If there is one lesson the coronavirus pandemic has taught investors, it is that the global economy can be brought to a sudden standstill by a large-scale unpredicted event. A parallel can be drawn with climate change, now widely recognised as a large systemic risk that will affect the global economy, and one which may affect investment portfolios in ways we can’t yet fully imagine or predict.

Climate change has become perhaps the biggest sustainability issue for investment portfolios. Investors are increasingly aware that greater climate variability and more frequent extreme weather events could have considerable effects on businesses. They are also recognising that the world must transition from a fossil-fuel-based economy to a low-carbon economy sooner rather than later.

Regulators, technology, and consumers will all play a role in this paradigm shift. And this, in turn, creates tangible risks and opportunities for investors.

A Flurry of Fund Launches

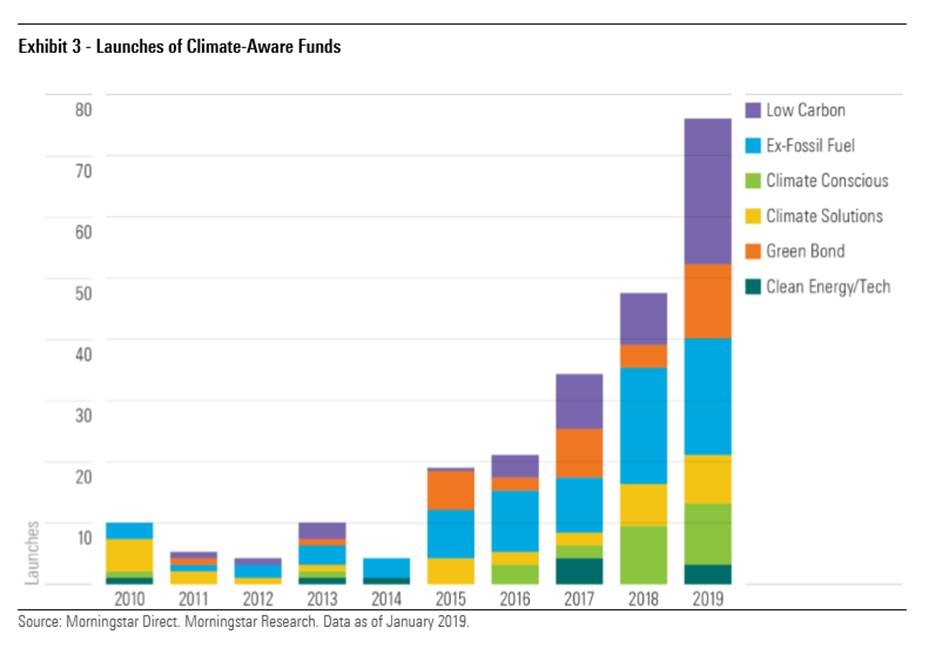

Asset managers have responded to this new dynamic by launching a flurry of climate-aware funds and tweaking existing strategies to incorporate climate change objectives such as lower-carbon footprint, reduced exposure to fossil fuels, and greater exposure to renewable energy opportunities.

Climate-aware funds represent a broad range of approaches that aim to meet varying investor needs and preferences.

In 2019, 76 came to market, following 67 new launches in 2018. The decarbonisation-type of strategy, including Low Carbon and Ex-Fossil Fuel, has seen the highest number of new launches.

Our research paper “Investing in Times of Climate Change” takes a deep dive into 405 funds with a climate-related investment objective, examines their involvement in fossil fuels and the like, and looking under the bonnet at their most common holdings.

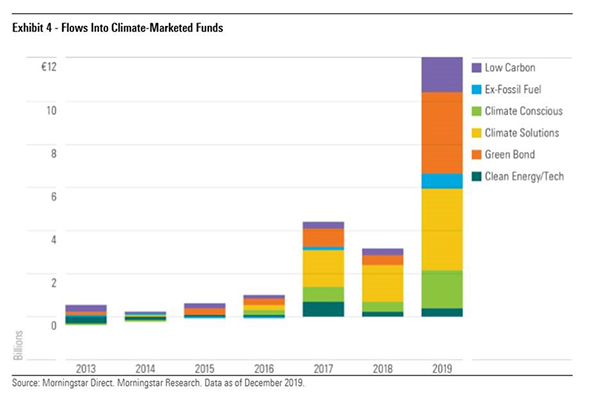

Flows into funds that specifically markets themselves as climate funds have increased in recent years with a major uptick in 2019. Around €12 billion poured into these products last year, driven mainly by growing investor interest in climate issues but also by the growing number of climate-related funds. Climate Solutions and Green Bond funds have proved the most popular strategies.

Do These Funds Deliver on Their Claims?

What many investors want to know, of course, is whether these funds deliver on their claims. Do Low Carbon and Ex-Fossil Fuel funds actually exhibit lower exposure to companies with high carbon emissions compared to the benchmark?

Morningstar analysis found that of 208 funds with carbon intensity numbers available, some 149 – or 72% - offer an improvement on the benchmark. The majority of these are designated Low Carbon, Ex-Fossil Fuel and Climate Conscious funds.

Next, we looked at fossil fuels. Sustainalytics (Morningstar’s partner) defines companies with fossil fuel involvement as those which get at least 5% of their revenues from thermal coal extraction, thermal coal power generation, oil and gas production, and oil and gas power generation. Companies deriving at least 50% of their revenue from oil and gas products and services are also included.

Our analysis shows that designated Low Carbon and Ex-Fossil Fuel funds do have the lowest exposure to these companies. However, some 60% of Ex-Fossil Fuel funds do have some involvement in the sector. Meanwhile, more than 80% of Climate Conscious and Climate Solutions funds have lower Fossil Fuel Involvement than the index, but only 57% of Clean Energy/Tech funds.

One area where investors may be looking for their fund to have greater involvement than the benchmark is in Carbon Solutions Involvement, which includes renewal energy production and services, and green transportations.

As the chart below shows, Clean Energy/Tech and Climate Solutions funds offer the greatest exposure here (indicated by the dots above the red line, which is the benchmark), although their involvement levels vary greatly.

What do Climate Aware Funds Invest in?

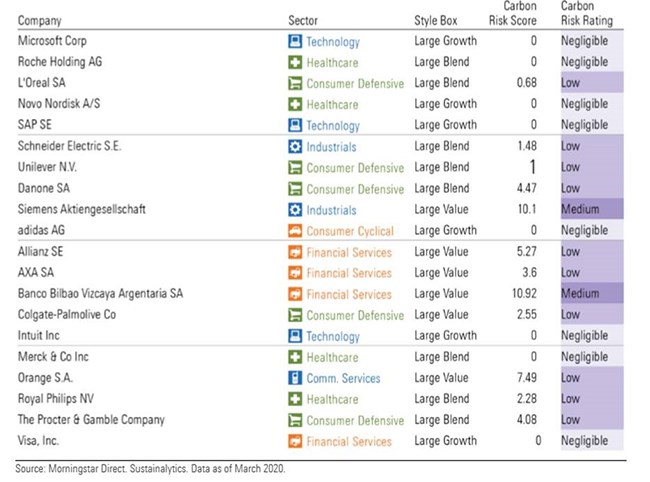

It may not surprise that there is a fair degree of commonality between the companies that many climate aware funds invest in. The below table shows the 20 most-commonly held companies in Low Carbon Funds.

Some 18 of these stocks have a Low or Negligible Carbon Risk Rating with several achieving a Carbon Risk Score of zero including Microsoft, Roche and Adidas. In our full report, we also look at the most common holdings among Ex-Fossil Fuel funds, Climate Conscious funds and Climate Solutions funds among others.

The various fund groups represent a broad range of approaches to investing in climate aware way, which may suit different investors depending on their priorities and risk appetite. Low Carbon or Ex-Fossil Fuel funds can provide broad exposure to the market and may be a solid core portfolio holding, while Climate Solutions and Clean Energy/Tech funds may appeal to those with a greater risk appetite because of their bias towards mid- and small-cap companies.

Either way, the menu of options for climate-conscious investors has expanded considerably in recent years and will continue to do so. At first, the choice may seem complex and it is important that investors do their homework and understand a fund’s objectives and, crucially, look at its holdings to avoid any bad surprises.