A revamped Morningstar Sustainability Rating has led to a number of changes to funds' ratings.

Morningstar is now incorporating the Sustainalytics company ESG Risk Rating as the basis for the Morningstar Sustainability Rating for funds. The company ESG Risk Rating is an indicator of a company’s material ESG risks measured on the same scale across all economic sectors.

The fund-level Morningstar Sustainability Rating, also known as the Globe rating, evaluates how much ESG risk is embedded in a fund relative to its Morningstar peer group. Under the widely accepted premise that the world is transitioning to a more sustainable economy, Morningstar views a risk-based lens as the best available technique to assess the ESG characteristics of a fund.

The Globe rating is awarded to all funds in Morningstar’s database, irrespective of whether they have a sustainability focus, provided that the funds have at least two thirds of their assets covered by Sustainalytics.

In this article we focus on those funds that incorporate ESG factors into their investment process. As the number of funds that claim to be sustainable grow, they are increasingly scrutinised; investors want to know if sustainable funds live up to their claims.

The Effect of the New Rating on Funds

Under the revamped ratings system, the vast majority of sustainable funds either maintained their ratings or improved it, gaining one or more globes. Some 54% of sustainable funds kept their ratings, the majority of which were high to start with. Meanwhile, 23% gained one or more globes.

Around 22% lost one or more globes. It’s worth noting that among these, most lost only one globe from the highest level of 5 globes. These also tend to be funds that use a "best-in-class" approach for portfolio creation, as they hold companies in higher-risk sectors, including oil & gas, utilities, and materials.

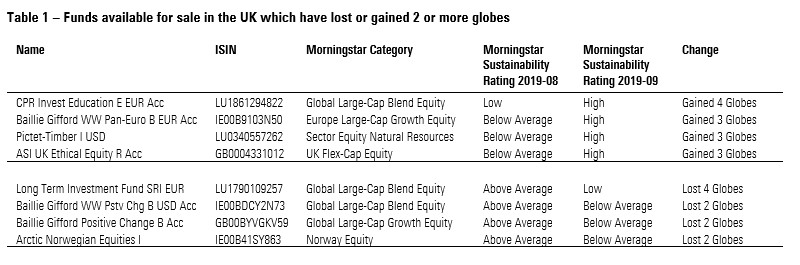

The funds available to UK investors that experienced the most significant changes (lost or gained 2 or more globes) are listed below:

To illustrate the impact of the rating change, we will look at two Baillie Gifford funds, one gained 3 globes while the other lost 2 globes. We will also explore the triggers for the changes.

The Baillie Gifford Worldwide Pan-European fund invests in European growth companies while applying an ESG overlay, assessing stocks based on the 10 principles of the United Nations Global Compact for business, which cover areas such as human rights, labour rights, and combating bribery and corruption. The fund will not invest in any companies that derive more than 10% of their revenues from tobacco, weapons, thermal coal or tar sands.

The fund gained three globes following the implementation of the new rating, moving from 2 to 5. This can be largely attributed to the inherently low ESG risk profile of the portfolio rather than portfolio changes from one month to the other. We compared September’s portfolio with August’s and the holdings were the same, although the weightings had shifted slightly. (It should be noted that any changes to a portfolio’s composition or a company’s ESG rating from one month to the next would be smoothed out by the fact that a fund’s globe rating as it is calculated based on 12 months of portfolio data).

In the first iteration of the Morningstar Sustainability rating, where a best-in-class ESG score was pulled through from Sustainalytics, the Funds scored 2 globes. It would have been due to the higher percentage of average and underperforming holdings and/or higher levels of controversies relative to competing funds in its category.

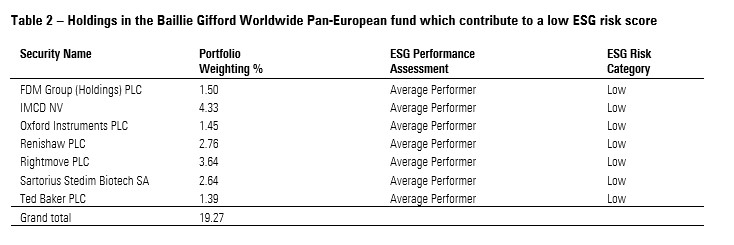

Looking at a sample of companies which scored “average” under Sustainalytics’ previous rating system, we can see that many now score as “low” or “negligible” risk under the new rating framework, contributing positively to the portfolio’s overall low ESG risk score.

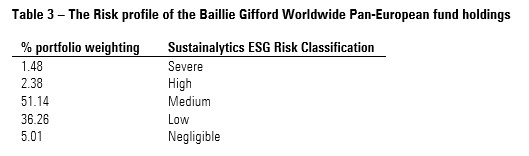

Currently, less than 4% of this portfolio scores medium or high risk. There is only one holding, Cosmo Pharmaceuticals, with severe risk. This accounts for 1.48% of the portfolio and according to Sustainalytics, the risk owes to very poor disclosure and weakness or absence of policies and programmes to manage risks related to its material ESG issues. These include weak clinical trial standards policies and diversity programmes. Nevertheless, the company has not been implicated in any significant ESG-related controversies apart from a settled patent dispute in the United States.

In contrast, the Baillie Gifford Positive Change fund seeks to identify companies for whom delivering a positive social impact is core to their business. This includes businesses addressing critical challenges in areas such as the environment, healthcare, education, and social inclusion. The fund lost two globes moving from 4 to 2. Looking more closely at the fund’s largest holdings helped us understand why:

Medical device company DexCom is the second largest holding in the portfolio, with a weight of 6.22%. But according to Sustainalytics, DexCom faces severe ESG risks mainly due to the type of products and services it offers, as well as its customer base, which triggers exposure to quality and safety issues. Due to its employee base and qualification needs, the company is also exposed to labour relations issues and skill deficit.

Similarly, Umicore, the 8th largest portfolio holding with a 4.22% weight, exhibits high ESG risk. The company produces catalytic converters, which reduce emissions of three harmful compounds found in car exhaust: carbon monoxide (a poisonous gas), nitrogen oxides (a cause of smog and acid rain) and hydrocarbons (a cause of smog).

While these products do indeed fit the bill in terms of positive environmental impact, they come with risk. Operating in a traditionally energy-intensive industry, Umicore is exposed to carbon-related regulations, especially in Europe. As well as this, Umicore is exposed to business ethics-related issues, including political lobbying to delay regulation for specific substances, and ethical issues, such as tests performed on animals to evaluate the quality and safety of the products it manufactures

ESG Risks Prompt Downgrades

Surprisingly, Tesla, which accounts for 4.2%, of the portfolio, sits at high risk too. Tesla selling electric cars, it is counter intuitive to imagine it having high ESG risk but the company scores badly on the S and G of ESG.

According to Sustainalytics, Tesla’s reliance on its factory workforce to meet its ambitious production targets means that it is exposed to risks concerning labour relations and its ability to recruit and retain employees. Additionally, an automaker’s business is dependent both on the safety of its products and its ability to deliver them to customers on time, with some risks from the former coming in Tesla’s case from the company’s development of assisted-driving technology, and from the latter by its plans to quickly ramp up vehicle production.

Tesla’s management of these issues ranges from one extreme to the other. What it manages well – the carbon impact of its products – it manages very well, while on the other hand, its management of human capital and product governance risks reveals significant shortcomings.

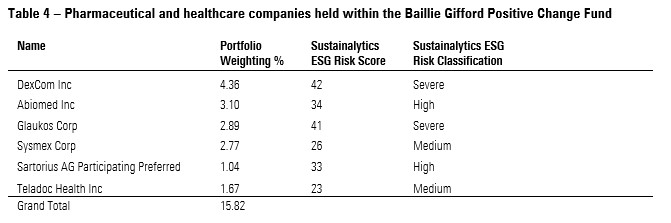

Other examples of holdings that have the potential to deliver positive impact on society but score unfavourably through a risk lens include healthcare companies The fund holds six medical device companies, totaling to 15.8% of the portfolio, and their risk level ranges from medium to severe.

These companies offer innovative solutions to public health issues such as diabetes or heart diseases, but they also face significant litigation and regulatory risks.

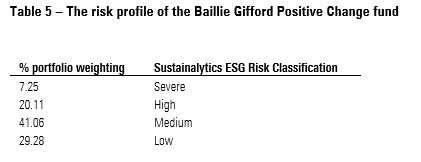

Overall, as the table 5 shows, more than 27% of the Baillie Gifford Positive Change fund’s portfolio exhibits high or severe risk, while less than 30% showing low risk. None of the holdings exhibit ‘negligible risk’.

To conclude, the Morningstar’s enhanced sustainability rating provides a way to evaluate any fund on ESG Risk. Investors can use it to evaluate how much ESG Risk is embedded in the funds they own.

While those wanting to invest in, or evaluate, intentional sustainability-focused funds should expect those funds to have relatively low ESG Risk it is not always the case, as evidenced here. The rating should just be a first step in a broader evaluation of those funds. Investors may also want to know how funds engage with companies, vote their proxies, and, more broadly, seek to provide impact alongside financial return.