Companies today face unprecedented risks as investors demand accountability and transparency in how corporations approach the environment, attend to the well-being of their workers, and govern themselves in an ethical way.

To Morningstar, these factors—environmental, social, and governance—come down to the bedrock of investing: risk.

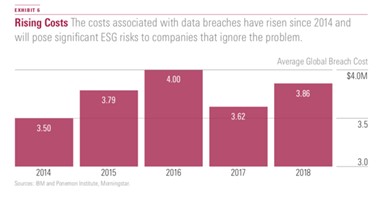

A company that ignores these risks or commits a misstep could incur significant economic costs that jeopardise its ability to deliver long-term, sustainable profits.

One way that investors can identify and manage the ESG-related risks in their portfolios is to understand how companies’ sustainable competitive advantages—or economic moats—have an impact on these risks.

This is the approach Morningstar’s equity research analysts take. They ask:

• Which environmental, social, and governance issues are financially material for each company or industry?

• How are companies tackling these material risks?

• How will these risks affect companies’ long-term value?

The answers are varied and demonstrate that ESG issues often overlap. Here, we take a look at the close relationship between economic moats and ESG risk and how these issues have manifested in various companies.

ESG Risks and Economic Moats

A company’s economic moat can take many forms. It can be built on high customer switching costs, intangible assets, and efficient scale, to name just a few. The Morningstar Economic Moat Rating—wide, narrow, or none—indicates the strength of a company’s sustainable competitive advantage and its ability to create long-term value for investors.

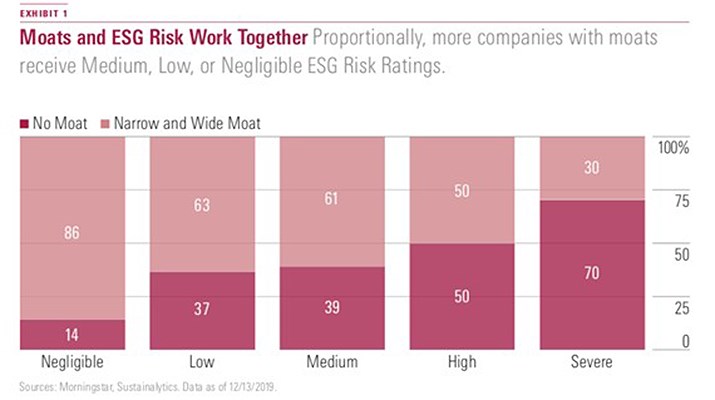

Economic moats and ESG risk tend to work together. Sustainalytics rates companies’ exposure to ESG risks on a scale from Negligible to Severe. As demonstrated on the chart below, more narrow- and wide-moat companies receive Medium, Low, or Negligible risk ratings from Sustainalytics than firms without a moat.

However, ESG-related risk—just like a company’s competitive advantage—is always in flux. Just as companies must adapt to protect their moats, companies must also adjust to changing ESG risks, such as new regulation, stakeholder demands, and technology.

Companies that don’t adapt might skirt by in the short term, but over the long term, they can put investors in jeopardy with more risk or lower returns. How? By letting their sustainable competitive advantages erode.

Here we look at each component of ESG and how companies managing, or mismanaging, their risks can affect a firm's competitive advantage.

Environmental: Dominion and Orsted

With climate change top of the agenda, many investors are focused on companies' environmental risk. The financial risks associated with environmental impacts are highlighted by debate over carbon pricing, climate change protests and environmental disasters such as the BP Deepwater Horizon oil spill.

How a company manages its environmental risk, and the regulation that goes with it, is especially important to assessing sustainable economic moats in resource- and energy-intensive industries.

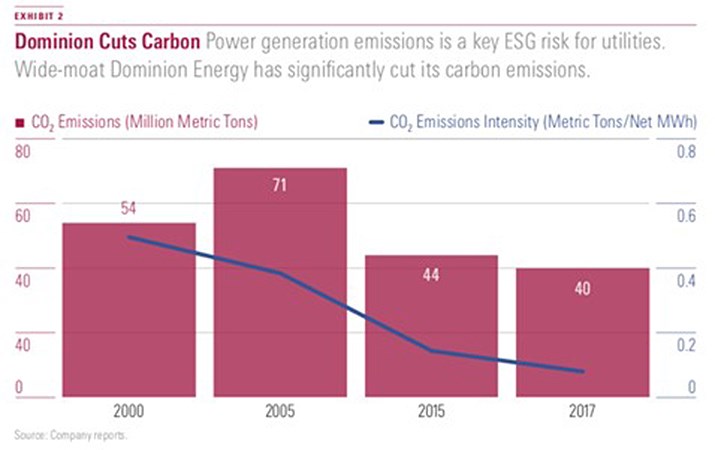

US energy company Dominion (D) stands out as an example of how a utility can adapt to the transformation to clean energy while producing benefits for all stakeholders. We expect Dominion to invest $35 billion by 2023, helping deliver what we estimate will be 7% annual operating earnings growth and high-single-digit annual returns for investors over the next five years.

Dominion has cut carbon emissions intensity more than 40% since 2000, while serving growing electricity demand; its new gas plants emit less than 50% the amount of carbon dioxide of the older coal plants they replaced.

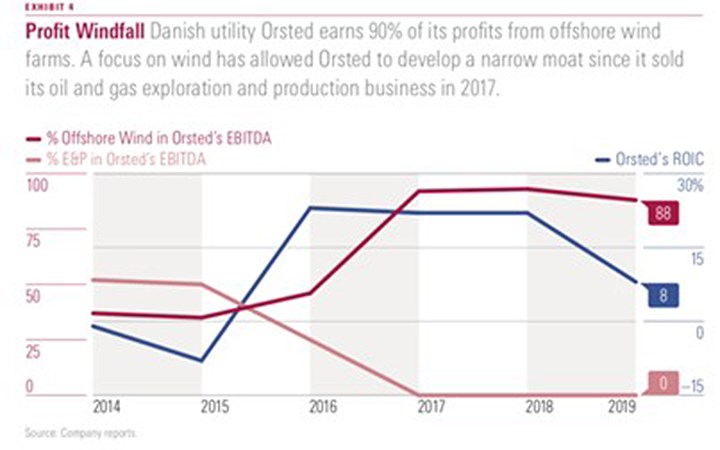

Meanwhile, Orsted (ORSTED) is the global leader in offshore wind – an activity which generates 88% of the firm’s profits. The highly subsidised nature of this industry along with high visibility of future earnings underpins its Narrow moat rating.

But Orsted has expanded its moat by taking steps such as selling its North Seal oil and gas exploration and production business in May 2017, and closing or converting its coal plants into biomass plants.

Social: Astra and Equifax

Social risks are diverse and numerous, ranging from effective use of human capital to human rights in developing nations.

Social issues tend to involve the impact a company has on all of its stakeholders: employees, customers, suppliers, and local communities. A firm’s ability to avoid damaging its relationship with these stakeholders can be an important part of sustaining its long-term competitive advantages, particularly when the firm relies on the public trust in its products or services to maintain its economic moat.

Two companies in different industries—AstraZeneca (AZN) and Equifax (EFX)—demonstrate how social risks can be handled to the benefit of investors or downplayed to their potential detriment.

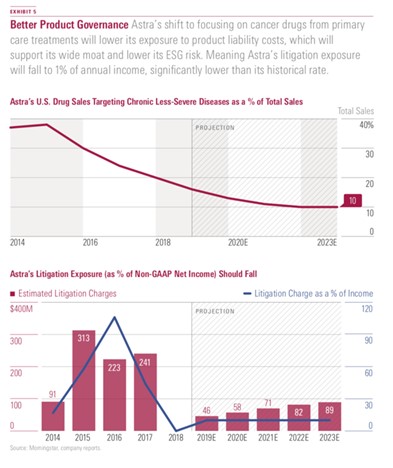

As a global pharmaceutical firm with an evolving product portfolio, AstraZeneca supports its wide economic moat with smart strategic decisions on drug pricing and product governance, two of the biggest social issues affecting the branded drug industry.

Strong pricing power around Astra’s portfolio of drugs is a core pillar of the firm’s wide moat. Pricing dynamics have an impact on public access to basic healthcare services (a central ESG issue), and Astra has a history of fair US price increases for its oncology portfolio.

It also has a strong track record with regard to product governance, or the quality management associated with its healthcare products. Astra has done a good job of lowering the liability risks related to its portfolio by focusing more on life-threatening diseases with acute treatment. Drugs treating life-threatening diseases like cancer rarely face significant side-effect issues that can lead to major product liability cases, given that the high severity of the underlying disease tends to offset most potential side effects. Indeed, most of Astra’s sales are projected to come from drugs that are less probable litigation targets, solidifying its moat.

Looking ahead, as the second chart above shows, we are projecting legal exposure at 1% of annual income. This is significantly lower than the previous five years, which is due to less exposure to drugs associated with high product governance issues. Also, the projected amount is slightly less than its peer group because of the company’s increasing international sales, where liability settlements tend to be much less than in the United States.

In a different sector, Equifax is an example of how failure to invest in areas related to stakeholders could lead to sudden and dramatic ESG risk events. Its data privacy breach in 2017 affected 147 million stakeholders and became a material factor in our moat analysis.

Despite the breach, Equifax operates in a market with only three major players, so the barriers to entry are high and that its moat. There’s also the strength of its intangible asset, credit data on 210 million consumers and more than a century of credit information, which supports a wide economic moat.

But management’s slow response damaged the company’s reputation and sales have slowed as a result. Management said it had planned to spend upward of $300 million on IT infrastructure in 2019 to improve cybersecurity and was also charged $690 million in breach-related settlements.

It’s not alone. The UK Information Commissioner's Office proposed fines of $230 million for British Airways' parent company, International Consolidated Airlines Group (BABWF), and $124 million for Marriott International (MAR) because of breaches in 2019. A breach at Capital One Financial (COF) included 109 million records, with the company estimating up to to $150 million for costs associated with notifying customers, credit monitoring, technology costs, and legal support; associated legal investigations could increase the grand total.

Despite this, Morningstar maintained Equifax’s wide moat rating after the data breach as analysts are still confident its returns will remain above the cost of capital for the next 20 years.

Barring major regulatory changes to the credit bureau industry itself, though, we think the impact from the data breach will be manageable for Equifax and dissipate over time. We also believe that the company's wide economic moat helped in this situation. Equifax is a clear example of how moats truly matter for assessing the likelihood of ESG risk events and the full financial impact when they occur.

Governance: The Case of General Electric

While most investors have a sense of good governance practices, it is difficult to identify where and how best practices might have an impact on business performance.

One example is General Electric (GE), which many ESG and governance analysts once considered a top performer in its industry. Traditional data did not easily capture GE’s lax governance culture, which enabled management to make poor capital-allocation decisions. Ultimately, we downgraded the firm’s moat rating to narrow from wide.

It's well understood that former GE chief executive Jack Welch frequently compromised long-term value to meet short-term earnings goals, even through financial engineering. But GE's more recent problems are due to poor capital-allocation decisions by chief executive Jeff Immelt, such as acquiring a subprime mortgage lender in the run-up to the financial crisis and overpaying for acquisitions such as French conglomerate Alstom.

So while management does not create an economic moat, it can destroy one. We believe GE's reconstituted board reflects its newer lean strategy with 10 directors, including five new ones, which should allow more open debate and deeper analysis, making further value-destructive capital allocation less likely.

How Risk Relates to ESG

Sustainability and ESG investing are top of mind for investors, we can see that the groundswell of interest from new fund launches and record inflows into sustainable funds. But the varying approaches also highlight how disparate the space is.

Morningstar’s focuses on risk management by determining which environmental, social, and governance issues are financially material to a company’s sustainable competitive advantage, or economic moat.

How a company manages these risks is related to its moat; moats and ESG-related risk tend to work together. Corporations with the ability to tackle ESG risk create or strengthen moats over the long term.

Companies that ignore ESG risk might skate by in the short term, especially if they have a moat. But over the long term, a costly risk event can destroy moats, leaving investors with more risk and poor returns.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)