The coronavirus crisis has shone an unforgiving light on the fragility of company finances, especially those in sectors most exposed to the shutdown like retail, travel and leisure. The rush to cut dividends is one way many firms are trying to shore up their balance sheets ahead of an expected economic slowdown. But what about the companies in better shape?

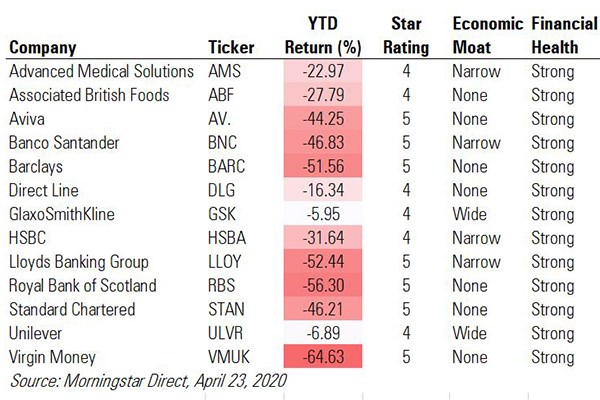

Morningstar scores companies’ financial health on a combination of factors, including low debt and strong cash, and rates these between Weak, Moderate and Strong. We have screened FTSE companies to find those with strong balance sheets, which are also trading below their fair value and rated four or five stars by Morningstar analysts. While the share prices of these firms have all been hit in recent weeks, their solid financial position and competitive advantage could make them bargains for the brave.

Two companies on the list have a wide economic moat and four have narrow moats. The two with the strongest competitive advantages, GlaxoSmithKline (GSK) and Unilever (ULVR), are the best performers on the list by a long way - compare Glaxo's near 6% loss in the year to date with the 65% fall in Virgin Money's share price, for example.

Bank Share Prices Hammered

Banks dominate our list of most undervalued stocks with strong balance sheets: all of the high street big names are there, including Royal Bank of Scotland (RBS), Lloyds Banking Group (LLOY), Barclays (BARC) and HSBC (HSBA).

After the financial crisis, European banks were forced to cut their debt and increase their capital buffers. This made them decent income stocks as investors cautiously returned to the sector. But as the coronavirus crisis struck, UK regulators insisted these companies suspend their dividends to focus on supporting individuals and businesses.

As a result, bank share prices have crumbled amid fears about the long-term effects of the lockdown on people’s finances. Shares in four of the banks on our list have halved this year.

Morningstar analyst Johann Scholtz thinks that, while the coronavirus crisis poses a threat in terms of lower profitability, European banks are better capitalised and more liquid than in the last downturn. He doesn’t forecast any UK banks to be loss making this year and argues that current market valuations for banks are pricing in severe losses and liquidity problems: “A number of the banks we cover are now trading at their lowest valuation multiples ever.”

For those investors willing to look to the long term, these banks have never been cheaper. Taking in two relatively new entrants to the UK banking market, narrow-moat Santander (BNC) and Virgin Money (VMUK), banks make up seven out of 13 on our list.

Insurance and Healthcare

There are two consumer-facing insurance companies on the list, Direct Line (DLG) and Aviva (AV.), both of which have suspended dividends. Colin Morton, manager of the Silver-rated Franklin Equity Income fund, thinks Direct Line has cut its payout for safety rather than necessity, and will resume dividend payments faster than the banks.

While Morningstar analysts don't think insurance companies are worthy of a moat because competition in the industry is too intense, they argue there are plus points for the sector during the lockdown. The obvious point is that with fewer cars on the road, there will be fewer accidents and thus fewer claims to pay out. While some companies have offered refunds to people not driving under lockdown, analyst Henry Heathfield argues that there won't be too many discounts on offer when life starts returning to normal.

Two healthcare names also make it onto the list: wide-moat GlaxoSmithKline, which is working on a coronavirus vaccine, and whose shares have also benefited from the defensive qualities of pharma companies during the downturn.

Advanced Medical Solutions (AMS), which specialises in surgical products and supplies the NHS, is an outlier on our list because of its size: its market cap of £486 million is dwarfed by HSBC's £86 billion, for example.

Morningstar analyst Debbie Wang thinks AMS is a "powerhouse for innovation" and can hold its own against rivals like US giant Smith & Nephew (SN.). "Its intellectual property, trade secrets, materials, and manufacturing expertise make it difficult for other companies to simply copy its products," she adds.

Before the coronavirus outbreak, specialist healthcare was an area tipped to benefit from long-term demographic trends. That case has been made more compelling by recent events, with governments across the world ramping up spending on healthcare. This has been matched by the short-term performance of these funds and trusts exposed to healthcare - investment trusts Worldwide Health (WWH) and Biotech Growth (BIOG) were among the best performing in the first quarter.