Shares in German car giant Daimler (DAI) slipped 6% to market close today after the company announced it had opened an investigation into its diesel emissions at the request of the US Department of Justice.

The owner of the Mercedes-Benz brand said on Thursday evening in its statement that it is “cooperating fully with the authorities” to investigate any possible irregularities in its emissions test in the US.

The car company also reported a 31% decline of its first quarter earnings this morning to €1.35 billion from last year’s €1.96 billion; however the results were overshadowed by its emissions investigation.

The news comes after Volkswagen AG (VW) reached a deal on Friday with the US over cheating in their emissions test. Volkswagen has set aside €16.4 billion to cover costs of the cheating revealed last year, buying back or fixing some 500,000 affected cars in the US and paying substantial damages.

Global car manufacturers have seen share price declines across the sector as the market digested the news of yet another car emission scandal. Daimler shares fell 62.8p at 4pm GMT this afternoon, while Bayerische Motoren Werke (BMW) fell 2%. Shares of Volkswagen rose moderately 0.7% to 151p after it said it increased the compensation costs, reversing an earlier fall. European car companies Renault (RNO) and Peugeot (UG) dropped 3% in Paris.

How Wide Spread is the Emissions Scandal?

While Daimler has started an internal investigation into emission testing this week, it is reported that Peugeot Citroen offices have been raided by anti-fraud squad as part of a probe into a similar crime.

Earlier this week Mitsubishi Motors Corp (MMO) the Japanese car company was also reported to manipulating fuel-economy tests and misleading consumers. The company’s shares fell 8% in one afternoon as a result.

What Do the Analysts Say?

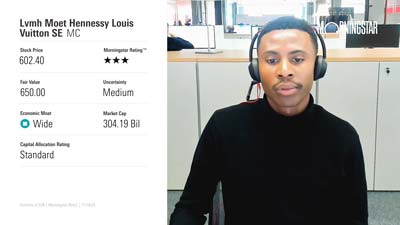

Morningstar analyst Richard Hilgert believes that Daimler’s strong R&D capabilities and electrified powertrain should prove valuable because of global clean air legislation, and he thinks Daimler's balance sheet is also in good shape.

As the company’s brand Mercedes-Benz is recognisable and well-respected, it gives the company a modest buffer against the cyclical downturns of auto sales. The company’s geographically diverse sales also reduce exposure to the economic conditions of any one region.

However the company faces stiff competition in all of its markets. The company operates in a cyclical, capital-intense industry where raw material commodity costs can be volatile and unionized labor can be expensive. The stock is rated as fair valued by Morningstar analysts.