Buying a stock simply because the company’s boss is a woman doesn’t make any more investment sense than buying a stock simply because the company’s chief executive is a man.

Instead, you want to examine fundamentals, consider valuation, and apply whatever other investment metrics matter to you before buying. Moreover, chief executives come and go. That female-run company may be led by a man - and vice versa - soon enough.

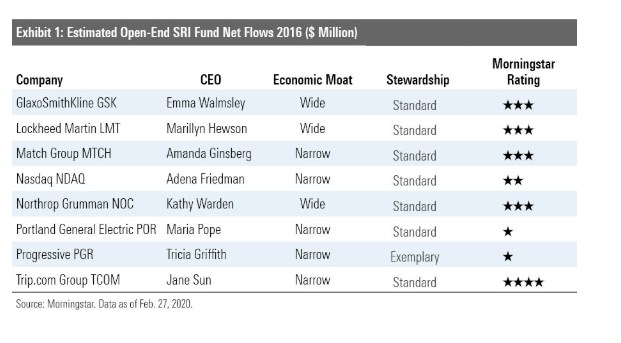

Here are eight companies with Morningstar Economic Moat Ratings of wide and narrow that have females at the helm. These firms have all carved out competitive advantages that should allow them to thrive for the next decade or more.

Lockheed Martin (LMT)

Lockheed Martin (LMT)

Marillyn Hewson assumed the chief executive role at the world’s largest defence contractor in early 2013. Before that, Hewson held 18 different leadership positions over 30 years, spanning multiple businesses. That experience provides her with a deep understanding of the firm’s history, culture, and customers, says analyst Joshua Aguilar.

“Decades of experience dealing with arcane government regulations coupled with a leadership position in high-tech areas such as combat aircraft, transports, missiles, and helicopters provide Lockheed with strong intangible assets and lock its customers into long-term relationships with the company. In many instances, the US Department of Defense has no choice but to use Lockheed because there are no other qualified bidders," he says.

"In missiles, Lockheed and Raytheon effectively compete in a duopoly with other players only capturing a small portion of the US market. In certain segments, such as manned combat aircraft, where we believe Lockheed will be the sole US supplier by 2025, the company enjoys efficient scale dynamics. These intangible assets, customer switching costs, efficient scale in certain segments, and historical returns well above its cost of capital and above peers lead us to assign Lockheed a wide moat rating.”

In early February, Morningstar increased its fair value estimate for Lockheed to $412 from $385 after the three major credit rating agencies upgraded Lockheed’s debt ratings.

Nasdaq (NDAQ)

Adena Friedman has been chief executive of narrow-moat Nasdaq since 2017 and Moningstar analyst Colin Plunkett thinks her deal-making experience is a plus. This is particularly true as the company pivots away from its exchange business, developing new products in data and expanding its technology offerings.

Plunkett notes: “Nasdaq is making the transition from being solely an equity exchange to a diversified data and technology company. Although Nasdaq's market services business accounts for a little less than half of operating income, investors should focus on the company's expanding information services (45% of operating income) business, which provides the market data that investors need in order to trade. Historically, exchanges gave this data away to encourage trading. Now, Nasdaq and other exchanges increasingly view this intangible asset as a profit centre. We expect a majority of Nasdaq's operating income will be realised through data sales while becoming less dependent upon highly cyclical trading volume.”

Shares look pricey according to Morningstar metrics, currently trading at around $106, compared to a Fair Value Estimate of $85.

Progressive (PGR)

Tricia Griffith became chief executive of narrow-moat insurer Progressive in 2016 after previously serving as chief operating officer at the group. When she ascended to the chief executive role, Griffith had nearly 30 years of experience at the firm, with responsibilities across its operations. We award the firm Exemplary marks for stewardship. Management has done a great job of allocating capital to high-return businesses, observes senior analyst Brett Horn. Further, management has proved to be innovative: Progressive was the first to offer online policy quotes and comparisons as well as 24-hour claims service.

Horn says: “Progressive is one of the strongest franchises in the insurance industry, and it is currently firing on all cylinders. The auto industry had seen an uptick in costs in previous years, as a multitude of factors ranging from low gas prices to distracted driving pushed up claims. This compressed industry underwriting margins, but Progressive and the industry have executed a more than sufficient pricing response. Progressive has fully moved past the issue, and underwriting margins are now at the low end of its historical range. However, we view this as a cyclical phenomenon and expect mean reversion over time."

Shares are overvalued today according to Morningstar metrics, with a fair value of $64, against a current price above $76.