Oil prices went negative for the first time this week, a move that has rocked the fragile recovery in stock markets since the March sell-off.

While this week's volatility has stemmed from technical reasons relating to commodity derivatives, the moves also relate to the real world: with coronavirus keeping many countries in lockdown, the use of oil products in transport and industry has fallen off a cliff. As a result, storage capacity is approaching its limits in the US.

The price of crude matters for investors because it gives an insight into the health of the global economy, which is currently in suspended animation. As well as this energy companies, because of their size, make up a large part of stock market indices. The 30-stock Dow Jones index, for example, contains two oil companies, Exxon (XOM) and Chevron (CVX), while Shell (RDSB) and BP (BP.) make up a big chunk of the FTSE 100 and are some of the UK's biggest dividend payers.

Because of the disruption to the world economy, Morningstar energy analysts Dave Meats and Preston Caldwell are forecasting a drop in oil consumption comparable to that seen in the second world war. They do expect oil demand to bounce back in 2021, however.

"This is a stunning contraction by historical standards, easily surpassing the 1.6% decline seen in the prior recession (2007 to 2009). No one-year decline in oil demand in the post-WWII era comes close," they say.

Share prices in oil companies have not fallen as dramaticaly as the oil price itself, but they've been volatile this year, with a big sell-off in March; shares in Shell and Exxon are down around 40% so far this year.

Oil-Focused Funds and Trusts

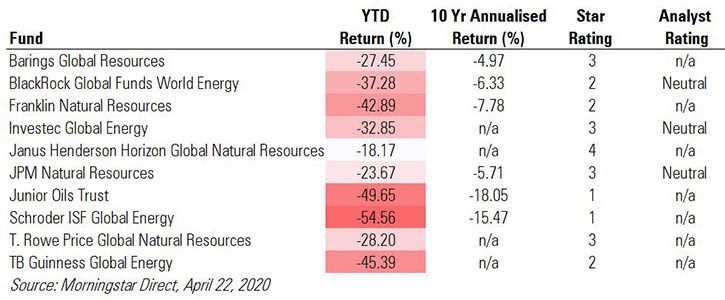

The effect of these falls can be seen in the performance of energy-focused funds. Many funds in the Investment Association Specialist sector have a substantial oil exposure, such as those labelled as energy or natural resources. Some of these funds are nursing staggering losses in the year to date - the Junior Oils Trust, for example, is down nearly 50% so far in 2020 and Schroder ISF Global Energy is off 54%, according to Morningstar Direct Data.

Neutral-rated JPM Natural Resources Fund, which counts Total and Chevron in its top five holdings; the fund was downgraded by Morningstar analysts from Bronze to Neutral in 2019 amid concerns over performance. But its year-to-date returns have been better than some of other funds in the sector because of its exposure to mining companies, which have rallied as China has started to re-open.

Investment trusts focusing on emerging and frontier markets, meanwhile, will often focus on countries that are part of the Opec cartel such as Saudi Arabia, Kuwait – as well as oil producing countries like Russia. These trusts are also down sharply year to date as emerging market funds deal with a strong dollar and economic problems caused by the current crisis.

What Next for Oil?

Sébastien Galy, senior macro strategist at Nordea Asset Management, says a lower oil price “translates into a transfer of wealth from Russia, Saudi Arabia and allies to the rest of the world”. He thinks emerging market fund managers will have to nimble in rebalancing their portfolios away from export-dependent countries. India, for example, relies on oil imports so the economy should be boosted by lower fuel prices.

The resumption of "normal" economic life is key to what happens next for oil prices. As this is hard to pin down, investors will be closely watching the next move by the oil cartel Opec, which is expected to slash production to support prices. While BP and Shell, for example, have conspicuously not announced dividend cuts, their income payments could be vulnerable if oil remains at such low levels.

Tal Lomnitzer, a manager on the four-star rated Janus Henderson Horizon Global Natural Resources fund, argues that "the risk is rising that the second quarter is now starting to look so bad that we could see earlier cuts to dividends than the market expects from some big oil companies". He prefers oil storage and shipping companies to oil producers in the current environment of oversupply and capacity constraints.

Fund Expert managing director Brian Dennehy says investors should be wary of piling into energy funds just because they have collapsed: "With so many unknowns, there are better opportunities that are both beaten up and look decent value."