Investing in companies that pay dividends has obvious attractions, but the holy grail for income investors is a firm that increases its payout to shareholders year-on-year.

A growing dividend can have a powerful effect on an investment over the long-term for a number of reasons. Firstly, if a dividend increases each year it helps the income you receive keep pace with the rising cost of living. An income of £100 from an investment in the first year might sound great but if it doesn't increase, then the buying power of that £100 will be eroded away by inflation over the years.

The yield of the dividend will also fall as a company's share price rises. If the firm's share price is 100p and its dividend is 6p a share, that's a healthy 6% yield. If the share price doubles to 200p but its dividend stays the same, the yield is a less impressive 3%.

Finally, for those still in the accumulation phase of their investing journey (where you are growing your money rather than withdrawing it), re-investing any dividends earned can seriously boost your returns.

The below chart shows how a £10,000 investment in the FTSE 100 would have grown over the past 10 years if you re-invested the dividends you received over that period, compared with how it would have fared if you had taken the income each year.

So which are the companies reliably growing their dividends year after year?

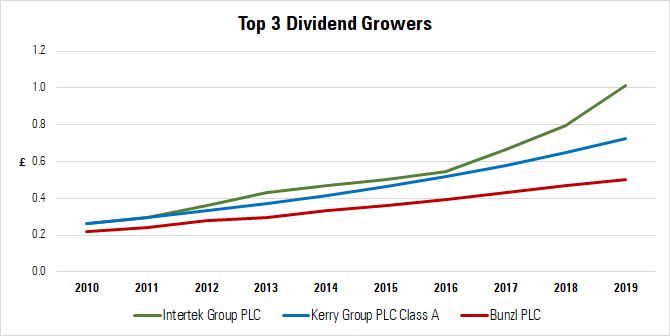

Our analysis looked at companies rated by Morningstar analysts and considered to have an "Economic Moat", which means they have some competitive advantage over their peers. Of these, we found nine FTSE-listed companies that have increased their payout every year for the past decade.

|

Stock |

Morningstar Rating |

Economic Moat |

2010 Total Dividend (£) |

2019 Total Dividend (£) |

10-Year Dividend Growth Rate (%) |

|

Intertek Group |

1 |

Narrow |

0.27 |

1.01 |

281 |

|

Kerry Group |

3 |

Wide |

0.26 |

0.73 |

179 |

|

Bunzl |

4 |

Narrow |

0.22 |

0.51 |

129 |

|

Burberry Group |

3 |

Narrow |

0.19 |

0.43 |

125 |

|

RELX |

1 |

Narrow |

0.20 |

0.43 |

112 |

|

Meggitt |

3 |

Narrow |

0.09 |

0.17 |

97 |

|

Diageo |

2 |

Wide |

0.38 |

0.69 |

80 |

|

SSE |

2 |

Narrow |

0.70 |

0.98 |

39 |

|

BAE Systems |

2 |

Wide |

0.17 |

0.23 |

36 |

|

Source: Morningstar Direct, February 19, 2020. Figures do not include special dividends. |

|||||

Intertek (ITRK) tops the table as its dividend today is up 281% from its payout 10 years ago, with shareholders currently receiving £1.014 per share, up from 26.6p a decade ago. The quality assurance company has benefited as the demand for its inspections has increased, helping it improve both sales and profits. Intertek benefits from trends such as a shift to outsourcing and an increased demand for consumer goods testing in emerging markets.

Meanwhile, Kerry Group (KYGA) has increased its dividend from 26.1p to 72.7p a share over 10 years, thanks to its strong results. The food company owns brands such as sausage producer Richmond and meat-free range Naked Glory, which has benefited from the vegan boom.

Third in the table is Bunzl (BNZL), whose dividend has grown from 22.1p in 2010 to 50.5p in 2019. Part of the growth has come as the company has spread internationally; it now operates across the Americas, Europe and Asia Pacific.

Finding businesses that can grow their dividends is a priority for many income fund managers. Colin Morton is manager of the four-rated Franklin UK Rising Dividends fund, whose strategy is based around finding companies that grow their payout. He likes Diageo because its products have been around a long time and have a loyal customer based, and another favourite is Marmite-maker Unilever (ULVR), which has a longer track record of increasing dividends.

Morton also owns many of the names in the table – Bunzl, Burberry (BRBY), RELX (REL), SSE (SSE) and BAE Systems (BA). While he looks for companies that increase their dividends over the long-term, he doesn’t mind if a company has maintained the same dividend for a couple of years.

“Ideally I want companies to increase dividend each year, but if it was a tough year and something happened, I am not just going to sell a stock because the dividend growth was a bit lower than I had thought, as long as there is a good reason,” he explains.

When Not to Sell After a Dividend Cut

The outbreak of the coronavirus could cause many companies to hold or even cut their dividend, as their industries are hit by the spread of the virus. Morton says this is an example of something beyond a company's control and often an opportunity to top up an investment in a firm rather than sell.

Indeed, he has recently been buying more shares in Intercontinental Hotel Group (IHG) and Burberry, after shares in the companies fell over concerns about the impact of coronavirus. The tourism industry has been severely hit by the outbreak as people are afraid of travelling, while Burberry generates a significant proportion of its sales from the far east and China. Morton adds: “I acknowledge it’s going to be a tough time, but when all this comes to an end, we should see these companies pick up once again.”

Job Curtis is another fund manager on the lookout for rising dividends. Indeed, the Silver-Rated City of London (CTY) investment trust he runs has raised its own payout for 53 years in a row. Curtis bought Diageo (seventh in the table) back in 2016, after the company disposed of its non-beverages businesses, and it is now the fourth largest position in the trust's portfolio. He also rates the firm's strong stable of brands and global presence. Another of his top holdings is RELX, which comes in at fifth place in our list of dividend growers.

Annabel Brodie-Smith, communications director at the Association of Investment Companies points out that for investors who may not be confident picking individual stocks, a fund or trust can be a good option if a growing income is a priority. “While it’s never guaranteed that rising dividends will continue in the future, it can be comforting to know that there are investment companies which have been able to increase their dividends through thick and thin for decades,” she adds.

A key indicator of companies that will able to achieve this is their so-called dividend cover. This is a ratio which indicates how many times over a firm can afford its payout. Anything under 1 indicates it cannot afford its dividend and may have to fund the payout through borrowing or other means, making it more likely the payout will be cut in the future.

A ratio of 2, meanwhile, indicates a firm can afford its payout at least twice. This means the business can maintain its payout even if profits falls and may make it more likely to hike the dividend in the future.

But there are valid reasons a company's payout may not grow every year. Many companies in the FTSE report their earnings in dollars rather than pounds, which means the dividend they pay will be affected by exchange rate movements. "This means that sterling investors, for example, would not see an increase in their dividends if the pound gets stronger than the dollar," explains Morton. It's something he allows for when considering companies that may not have increased their pay out.

.jpg)