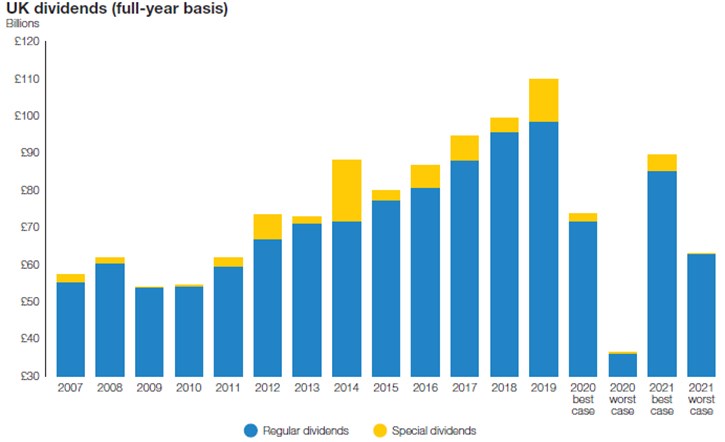

The dire state of income investing in 2020 as the coronavirus crisis unfolds has been laid bare by Link’s latest dividend report. In its worst-case scenario, the report forecasts that dividends will more than halve to below £46.5 billion, having breached the record £100 billion mark in 2019.

Companies have been cancelling payouts in their droves as they look to shore up balance sheets ahead of an expected economic slowdown or worse. Link estimates that 45% of Britain’s listed companies had scrapped their payouts by April 8.

Instead of its usual single annual forecast, Link outlines four possible scenarios for the impact of the coronavirus lockdown on payouts, best and worst case scenarios and two “realistic” estimates within that range. In the best-case scenario, overall dividends fall 29% to £70.4 billion, and in the worst they more than halve to £46.5 billion. Link estimates that the true impact will be somewhere in between these two extremes, with a fall of around 33-41% to between £58 billion and £65 billion. Before the crisis, Link had forecast £100 billion in dividends would be paid by UK firmsin 2020.

Link estimates the biggest impact on dividends overall will be the loss of £13 billion from the banking sector, which has been forced by the regulator to suspend payments.

Will Oil Companies Cut?

While the price of crude has dropped 50% so far this year, taking oil down to around $30 a barrel, oil companies have not explicitly said they will cut dividends. Shell (RDSB), which contributes a big chunk of the FTSE 100’s dividends, will stop its buyback programme, which supports the price of the shares.

The business paid $15 billion in dividends in 2019, and at current exchange rates that would make up 20% of the total that Link forecasts will be paid out this year. But, like income giant and rival BP (BP.), the firm has stopped short of making a decisive move on dividends: with recent share price falls, Shell is yielding more than 10% and BP just under 10%.

Morningstar’s oil analyst Allen Good thinks that dividend cuts are unlikely even if the oil price remains depressed. He believes companies like Shell will be able to reinstate “scrip dividends” rather than cut the payout – this means shareholders get new shares rather than cash. Good adds: “We actually think most of these firms will be able to muddle through the next couple of years relying on those various levers to ensure that the dividend remains intact."

While Link is expecting a sharp reduction in payments this year, it is more optimistic for 2021. Kit Atkinson, head of capital markets at Link Group, says: “Even as we face the deepest recession since the second world war, investors can take comfort from the knowledge that tens of billions of pounds of dividends will still be paid this year. More importantly, they will bounce back next year, even under quite bearish scenarios.”

Jane Shoemake, investment director at Janus Henderson, believes certain sectors will resume dividend payments next year as long as the global economy starts to recover. She says many companies have cut dividends because it is seen as the right thing to do rather than because they need to, so restarting them will be be easier than in the financial crisis. "In some cases, companies have cut their dividends out of prudence and political consideration rather than necessity," she says.

.jpg)