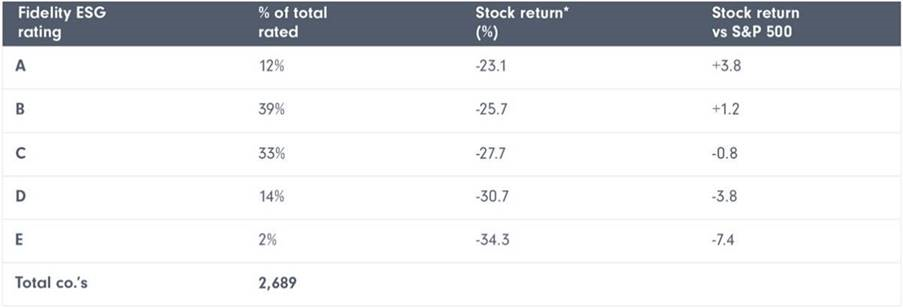

Companies with the highest ESG ratings have performed better than their less-sustainable peers during the market sell-off caused by the coronavirus pandemic, research from Fidelity reveals.

While the S&P 500 plunged 26.9% between February 19 and March 26, companies with a high Fidelity ESG rating (those rated A or B) fell by less than the benchmark, while those rated C to E endured greater falls

“Our thesis, when starting the research, was that the companies with good sustainability characteristics have better management teams and so should outperform the market, even in a crisis,” explains Jenn-Hui Tan, global head of stewardship and sustainable investing at Fidelity International. “The data that came back supported this view.”

Fidelity's research looked at the performance of more than 2,600 companies, assigned an ESG rating by Fidelity based on its engagements with the businesses. It found that companies with an ESG rating of A or B outperformed the S&P500 by 3.8 and 1.2 percentage points during the period. Meanwhile, stocks rated C, D and E by Fidelity underperformed the benchmark by 0.8, 3.8 and 7.4 percentage points respectively.

While the importance of environmental, governance and social (ESG) factors within companies has become more prevalent in recent years, this is the first time that these attributes have been tested in a bear market environment. While sceptics have argued that how sustainable a company is may have no effect on its resilience or performance, Fidelity says the recent sell-off has proved that more sustainable companies hold up better in a downturn.

“While some caveats remain, including adjustments for beta, credit quality and the sudden market recovery, we are encouraged by the evidence of an overall relationship between strong sustainability factors and returns, lending further credence to the importance of analysing ESG factors as part of a fundamental research approach," says Tan.

Morningstar research, meanwhile, found that in the US around 70% of sustainable equity funds finished in the top half of their Morningstar Category in the first three months of the year, while 24 out of 26 ESG-tilted index trackers outperformed their closest conventional counterparts.

Fixed Income Focus

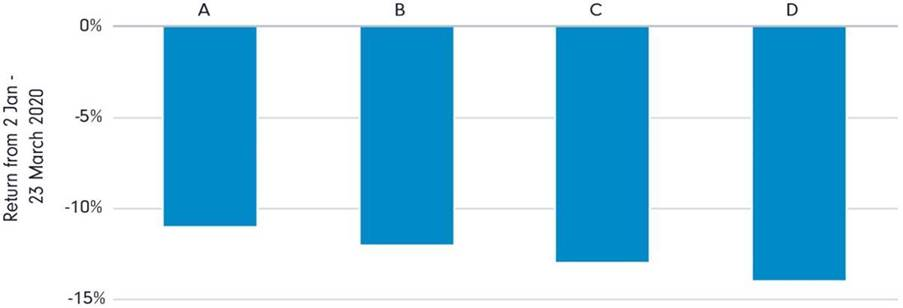

As well as looking at how company share prices fared in the market volatility, Fidelity also looked at the performance of bonds issued by corporates. Here the research showed similar outcomes, with the bonds of companies with a higher ESG rating performing on average better than their lower-rated peers from the start of the year to March 23.

The bonds of the A-rated companies were down an average of -9.23%. Bonds of B-rated companies, meanwhile, were down 13.16% and C-rated companies -17.14%.

Most assets suffered falls and there was little place for investors to hide, but Tam says: "Our research suggests that, what initially looked like an indiscriminate sell-off did in fact discriminate between companies based on their attention to ESG matters."

But Jon Hale, director of sustainability research at Morningstar argues it is not the fact that they are “ESG” that specifically helped these made these funds top performers, but rather the way their portfolios are tilted as a result of their strategies. Sustainable funds, for example, have less exposure to energy stocks, which has helped performance at a time when oil has fallen to its lowest ever levels. They also tend to have a higher exposure to tech stocks, which have soared as beneficiaries of e-commerce, remote working and home-school while entire nations have been on lockdown.

Hale says: “Perhaps the biggest reason for their outperformance is that sustainable funds appear to have benefited from selecting stocks with better ESG credentials. Many such companies are proving to be more resilient during the sudden crisis in which we now find ourselves. They are the quality companies of 21st century, and quality companies tend to hold up better than their lower-quality counterparts in difficult markets.”