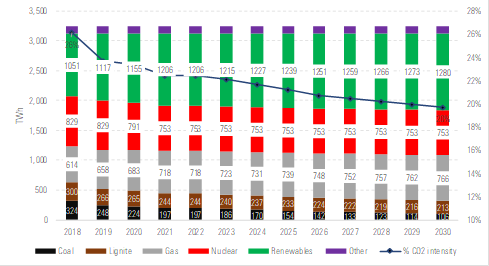

We forecast that European power generation from coal plants will halve by 2030, based on the national coal exit plans developed by each country in the EU. We project that 60% of this withdrawn coal generation will be replaced by wind and solar energy and 40% by gas generation.

These numbers are consistent with the National Energy Climate Plans (NECPS) that member states submitted earlier this year, which outline their plans for cutting carbon emissions and diversifying energy sources between 2021 and 2030.

With regards to the overall industry, we believe that the decarbonisation trend, which began in 2013, will continue implying a 0.6% annual decline in industry emissions through 2030. Our forecasts for power generation and industry, which are the sectors covered by the European Emissions Trading System, or EU ETS, point to a 43% fall in carbon dioxide emissions between 2005 and 2030, in line with the EU’s target.

Further predictions around European energy prices are detailed below, and in our latest Utilities Observer.

CO2 Projections: Two Potential Paths

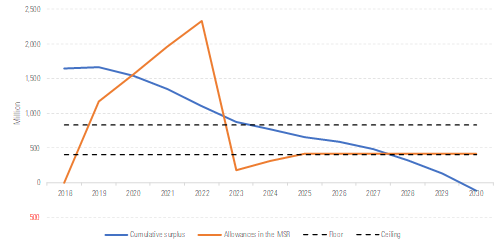

Assuming the EU ETS rules don’t change, our CO2 projections involve a fall in the CO2 allowances surplus from 1.6 billion in 2019 to 1.1 billion in 2023. After that, the surplus would be flattish through 2030, which is potentially bearish for CO2 prices.

However, Ursula von der Leyen, the new president of the European Commission, has pledged to increase the CO2-emission reduction between 1990 and 2030 from 40% to 55%. This would require the EU to more than double the annual reduction in the CO2 allowances supply between 2021 and 2030. Under that system, the chart shows our estimate that the CO2 allowances surplus would be eliminated by 2030.

This potential reform implicitly supports CO2 prices: Any slide below the coal-to-gas switch breakeven, where the profitability of coal and gas plants is equal, would strengthen the case for a reform.

The Impact on CO2 Prices and Utilities

We believe that CO2 prices will be ultimately driven by the coal-to-gas switch breakeven, which we estimate will occur at €29. That involves long-term German power prices of €51/megawatt-hour and western European power prices that are on average €5/megawatt-hour higher than the forwards seen in early September 2019.

We expect the coal-to-gas switch to favor utilities with large fleets of gas plants across Europe, while the CO2-driven increase in power prices will be primarily positive for utilities with low-carbon intensity and generally positive for the sector. This is because the average carbon intensity of continental European power producers under our coverage is around 0.35, below the correlation between CO2 and power prices of 0.8.

This is mostly priced in as we see the sector as slightly overvalued. However, there are still some pockets of value. For instance:

- Engie (ENGI) is the best-positioned European utility. We see a total shareholder return of 15%, including 5% of dividend yield. This is owed to its geographically diversified fleet of gas plants, the low-carbon intensity of its French hydro plants and Belgian nuclear plants, and its large liberalized electricity volumes.

- Électricité de France (EDF) is also well-positioned and significantly undervalued, but that comes with a high uncertainty.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)