Amid the tumult surrounding WeWork's implosion, investors may be forgiven for asking whether co-working will ever work for them. We are convinced the answer is a resounding yes.

While the current structure of the co-working industry involving risky long-term leases and the dominance of a few firms will prove short-lived, the demand drivers for flexible office space - the rise of the gig economy and increasing acceptance of co-working - should endure.

Although these dynamics have left some to believe that the the office is on the wane, the desire to conduct work in a dedicated space persists. What has changed is the nature of how work is done, and consequently, how office space is being demanded.

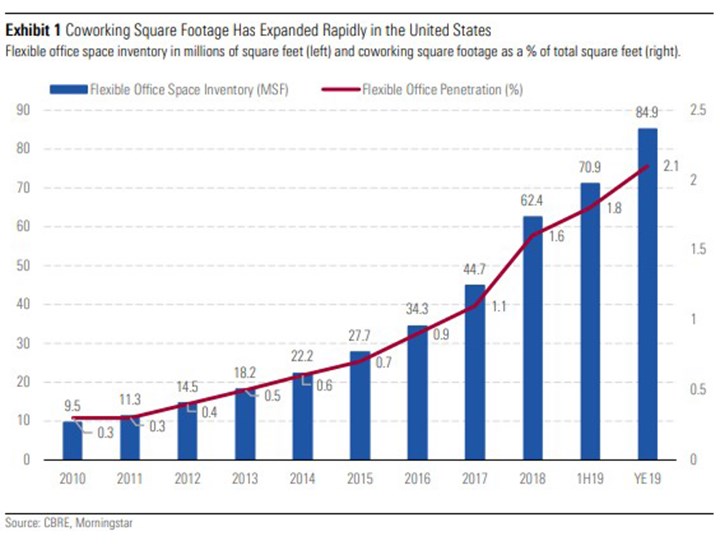

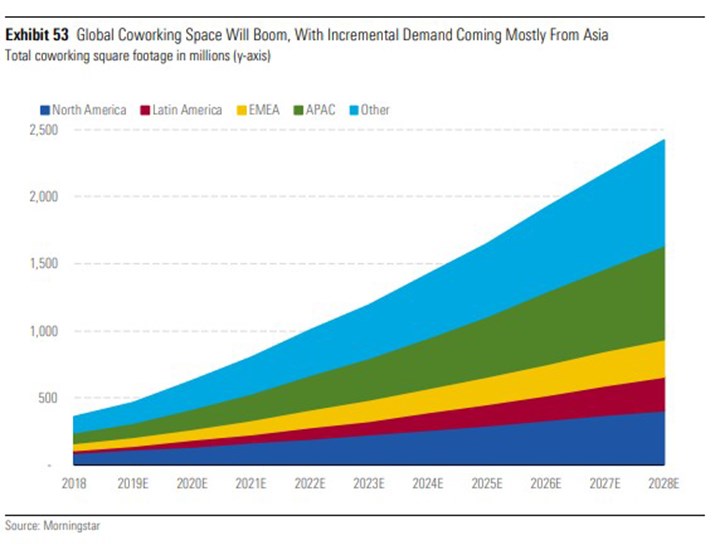

We expect co-working space in the US to more than quadruple from around 80 million square feet in 2018 to more than 360 million square feet by 2028. Globally, we expect co-working space to increase sevenfold, with strong growth outside the US. Amid this breakneck pace of growth, we estimate that co-working will increase its overall share from around 2% of occupied office square footage in the US in 2018 to around 8% by 2028, and from 2.5% to 14.5% globally.

Remote working arrangements should provide a headwind to office demand, but the effect will be muted by the tendency for employees to work from home only part of the time, meaning they are still allocated office space.

More Flexible Leases

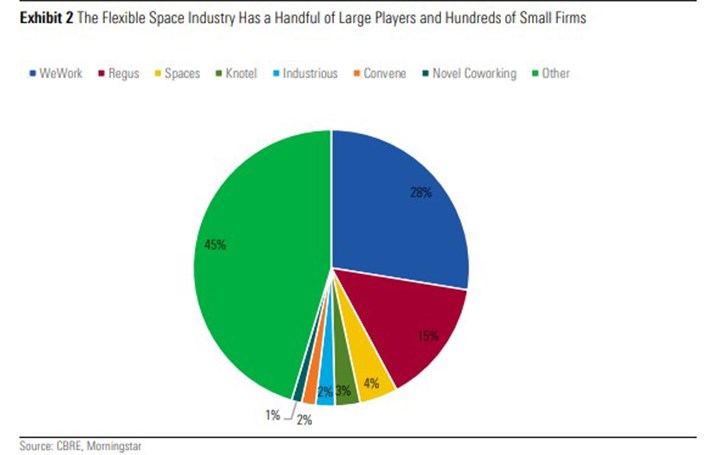

The co-working industry is currently dominated by a few large players, such as WeWork and Regus, with many smaller firms. But competitive pressures and more judicious venture capital money should result in less concentrated market share. We also expect a shift away from long-term leases to operating agreements that feature a management fee to operate a space.

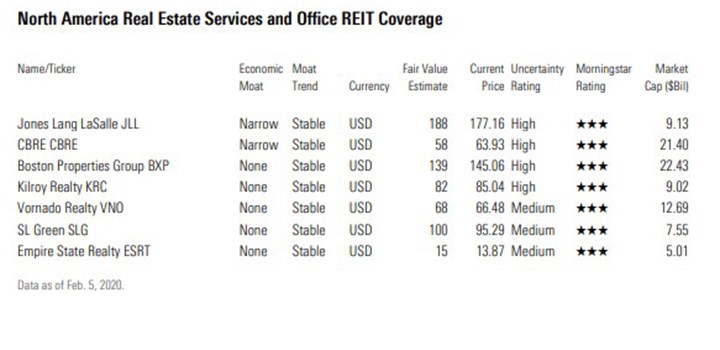

Because of the real estate focus of co-working firms, competitive advantages or "moats" will be very hard to come by, but a focus on real estate services rather than exposure to real estate economics remains the best bet.

But with Regus's parent company, IWG (IWG), currently the only publicly traded co-working firm, investors may have to wait to fully share in the spoils. Nevertheless, companies across the real estate industry should benefit from the impending shift because of the increased demand for office space, including the office real estate investment trusts (REITs) and the commercial real estate brokers we cover.

What is Co-Working?

Co-working, or collaborative working, refers to different types of workers (such as freelancers or companies) coming together in a communal environment to conduct work, share ideas, and innovate. This type of communal environment is also called flexible office space, or flex space, mainly because of fluid lease terms and ease of access by a wide variety of people.

Although the tremendous scope of growth has put co-working in the spotlight recently, the concept isn't new. After World War II, office space changed in terms of what was considered a productive working environment. Consequently, what were known as serviced offices rose to prominence, providing flexible rental office offerings with various amenities, such as snacks and drinks. However, these spaces lacked a collaborative emphasis, and as the business world evolved, the idea of co-working changed along with it.

Some people disagree about who the first true co-working provider was, but most can agree that IWG (Regus' parent company) has played a significant role in shaping the industry. And in the aftermath of the 2008 financial crisis, there was an explosion of growth in the co-working space, much of which can be attributed to the meteoric rise of WeWork, founded in 2010.

The Case of WeWork

Co-working providers that operate under these models all remain focused on improving members' experience of the space by offering a host of amenities and other services such as snacks and drinks, sit-stand desks, personal care services, fitness areas, social hours, and many more.

Such amenities help foster the collaborative environment co-working is known for. While providers under all models provide such services to attract clients, those under the traditional model have the highest level of control over how they curate these options. Under the traditional model, a co-working provider enters a long-term lease with a landlord. The provider then builds out the space to its specifications and sub-leases it to clients for shorter, more flexible lease terms.

WeWork has skyrocketed to its position as the market leader in the co-working industry under this model; over the past nine years, the company has grown to more than 500,000 members in more than 500 locations.

But despite this breakneck pace of growth, WeWork's unsustainable expansion is one of the many reasons why the company has floundered recently. Expenses have been growing faster than revenue, as most of WeWork's locations are still new and not yet profitable. The company hopes ousting ex-chief executive Adam Neumann and installing new leadership will help it navigate to profitability.

Similarly, Knotel leases office space from landlords and converts it into large-scale, office environments. However, its members consist solely of corporate enterprise clients, compared to around 40% for WeWork.

Meanwhile, Regus signs long-term leases with landlords, renovates the space, and then offers tiered memberships to clients. It provides clients with access to workspaces across the world and provides a full host of amenities in its locations. Its parent company IWG owns other subsidiaries, including HQ and Spaces, which provide tailored spaces like creative labs, luxury offices, and members clubs.

Scope for Growth

While expenses remain a key concern, the co-working industry is expected to grow rapidly. It is estimated that flexible office spaces will represent 30% of the total office market by 2030 compared with less than 5% today. The industry is also focused on attracting more enterprise clients. From 2012 to 2017, the proportion of freelancers in co-working spaces fell to 41% from 55%, while company employers and employees grew from 40% to 52%.

The highly publicised struggles of WeWork have certainly dampened investor sentiment towards the firm. Amid a deluge of discouraging news, investors could be forgiven for writing off the prospects of the co-working model altogether.

Nevertheless, we maintain that co-working is here to stay. And investors seem to agree. When CBRE asked in an investor conference poll in 2017 whether the flexible office space disruption was permanent or temporary, 84% of participants responded that they thought it was permanent.

Most tenants are drawn to the flexibility, lower upfront capital costs, and the ability to share resources that co-working provides. We view this shift as less of a revolutionary disruption, but rather a long overdue reconfiguration of the structure of the office real estate industry. For all its missteps, WeWork exposed the true scale of the latent demand that exists for flexible office space.

The Potential for Global Growth

We expect the same trends affecting US office space to also affect global office markets. At the low end, we have India and China, both developing countries. In India's case, a small fraction of the population is office-using and urbanisation is still in the early stages. In China, extremely low office density and the country's continued status as a developing country both contribute to the low figure.

At the high end, we find the United States, Australia, and Canada. This is unsurprising because each of these countries is highly developed, has a higher than average office density, and is relatively built up.

Our total forecast demonstrates that the next 10 years will be devoid of dramatic change in the composition of total office space.

But we think many countries outside the US possess characteristics that make them fertile grounds for co-working to take root. North America and Europe, the Middle East, and Africa should continue to grow at a healthy rate, but their growth will be eclipsed by that of Asia-Pacific and Latin America.

Accordingly, we expect co-working's share of total occupied office space to exceed that of the US in these regions. For example, co-working should represent 25% of office space in China by 2028, up from an estimated 3.5% in 2018. This compares to the US, where occupied co-working square footage should represent around 8% of the total by 2028.