remains the largest company in the laid-up cruise industry,” says Morningstar analyst Jaime M. Katz. “Global travel has changed as a result of Covid-19, leading to longer-term secular shifts in consumer behaviour, challenging the economic performance of Carnival over an extended horizon - we suspect cruise operators will have to reassure passengers of both the safety and value propositions of cruising.”

Nursing Homes Remain a Weakspot

While some companies encountered the most incidents, not all of them were material enough to affect a company’s ongoing risk outlook. In the case of packaged foods and senior care, it hurt the most.

"The Packaged Foods subindustry has experienced the largest total number of downgrades, but only one of these cases – JBS USA Food – reached a Category 3 (most severe). The Medical Facilities subindustry has faced nearly as many total downgrades, including two downgrades to Category 3 for Canadian senior care companies Extendicare and Sienna Senior Living,” the report says. “The case of Extendicare demonstrates how an incident chain can contribute to changes in a firm’s ESG risk profile. This publicly-traded senior housing company has faced allegations of negligence leading to a disproportionate number of Covid-19 related deaths among residents at several Ontario facilities it manages. The firm has been the subject of regulatory investigations and is facing a $40m class-action lawsuit.”

Top 10 Subindustries By Covid-19 Event Category Downgrades

This article first appeared on Morningstar Canada

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)