ESG - environmental, social, and governance - has become one of the hottest topics in the investing world. An increasing number of investors no longer consider it a luxury but rather an effective way of addressing long-term investment risks such as climate change.

Many asset managers are striving to adapt their product offering to this changing market landscape, but progress so far has been faster in equity than bond funds. Many of the early equity ESG index funds came to market around the turn of the century, while most ESG bond passive funds have only launched in the past three years.

But the ESG bond market is starting to make up for lost time. Here, we look at the market’s landscape.

The Growth of European ESG Bond Funds

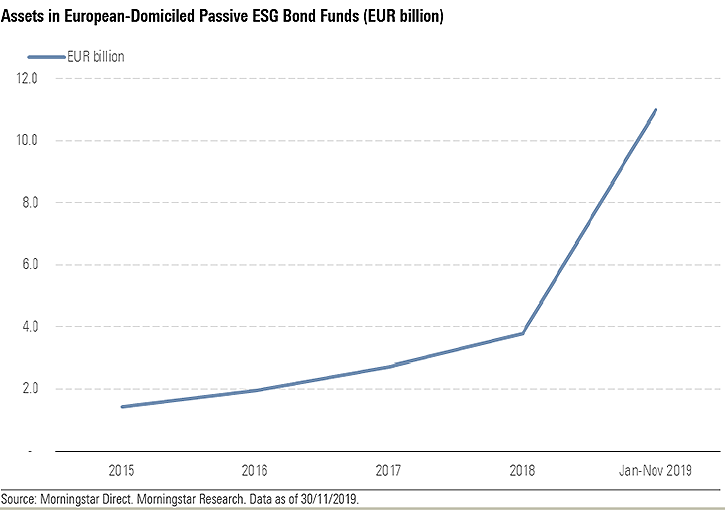

At the end of November 2019, assets in the European passive ESG bond-fund market amounted to €11 billion, representing only 2% of the money invested in European passive bond funds. By contrast, assets in European passive ESG equity funds surpassed €110 billion, accounting for 9% of the European passive equity-fund market.

Even so, 2019 was a good year for passive ESG bond funds in Europe. As shown on the chart below, the year’s flows were six times the amount in the previous two years, while assets tripled between the end of 2018 and the end of 2019.

More importantly, growth prospects are positive. Strong management of ESG risks may make bond issuers less vulnerable to credit-rating downgrades or, even worse, default. And this is what ultimately matters most to bond investors.

The mitigation of credit risks, coupled with the rising popularity of low-cost index-tracking, creates the perfect mix of conditions for an expansion of the ESG passive-bond-fund offering in the coming years.

Challenges Remain

It’s possible to apply the principles of ESG investing to both equities and bonds as, ultimately, doing so comes down to assessing the ESG credentials of the companies in which we want to invest.

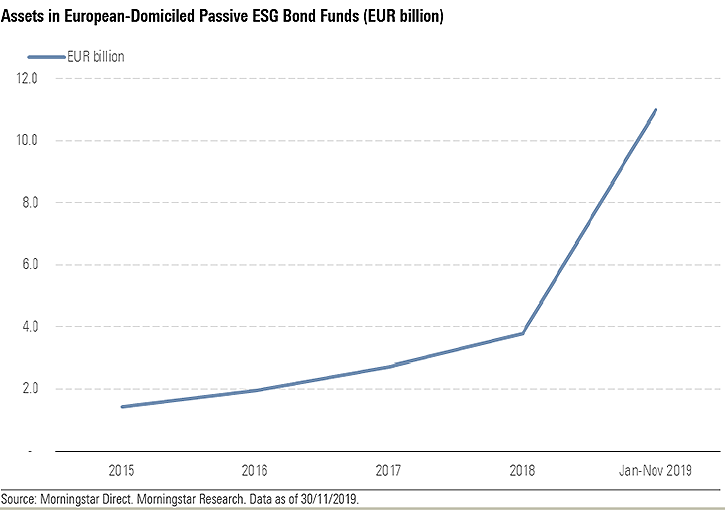

The challenge is to carry out due diligence. This can be straightforward for large corporations but difficult with smaller companies that lack the resources to disclose sustainability information. Also, historically, it has been easier to perform due diligence on companies that carry an investment-grade rating than on those who do not. Therefore, most passive ESG bond funds in Europe, and the bulk of assets, are currently in investment-grade-rated corporate bonds. This distribution is shown on the chart below.

Here’s a look at a few other categories:

- High-yield ESG bonds. Progress is being made in this area. In November 2019, iShares launched the first two high-yield bond ESG ETFs: iShares EUR High Yield Corporate Bond ESG ETF and iShares USD High Yield Bond Corporate Bond ESG ETF.

- Developed-government ESG bonds. Applying ESG criteria to government-bond issuers is another challenging area. ESG assessment of governments remains largely based on social and macroeconomic indicators, like data on labour markets, educational standards, and social mobility. This approach to evaluating ESG criteria has proved more successful for emerging markets than for developed sovereigns, partly because of the greater disparity in risk/return profiles and macroeconomic conditions between the large cohort of emerging-markets sovereign-bond issuers. Also, developed-bond issuers do not tend to be as vulnerable as emerging markets to unfavourable macroeconomic news.

- Green bonds and social bonds. Aside from corporate and government-bond offerings, investors are also interested in impact investing, such as green bonds or social bonds. Green bonds are issued to finance-specific environmental and climate projects and is a growing market. But labelling a bond as “green” can be costly and not all issuers do so, which poses problems for the development of indexes.

Investing Sustainably Doesn’t Mean Sacrificing Performance

The expected popularisation of passive ESG bond funds also rests on the fact that broad ESG bond indexes have closely mirrored the overall risk/return characteristics of their non-ESG-screened parents.

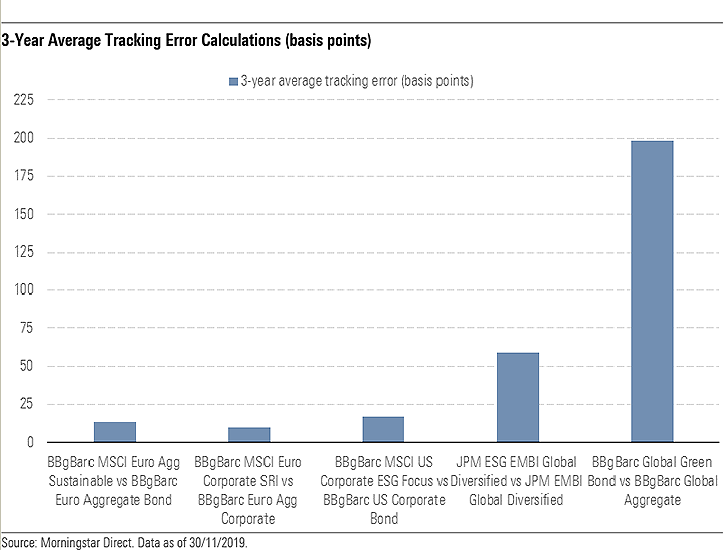

The chart below shows the analysis of tracking error between ESG and non-ESG bond indexes for a variety of market exposures for the three-year period ended in November 2019. Tracking error measures how closely two indexes or funds track each other. The lower the figure, the closer they are.

Typically, the main difference is one of a slight quality tilt in the ESG portfolios, as measured by the distribution of credit ratings of the index constituents. But overall, investors have not sacrificed performance when going down the ESG route.

It is only once we moved from broad ESG bond propositions to impact funds, such as green bonds, that we observed significant differences in performance relative to non-ESG-screened bond indexes. However, this is to be expected given the differences between the two investment propositions.