There have been a number of downgrades among the first batch of funds to be reviewed under the newly enhanced Morningstar Analyst Rating methodology.

As part of the enhancements to the Morningstar Analyst Rating, we’ve streamlined our five pillars to three – People, Process and Parent – and given more weight to the effect of fees on a fund. Under the enhanced system, different ratings may be given to a fund’s various share classes, depending on their fees, whereas previously all share classes for a fund automatically received one single rating.

We have looked at the effect on the ratings of the first batch of funds to be reviewed under the new methodology.

Some 55 funds have been analysed under the new methodology, spanning 673 different share classes. Among this cohort, downgrades outnumbered upgrades by more than five-to-one. Costly funds were downgraded seven times as often as inexpensive funds. It highlights how the new methodology will set a higher bar for active funds to clear.

To illustrate how the new methodology works, here is a before-and-after comparison of one fund: T. Rowe Price Emerging Markets Equity.

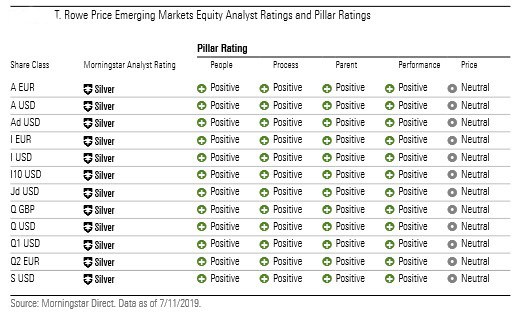

As the first chart shows, under the previous methodology, the fund had a Silver Rating across all of its 12 share classes:

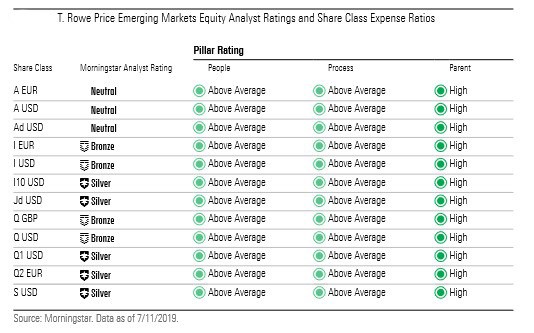

Under the new system, however, a different picture emerges:

Notice there are two fewer pillar ratings than before, a different pillar ratings scale and the Analyst Ratings aren’t the same across the fund’s 12 share classes.

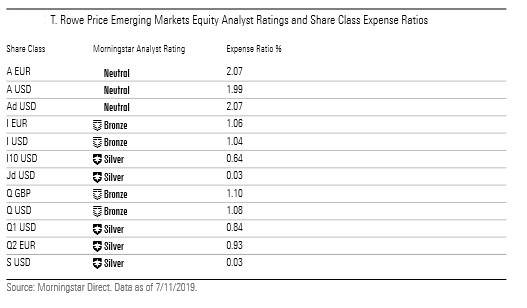

Why do the Analyst Ratings vary by share class? Because the fees those share classes levy differ. When we accounted for each share class’s specific fees, we concluded that the more expensive share classes wouldn’t add value for investors after adjusting for risk.

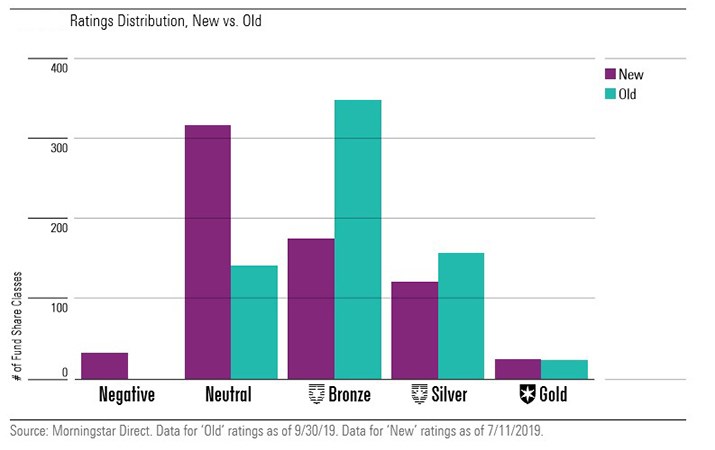

This is just one example, but is part of a trend that is emerging as we examine funds under the new methodology. The below chart shows the ratings of the 673 share classes we analysed under the old rating and the new. We can see that the distribution of ratings has shifted away from Silver and Gold, toward Neutral and Negative.

Just 30% of share classes we looked at that were formerly rated Bronze retained their rating, while 50% saw a downgrade to Neutral and 7% moved to Negative. Meanwhile, 9% were upgraded to Silver and 2% to Gold. In total, around 45% of share classes examined retained the same rating under the new methodology.

Most rating changes stemmed from individual fund share classes and related to their specific fee. Fees can vary considerably by share class fee basis given the practice of bundling in distribution and related costs to certain types of share class. While less expensive share class types fared better in general, clean share classes still saw a material number of downgrades.

How to Use the Ratings

We expect it will take around one year to complete the process of running all rated funds through the updated methodology. During that period, we’ll have ratings in force that were assigned under the former methodology as well as the new system.

So you may have a few questions:

How do I know if the Analyst Rating I’m seeing was assigned under the enhanced or former methodology?

The best indication is the date. If the report date is prior to October 31, 2019 then the Rating was assigned under the former methodology. If you don’t have the rating date handy, you can look for other tell-tale signs: the enhanced methodology has three pillars not five, and individual pillars are now rated on a five-point scale (High, Above Average, Average, Below Average, Low), rather than a three-point scale of Positive, Neutral or Negative.

Can I have the same confidence in the Analyst Ratings assigned under the former methodology, which have not yet been updated?

Yes. If we had reason to believe these Analyst Ratings weren’t reliable, we’d expedite the process of updating them under the enhanced methodology. That said, one key difference to keep in mind is that funds rated under the old methodology will continue to have the same rating across every share class.

The data in the original report has been modified since publication. The count of funds and classes were reduced by two and 68, respectively. The correction did not change any of our conclusions or meaningfully impact the data presented except to reduce absolute counts and slightly alter certain percentages and ratios.